IRS Form 5695 for

What is the IRS Form 5695 For

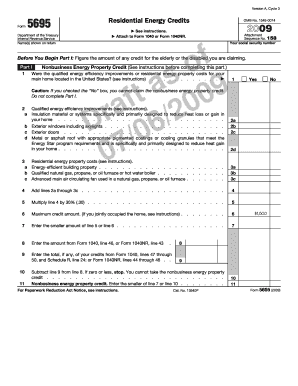

IRS Form 5695 is used to claim the Residential Energy Credits, which allow taxpayers to receive tax credits for certain energy-efficient home improvements. This form is particularly relevant for homeowners who have made qualifying upgrades, such as solar energy systems, energy-efficient windows, and heating and cooling systems. By filing this form, taxpayers can reduce their tax liability, making it a beneficial option for those looking to invest in energy efficiency.

How to use the IRS Form 5695 For

To effectively use IRS Form 5695, taxpayers must first determine their eligibility for the energy credits. This involves reviewing the specific improvements made to their homes and ensuring they meet the criteria outlined by the IRS. Once eligibility is confirmed, the form must be filled out accurately, detailing the costs associated with the energy-efficient upgrades. After completing the form, it should be submitted along with the taxpayer's annual tax return.

Steps to complete the IRS Form 5695 For

Completing IRS Form 5695 involves several key steps:

- Gather documentation related to the energy-efficient improvements, including receipts and manufacturer certifications.

- Fill out Part I for the Residential Energy Efficient Property Credit, detailing the costs of solar energy systems.

- Complete Part II for the Nonbusiness Energy Property Credit, listing qualifying improvements and their associated costs.

- Calculate the total credits and transfer the amounts to the appropriate line on your tax return.

Eligibility Criteria

To qualify for the credits claimed on IRS Form 5695, taxpayers must meet specific eligibility criteria. The improvements must be made to a primary residence located in the United States. Additionally, the energy-efficient products installed must meet certain performance standards set by the IRS. Taxpayers should ensure that they have proper documentation, such as receipts and certifications, to substantiate their claims.

Required Documents

When filing IRS Form 5695, taxpayers should prepare several important documents:

- Receipts for all qualifying energy-efficient improvements.

- Manufacturer certifications for products that meet IRS energy efficiency requirements.

- Any additional documentation that supports the claim, such as installation contracts or energy audits.

Filing Deadlines / Important Dates

The filing deadline for IRS Form 5695 aligns with the general tax return deadline for individuals. Typically, this is April fifteenth of each year. However, if taxpayers require an extension, they can file for an extension, which typically allows for additional time to submit their tax returns, including Form 5695. It is crucial to stay informed about any changes to deadlines, especially in light of potential tax law updates.

Quick guide on how to complete irs form 5695 for

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed papers, allowing you to access the right form and store it securely online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The easiest way to modify and electronically sign [SKS] without hassle

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IRS Form 5695 For

Create this form in 5 minutes!

How to create an eSignature for the irs form 5695 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 5695 For?

IRS Form 5695 For is used to claim the Residential Energy Credits, which can help homeowners receive tax credits for energy-efficient improvements. Understanding this form is crucial for maximizing your tax benefits related to energy efficiency.

-

How can airSlate SignNow assist with IRS Form 5695 For?

airSlate SignNow provides a seamless platform for electronically signing and sending IRS Form 5695 For. Our solution simplifies the process, ensuring that you can complete and submit your tax forms quickly and securely.

-

What features does airSlate SignNow offer for IRS Form 5695 For?

With airSlate SignNow, you can easily create, edit, and eSign IRS Form 5695 For. Our platform includes templates, document sharing, and tracking features, making it easier to manage your tax documentation efficiently.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5695 For?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solutions ensure that you can manage IRS Form 5695 For and other documents without breaking the bank.

-

What are the benefits of using airSlate SignNow for IRS Form 5695 For?

Using airSlate SignNow for IRS Form 5695 For streamlines the signing process, reduces paperwork, and enhances security. This means you can focus on maximizing your tax credits while we handle the document management.

-

Can I integrate airSlate SignNow with other software for IRS Form 5695 For?

Absolutely! airSlate SignNow integrates with various software applications, allowing you to manage IRS Form 5695 For alongside your existing tools. This integration enhances workflow efficiency and document accessibility.

-

How secure is airSlate SignNow when handling IRS Form 5695 For?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and compliance measures to ensure that your IRS Form 5695 For and other sensitive documents are protected throughout the signing process.

Get more for IRS Form 5695 For

- Wound care orders example form

- Vehicle usage log 224002657 form

- Sheffield high school library pass student name mcsk12 form

- State of illinois eye exam form

- Osca malabon form

- Swimming permission form re advised 1 columbianacountyjfs

- Renew or replacing your dl or id while you are out of state form

- Zip codet form

Find out other IRS Form 5695 For

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document