From it 2664 Form

What is the From IT 2664

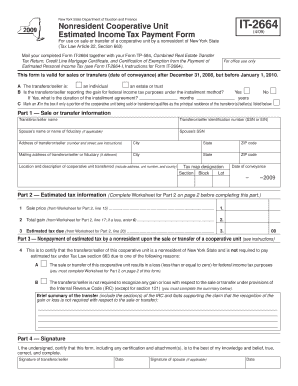

The From IT 2664 is a tax form used by businesses and individuals to report specific financial information to the Internal Revenue Service (IRS). This form is particularly relevant for entities that need to disclose certain types of income, deductions, or other tax-related details. Understanding the purpose of this form is crucial for accurate tax reporting and compliance with federal regulations.

How to use the From IT 2664

Using the From IT 2664 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents related to the income or deductions you are reporting. Next, fill out the form by entering the relevant details in the designated sections. Be sure to double-check your entries for accuracy to avoid potential issues with the IRS. Once completed, the form can be submitted according to the guidelines provided by the IRS.

Steps to complete the From IT 2664

Completing the From IT 2664 requires careful attention to detail. Follow these steps:

- Collect all relevant financial information and documents.

- Download or obtain a copy of the From IT 2664.

- Fill in your personal or business information at the top of the form.

- Complete the sections related to income, deductions, and any other required details.

- Review the form for accuracy and completeness.

- Sign and date the form where indicated.

- Submit the form according to the IRS submission guidelines.

Legal use of the From IT 2664

The From IT 2664 must be used in accordance with IRS regulations to ensure legal compliance. This form is designed to provide transparency in financial reporting and must be filled out accurately to avoid penalties. It is important to understand the legal implications of the information reported on this form, as inaccuracies can lead to audits or other legal issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the From IT 2664 are typically aligned with the tax year. It is essential to be aware of these deadlines to avoid late filing penalties. Generally, the form must be submitted by the tax filing deadline, which is usually April 15 for individuals and varies for businesses. Mark these important dates on your calendar to ensure timely submission.

Required Documents

To accurately complete the From IT 2664, specific documents are required. These may include:

- Financial statements showing income and expenses.

- Previous tax returns for reference.

- Any supporting documentation for deductions claimed.

- Identification information, such as Social Security numbers or Employer Identification Numbers (EIN).

Having these documents ready will facilitate a smoother filing process and help ensure accuracy.

Quick guide on how to complete from it 2664

Complete [SKS] seamlessly on any device

Digital document management has become popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to alter and electronically sign [SKS] effortlessly

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow supplies specifically for this purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and possesses the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, cumbersome form searching, or mistakes that require new document copies to be printed. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure effective communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to From IT 2664

Create this form in 5 minutes!

How to create an eSignature for the from it 2664

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to From IT 2664?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. From IT 2664 refers to a specific compliance standard that ensures secure and efficient document handling, making airSlate SignNow an ideal choice for organizations looking to meet these requirements.

-

How much does airSlate SignNow cost for users interested in From IT 2664?

The pricing for airSlate SignNow varies based on the plan selected, but it remains a cost-effective solution for businesses needing compliance with From IT 2664. We offer various subscription tiers that cater to different organizational needs, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for compliance with From IT 2664?

airSlate SignNow includes features such as secure document storage, customizable workflows, and advanced authentication methods, all designed to support compliance with From IT 2664. These features help ensure that your documents are handled securely and efficiently throughout the signing process.

-

Can airSlate SignNow integrate with other tools for From IT 2664 compliance?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms, enhancing its functionality for users focused on From IT 2664 compliance. This allows businesses to streamline their workflows and maintain compliance across different systems.

-

What are the benefits of using airSlate SignNow for businesses focused on From IT 2664?

Using airSlate SignNow provides numerous benefits for businesses, including increased efficiency, reduced paper usage, and enhanced security. For organizations focused on From IT 2664, these advantages help ensure that document management processes are compliant and effective.

-

Is airSlate SignNow user-friendly for those needing From IT 2664 compliance?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to send and sign documents. This user-friendly interface is particularly beneficial for organizations needing to comply with From IT 2664, as it minimizes training time and maximizes productivity.

-

How does airSlate SignNow ensure security for documents related to From IT 2664?

airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect documents. This is crucial for businesses that must adhere to From IT 2664 standards, ensuring that sensitive information remains confidential and secure.

Get more for From IT 2664

Find out other From IT 2664

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF

- How To eSign Hawaii Government Word

- Can I eSign Hawaii Government Word

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- Can I eSign Hawaii Government Document

- How Can I eSign Hawaii Government Document

- How To eSign Hawaii Government Document

- How To eSign Hawaii Government Form

- How Can I eSign Hawaii Government Form

- Help Me With eSign Hawaii Healthcare / Medical PDF

- How To eSign Arizona High Tech Document