Form 4835 Fill in Capable

Understanding Form 4835

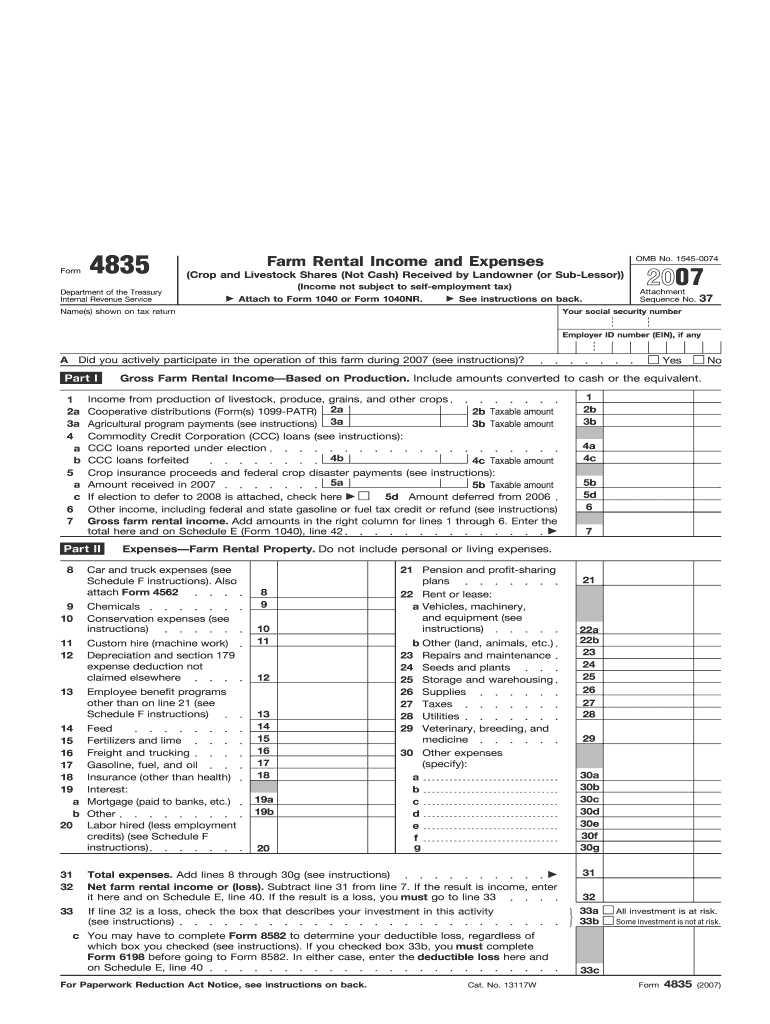

Form 4835, also known as the "Farm Rental Income and Expenses," is a tax form used by individuals to report income and expenses related to farming activities conducted as a landlord. This form is particularly relevant for those who rent out land for farming purposes but do not actively participate in the farming operations themselves. It is essential for accurately reporting income and ensuring compliance with IRS regulations.

Steps to Complete Form 4835

Completing Form 4835 involves several key steps:

- Gather necessary documentation, including records of rental income and expenses.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Report rental income received from farming activities in the appropriate section.

- Detail all related expenses, such as maintenance, repairs, and property taxes.

- Calculate your net profit or loss from the farming rental activities.

- Sign and date the form before submitting it to the IRS.

Legal Use of Form 4835

Form 4835 is legally recognized by the IRS for reporting farm rental income. It is important to ensure that all information provided is accurate and complete to avoid potential legal issues. Misreporting income or expenses can lead to penalties or audits, so maintaining thorough records is crucial for compliance.

Obtaining Form 4835

Form 4835 can be obtained directly from the IRS website or through tax preparation software. It is available in a printable format, allowing users to fill it out manually or electronically. Ensure you have the most current version of the form to comply with any updated IRS guidelines.

Filing Deadlines for Form 4835

The filing deadline for Form 4835 generally aligns with the individual income tax return deadline, which is typically April fifteenth each year. If additional time is needed, taxpayers can file for an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid penalties.

Examples of Using Form 4835

Form 4835 is commonly used by individuals who own farmland but lease it to farmers. For example, if a landowner receives rental payments for land that is cultivated by another party, they would report this income on Form 4835. Additionally, any related expenses, such as property maintenance or improvements, can be deducted to calculate net income.

IRS Guidelines for Form 4835

The IRS provides specific guidelines for completing Form 4835, including detailed instructions on what constitutes eligible income and deductible expenses. It is advisable to review these guidelines carefully to ensure compliance and maximize potential deductions. Consulting with a tax professional can also provide clarity on complex situations related to farm rental income.

Quick guide on how to complete form 4835 fill in capable

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools available specifically for that purpose in airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device you choose. Modify and eSign [SKS] and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 4835 Fill In Capable

Create this form in 5 minutes!

How to create an eSignature for the form 4835 fill in capable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 4835 Fill In Capable feature in airSlate SignNow?

The Form 4835 Fill In Capable feature allows users to easily fill out and eSign IRS Form 4835 directly within the airSlate SignNow platform. This functionality streamlines the process, ensuring that all necessary fields are completed accurately and efficiently. With this feature, businesses can save time and reduce errors when managing tax-related documents.

-

How does airSlate SignNow ensure the security of my Form 4835 Fill In Capable documents?

airSlate SignNow prioritizes document security by implementing advanced encryption protocols and secure cloud storage for all Form 4835 Fill In Capable documents. This ensures that your sensitive information remains protected from unauthorized access. Additionally, the platform complies with industry standards to maintain the confidentiality of your data.

-

Is there a cost associated with using the Form 4835 Fill In Capable feature?

Yes, the Form 4835 Fill In Capable feature is included in the various pricing plans offered by airSlate SignNow. Depending on your business needs, you can choose a plan that best fits your budget while gaining access to this essential feature. The pricing is designed to be cost-effective, making it accessible for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for Form 4835 Fill In Capable?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing the functionality of the Form 4835 Fill In Capable feature. This allows you to connect with tools like CRM systems, accounting software, and more, ensuring a smooth workflow and improved productivity.

-

What are the benefits of using airSlate SignNow for Form 4835 Fill In Capable?

Using airSlate SignNow for Form 4835 Fill In Capable provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. The platform simplifies the eSigning process, allowing multiple parties to sign documents quickly. Additionally, it helps maintain compliance with IRS requirements, ensuring your forms are always up to date.

-

Is it easy to use the Form 4835 Fill In Capable feature?

Yes, airSlate SignNow is designed with user-friendliness in mind, making the Form 4835 Fill In Capable feature easy to navigate. Users can quickly fill out forms, add signatures, and send documents without any technical expertise. The intuitive interface ensures that anyone can manage their documents efficiently.

-

What types of businesses can benefit from the Form 4835 Fill In Capable feature?

The Form 4835 Fill In Capable feature is beneficial for a wide range of businesses, particularly those involved in farming, rental activities, or any entity that needs to report income from these sources. Small businesses, accountants, and tax professionals can all leverage this feature to streamline their document management processes and ensure compliance.

Get more for Form 4835 Fill In Capable

- Electrical load calculation vancouver form

- From slavery to dom quiz storyworks scholastic form

- University of guam transcript request form

- D 2848 poa pmd office of tax and revenue otr cfo dc form

- How do i replace a form i 94 arrival departure record uscis

- Module 2 workbook spelling rules patterns amp strategies howtospell letterpatterns co form

- Dr 2447 020106 colorado department of revenue mail to state of colorado motor vehicle traffic records denver co 80261 0016 form

- Oriental insurance mediclaim form

Find out other Form 4835 Fill In Capable

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later