RTI Annual Return Information System Annual Return

What is the RTI Annual Return Information System Annual Return

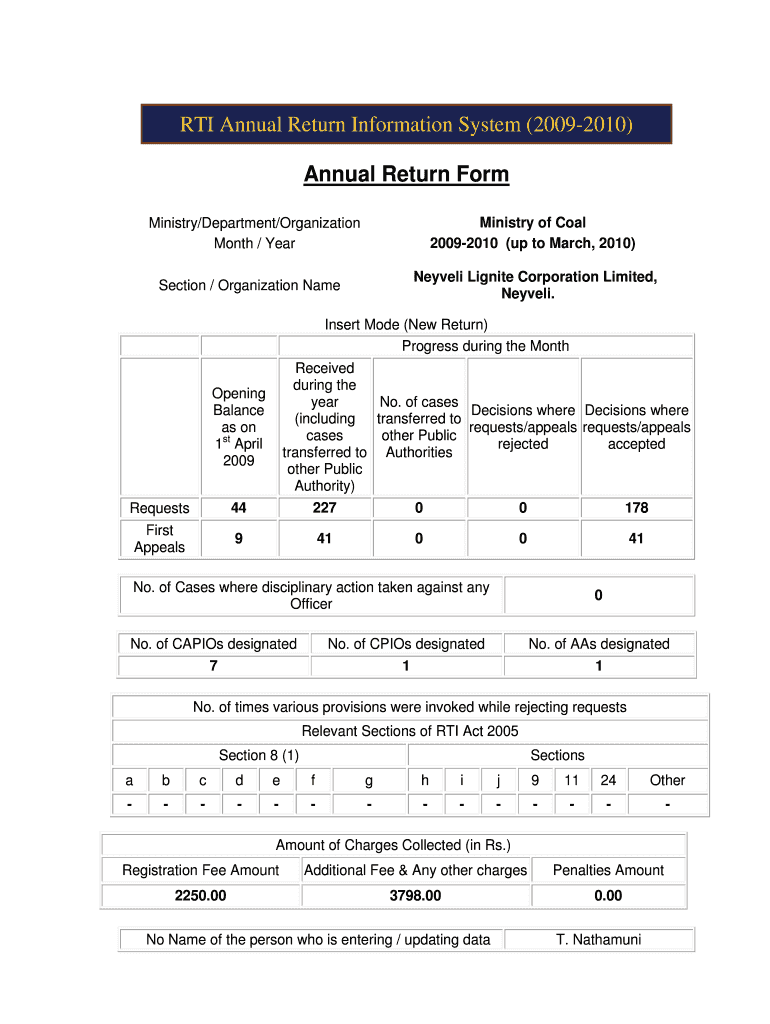

The RTI Annual Return Information System Annual Return is a crucial document used by organizations to report their compliance with the Right to Information Act. This form is designed to ensure transparency and accountability in the functioning of public authorities. It requires entities to disclose information about their operations, including details about the requests received and the responses provided. The primary goal of this return is to promote openness and facilitate public access to information, thereby enhancing the democratic process.

How to use the RTI Annual Return Information System Annual Return

Using the RTI Annual Return Information System Annual Return involves several straightforward steps. First, organizations need to gather relevant data regarding their RTI activities for the year. This includes the number of requests received, the nature of the information requested, and the time taken to respond. Once the data is compiled, it can be entered into the designated sections of the form. Users can typically access the system online, making it easier to submit this return digitally. Ensuring accuracy in the information provided is essential, as it reflects the organization's commitment to transparency.

Steps to complete the RTI Annual Return Information System Annual Return

Completing the RTI Annual Return Information System Annual Return involves a series of methodical steps:

- Collect data on all RTI requests received during the year.

- Document the outcomes of these requests, including approvals and denials.

- Fill out the return form, ensuring all sections are accurately completed.

- Review the form for any errors or omissions.

- Submit the completed form through the designated submission method, typically online.

Following these steps helps ensure compliance with legal requirements and fosters a culture of transparency within the organization.

Legal use of the RTI Annual Return Information System Annual Return

The legal framework surrounding the RTI Annual Return Information System Annual Return mandates that public authorities submit this document annually. Failure to comply can result in penalties, including fines or other legal repercussions. The information provided in the return is subject to scrutiny by oversight bodies, ensuring that organizations adhere to the principles of the Right to Information Act. Understanding the legal implications of this return is vital for organizations to maintain their credibility and accountability.

Required Documents

To complete the RTI Annual Return Information System Annual Return, organizations must prepare several key documents, including:

- Records of RTI requests received during the reporting period.

- Documentation of responses provided to each request.

- Internal reports on the handling of RTI requests.

- Any relevant correspondence related to RTI inquiries.

Having these documents readily available will streamline the process of filling out the return and ensure that all information is accurate and comprehensive.

Filing Deadlines / Important Dates

Organizations must adhere to specific filing deadlines for the RTI Annual Return Information System Annual Return. Typically, the return is due within a prescribed period following the end of the reporting year. It is crucial for organizations to stay informed about these deadlines to avoid late submissions, which could lead to penalties. Marking these important dates on a calendar can help ensure timely compliance.

Quick guide on how to complete rti annual return information system annual return

Effortlessly Prepare [SKS] on Any Device

Managing documents online has become popular among organizations and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] Without Hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal standing as a traditional wet ink signature.

- Review all entered information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to RTI Annual Return Information System Annual Return

Create this form in 5 minutes!

How to create an eSignature for the rti annual return information system annual return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RTI Annual Return Information System Annual Return?

The RTI Annual Return Information System Annual Return is a comprehensive tool designed to streamline the process of filing annual returns for organizations. It simplifies compliance with regulatory requirements, ensuring that businesses can efficiently manage their reporting obligations.

-

How does the RTI Annual Return Information System Annual Return benefit my business?

Using the RTI Annual Return Information System Annual Return can signNowly reduce the time and effort required for filing annual returns. It enhances accuracy and compliance, minimizing the risk of penalties associated with late or incorrect submissions.

-

What features are included in the RTI Annual Return Information System Annual Return?

The RTI Annual Return Information System Annual Return includes features such as automated reminders, customizable templates, and real-time tracking of submission status. These features help ensure that your annual returns are filed on time and with the necessary documentation.

-

Is the RTI Annual Return Information System Annual Return cost-effective?

Yes, the RTI Annual Return Information System Annual Return is designed to be a cost-effective solution for businesses of all sizes. By automating the filing process, it reduces administrative costs and helps avoid potential fines, making it a smart investment.

-

Can the RTI Annual Return Information System Annual Return integrate with other software?

Absolutely! The RTI Annual Return Information System Annual Return can seamlessly integrate with various accounting and business management software. This integration allows for a smoother workflow and ensures that all necessary data is readily available for filing.

-

How secure is the RTI Annual Return Information System Annual Return?

The RTI Annual Return Information System Annual Return prioritizes data security, employing advanced encryption and secure access protocols. This ensures that your sensitive information remains protected throughout the filing process.

-

What support is available for users of the RTI Annual Return Information System Annual Return?

Users of the RTI Annual Return Information System Annual Return have access to comprehensive customer support, including tutorials, FAQs, and direct assistance from our support team. We are committed to helping you navigate the system effectively.

Get more for RTI Annual Return Information System Annual Return

Find out other RTI Annual Return Information System Annual Return

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document