Alabama Department of RevenueMontgomery AL 2022-2026

Understanding the Alabama Department of Revenue

The Alabama Department of Revenue (ADOR) is the state agency responsible for administering tax laws and collecting revenue in Alabama. It oversees various tax programs, including income, sales, and property taxes. ADOR plays a crucial role in ensuring compliance with state tax regulations and providing assistance to taxpayers. Understanding its functions can help individuals and businesses navigate their tax obligations more effectively.

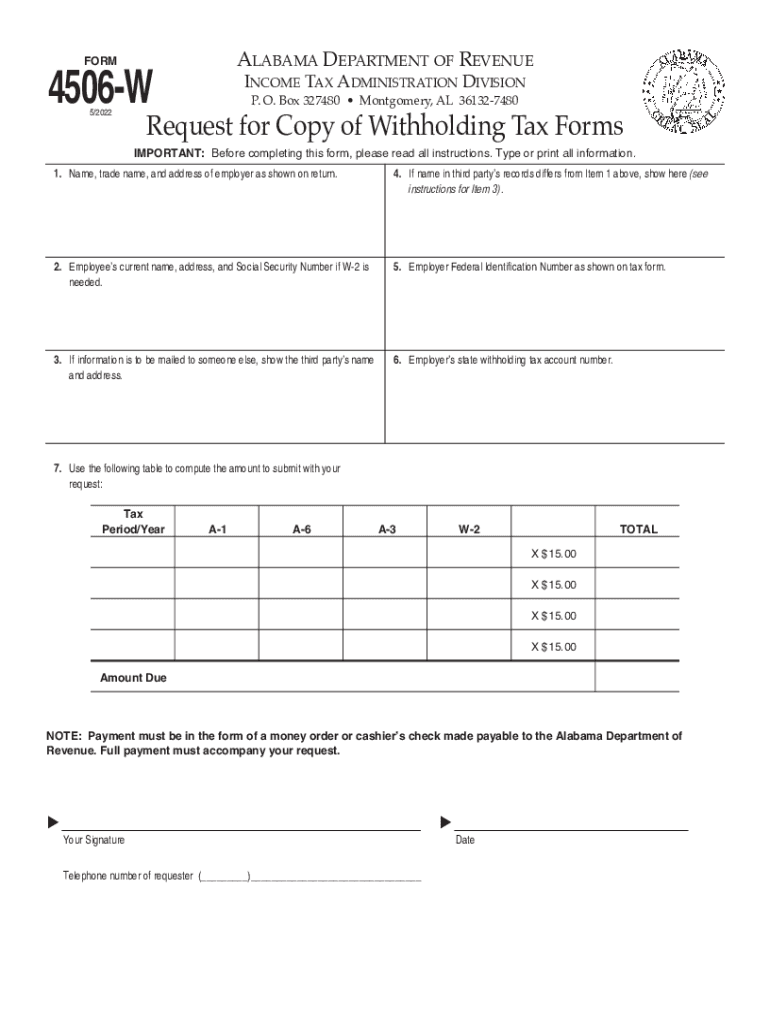

Steps to Complete the 4506 W Form

Completing the 4506 W form involves several key steps. First, gather the necessary information, which includes your name, address, and Social Security number. Next, specify the tax years for which you are requesting information. Ensure that you provide accurate details to avoid delays. Finally, sign and date the form before submitting it to the Alabama Department of Revenue. Following these steps will help ensure your request is processed smoothly.

Required Documents for the 4506 W Form

When filling out the 4506 W form, certain documents may be required to support your request. Typically, you will need to provide identification, such as a driver's license or Social Security card. Additionally, having copies of previous tax returns can be helpful for reference. Ensure that all documents are current and clearly legible to facilitate processing by the Alabama Department of Revenue.

Form Submission Methods

The 4506 W form can be submitted through various methods. You may choose to file it online via the Alabama Department of Revenue's website, ensuring a quicker response. Alternatively, you can mail the completed form to the appropriate address provided by ADOR. For those who prefer in-person assistance, visiting a local ADOR office is also an option. Each method has its advantages, so select the one that best suits your needs.

Eligibility Criteria for the 4506 W Form

To be eligible to file the 4506 W form, you must be an individual or entity that has filed taxes in Alabama. This includes residents, businesses, and non-residents who have earned income within the state. Ensure that you meet all eligibility requirements before submitting your request to avoid complications. Understanding these criteria can streamline your experience with the Alabama Department of Revenue.

IRS Guidelines for the 4506 W Form

The Internal Revenue Service (IRS) provides guidelines for the use of the 4506 W form. It is essential to adhere to these guidelines to ensure compliance with federal regulations. The form is primarily used to request a transcript of tax information from the IRS, which can be critical for various financial transactions, including loan applications. Familiarizing yourself with IRS requirements can enhance your understanding of the form's purpose and usage.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the 4506 W form can result in penalties. These may include fines or delays in processing your tax information requests. It is crucial to understand the implications of non-compliance to avoid unnecessary complications. Staying informed about your responsibilities can help ensure that you meet all necessary obligations with the Alabama Department of Revenue.

Quick guide on how to complete alabama department of revenuemontgomery al

Complete Alabama Department Of RevenueMontgomery AL effortlessly on any device

Online document administration has gained traction among businesses and individuals. It offers a perfect eco-friendly substitute to traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Alabama Department Of RevenueMontgomery AL on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to alter and eSign Alabama Department Of RevenueMontgomery AL effortlessly

- Obtain Alabama Department Of RevenueMontgomery AL and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight signNow sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes moments and holds the same legal value as a conventional wet ink signature.

- Verify the details and then click the Done button to save your changes.

- Select how you wish to send your form, by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your preference. Edit and eSign Alabama Department Of RevenueMontgomery AL and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama department of revenuemontgomery al

Create this form in 5 minutes!

How to create an eSignature for the alabama department of revenuemontgomery al

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 4506 W form and what is its purpose?

The 4506 W form is a request for a copy of tax return information, specifically designed for the IRS. It is primarily used by financial institutions to verify income information for mortgage applications. Understanding the importance of the 4506 W form can streamline your application process and ensure accuracy in financial reporting.

-

How can airSlate SignNow help with the 4506 W form?

airSlate SignNow provides an easy-to-use platform for sending, signing, and managing the 4506 W form electronically. By utilizing our eSignature features, you can expedite the approval process and maintain compliance with IRS regulations. This simplifies document handling and ensures your 4506 W form is processed efficiently.

-

Is there a cost associated with using airSlate SignNow for the 4506 W form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your business needs, including features specific to managing the 4506 W form. Our pricing is competitive and provides excellent value, considering the advantages of electronic signatures and document management. You can choose a plan that suits your budget and frequency of use.

-

Can I track the status of my 4506 W form with airSlate SignNow?

Absolutely! airSlate SignNow includes features for tracking the status of your 4506 W form or any document you send. Our platform notifies you when documents are viewed, signed, and completed, giving you peace of mind and ensuring transparency throughout the signing process.

-

What are the features of airSlate SignNow that facilitate the use of the 4506 W form?

airSlate SignNow offers robust features such as customizable templates, automated workflows, and real-time notifications that enhance the management of the 4506 W form. Additionally, our platform ensures that all documents comply with legal standards, making it a reliable choice for your document needs. This improves efficiency and reduces the chances of errors.

-

Can I integrate airSlate SignNow with other software for handling the 4506 W form?

Yes, airSlate SignNow supports integrations with various CRM and accounting software, making it easier to manage your 4506 W form alongside other business processes. This integration capability allows for a smoother workflow and improved data accuracy. You can easily connect your existing tools for a more streamlined experience.

-

Is the electronic signing of the 4506 W form legally binding?

Yes, electronic signatures on the 4506 W form created through airSlate SignNow are legally binding and comply with federal laws, including the ESIGN Act. This means that using our platform is not only efficient but also secure for legal documentation. You can confidently send your 4506 W form knowing it meets all legal requirements.

Get more for Alabama Department Of RevenueMontgomery AL

Find out other Alabama Department Of RevenueMontgomery AL

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe