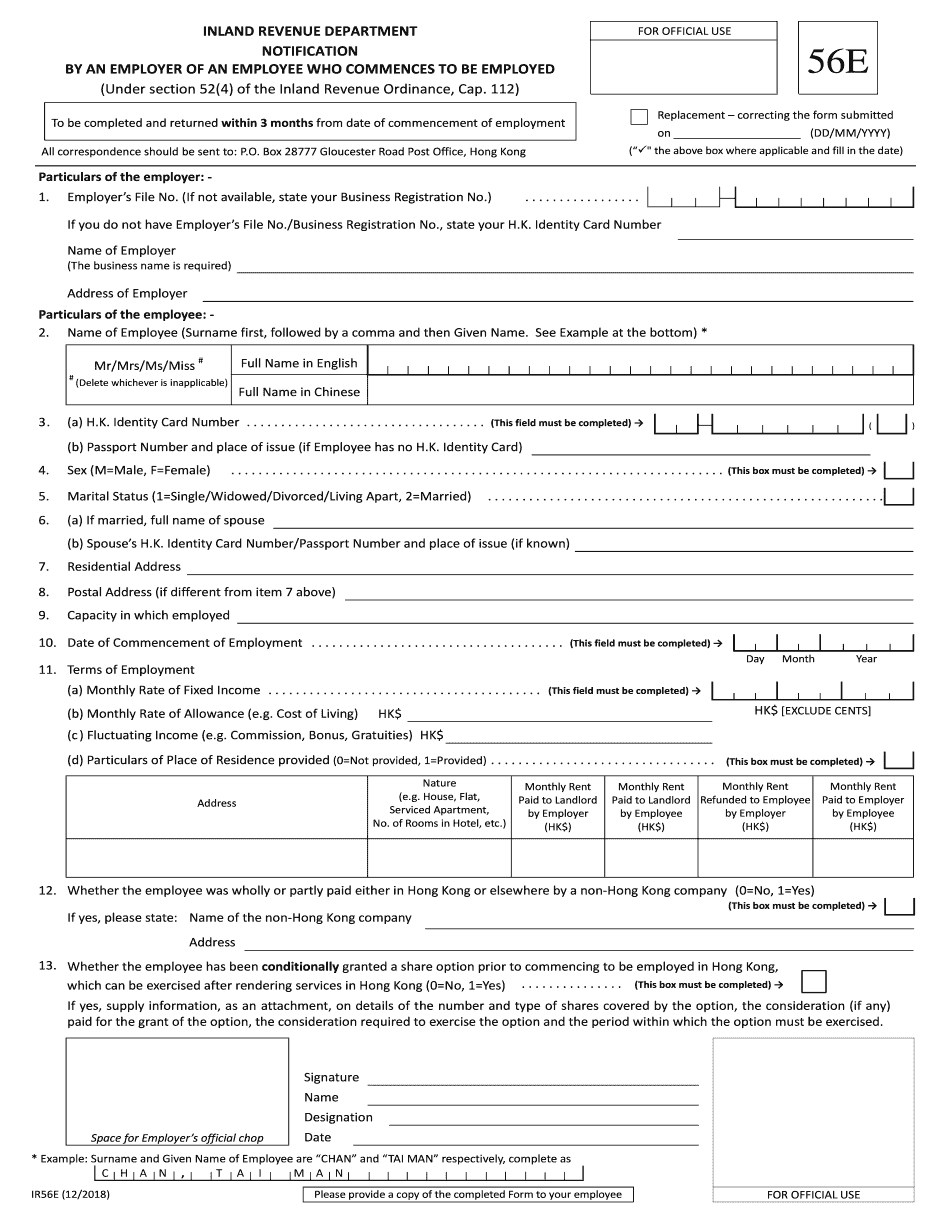

Ir56e Form

What is the IR1121 Form

The IR1121 form is a crucial document used for reporting income and tax information for individuals and businesses in the United States. It is primarily associated with tax filings and serves as a means for taxpayers to disclose their earnings to the Internal Revenue Service (IRS). The form is essential for ensuring compliance with federal tax regulations and helps in the accurate assessment of tax liabilities.

Steps to Complete the IR1121 Form

Completing the IR1121 form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, fill out the form with your personal information, including your Social Security number and filing status. Be sure to report all sources of income accurately. After completing the form, review it thoroughly for any errors. Finally, submit the form to the IRS by the designated deadline, either electronically or via mail.

Legal Use of the IR1121 Form

The IR1121 form is legally binding when completed correctly and submitted to the IRS. It must adhere to the guidelines set forth by the IRS to ensure that the information provided is accurate and truthful. Falsifying information on the form can lead to penalties, including fines and potential legal action. Therefore, it is important to understand the legal implications of submitting the IR1121 form and to ensure that all reported information is correct.

Filing Deadlines / Important Dates

Filing deadlines for the IR1121 form are critical for maintaining compliance with tax regulations. Generally, the form must be submitted by April 15 of the following tax year. However, if you are unable to meet this deadline, you may file for an extension. It is essential to keep track of any changes to deadlines announced by the IRS, as these can vary from year to year. Missing the deadline can result in penalties and interest on any taxes owed.

Form Submission Methods

The IR1121 form can be submitted through various methods, providing flexibility for taxpayers. You can file the form electronically using IRS-approved e-filing software, which often simplifies the process and reduces errors. Alternatively, you can mail a paper copy of the form to the appropriate IRS address. In some cases, in-person submission may be available at local IRS offices, although this is less common. Choosing the right submission method can help ensure timely processing of your tax return.

Who Issues the Form

The IR1121 form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing the form, ensuring that taxpayers have the necessary information to fulfill their tax obligations. It is important to refer to the IRS website or official publications for the most current version of the form and any updates to filing requirements.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the IR1121 form can result in significant penalties. These may include fines for late filing, underpayment of taxes, or inaccuracies in the information reported. The IRS may also impose additional interest on any unpaid taxes. Understanding these potential penalties emphasizes the importance of accurate and timely filing to avoid unnecessary financial burdens.

Quick guide on how to complete requirement specfications for submission of form ir56e in ird

Complete Ir56e Form effortlessly on any device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Handle Ir56e Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

The simplest way to modify and eSign Ir56e Form effortlessly

- Obtain Ir56e Form and click Get Form to initiate.

- Use the tools we provide to fill out your document.

- Emphasize key parts of your documents or redact sensitive information with tools that airSlate SignNow specifically designed for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes requiring the printing of new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Ir56e Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the requirement specfications for submission of form ir56e in ird

How to make an electronic signature for your Requirement Specfications For Submission Of Form Ir56e In Ird in the online mode

How to make an electronic signature for your Requirement Specfications For Submission Of Form Ir56e In Ird in Google Chrome

How to create an electronic signature for putting it on the Requirement Specfications For Submission Of Form Ir56e In Ird in Gmail

How to create an eSignature for the Requirement Specfications For Submission Of Form Ir56e In Ird from your smart phone

How to generate an eSignature for the Requirement Specfications For Submission Of Form Ir56e In Ird on iOS devices

How to generate an electronic signature for the Requirement Specfications For Submission Of Form Ir56e In Ird on Android OS

People also ask

-

What is the ir1121 form and why is it important?

The ir1121 form is a tax form utilized primarily for reporting various financial activities. Understanding its requirements is crucial for businesses to ensure compliance and avoid penalties. Using tools like airSlate SignNow can help streamline the process of completing and submitting the ir1121 form efficiently.

-

How does airSlate SignNow support the completion of the ir1121 form?

airSlate SignNow allows users to easily fill out and electronically sign the ir1121 form from any device. Our platform ensures that your documents are securely stored and easily accessible, which simplifies the overall process of managing your tax documents. Additionally, the electronic signature capabilities enhance the convenience for both senders and recipients.

-

Is airSlate SignNow cost-effective for businesses needing the ir1121 form?

Yes, airSlate SignNow offers competitive pricing plans, making it a cost-effective solution for businesses that frequently use the ir1121 form. With various tiers available, you can choose a plan that fits your budget while enjoying the full range of signing and document management features. Investing in airSlate SignNow can lead to signNow time and cost savings.

-

What features does airSlate SignNow offer for managing the ir1121 form?

airSlate SignNow provides features like customizable templates, collaboration tools, and real-time tracking for the ir1121 form. These features allow you to streamline your workflow, reduce errors, and quickly obtain signatures. The user-friendly interface ensures that anyone on your team can navigate the process effortlessly.

-

Can I integrate airSlate SignNow with other software for handling the ir1121 form?

Absolutely! airSlate SignNow supports integrations with a variety of productivity and accounting tools to facilitate the management of the ir1121 form. This capability means you can seamlessly connect with systems you already use, enhancing your overall efficiency and document management process.

-

What benefits do I gain by using airSlate SignNow for the ir1121 form?

Using airSlate SignNow for the ir1121 form streamlines your document processes and enhances compliance with tax regulations. The ease of electronic signatures and the ability to share forms securely means you can focus on your business instead of paperwork. Plus, it helps to save time, reduce costs, and improve accuracy.

-

Is it secure to use airSlate SignNow for the ir1121 form?

Yes, airSlate SignNow prioritizes security for your documents, including the ir1121 form. We employ industry-standard encryption and adhere to strict compliance regulations to ensure your data is protected. You can share and eSign documents with confidence, knowing that your confidential information is safe.

Get more for Ir56e Form

- Httpstax alaska govprogramsprogramsformsind

- Dl 14a 698380849 form

- Form alaska tobacco product manufacturer 510 certi

- Title 15 department of revenue tax division regulations form

- Alabama department of revenuemontgomery al form

- Instructions for form 6390 alaska federal bas

- Alabama business privilege tax initial return form

- Do i need to file a return department of revenue ky gov form

Find out other Ir56e Form

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form