Alabama Business Privilege Tax Initial Return Form 2023

What is the Alabama Business Privilege Tax Initial Return Form

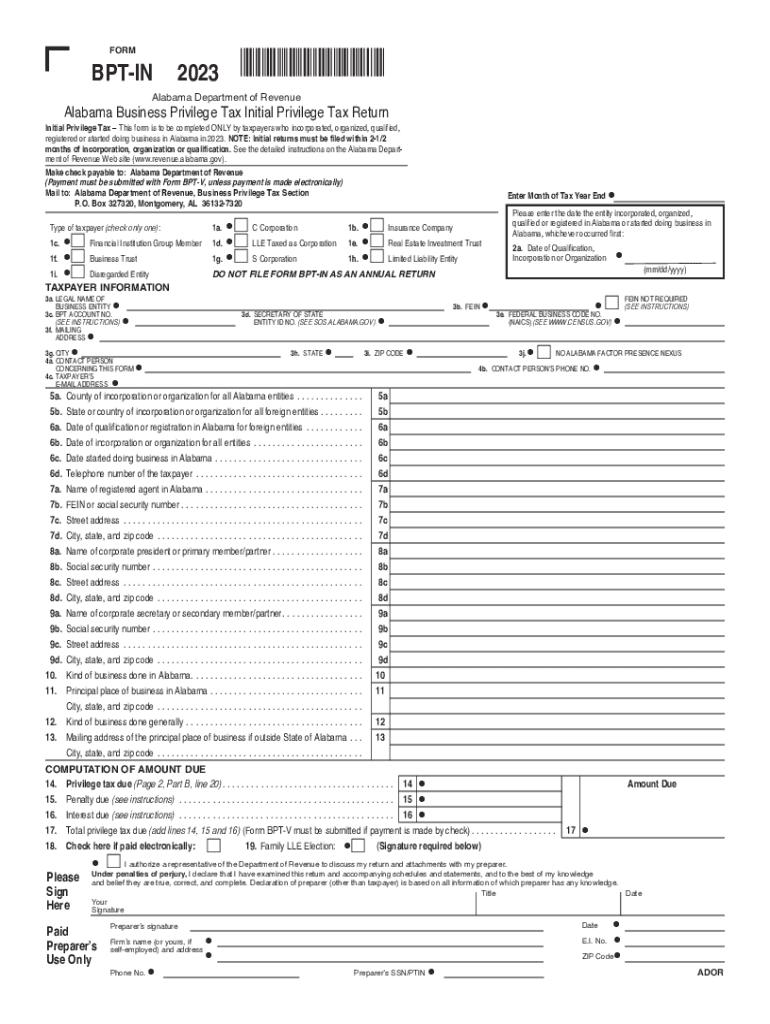

The Alabama Business Privilege Tax Initial Return Form is a crucial document for businesses operating in Alabama. This form is used to report the business privilege tax, which is a tax imposed on businesses for the privilege of doing business in the state. It is typically required for new businesses or those that have recently established a presence in Alabama. The form collects essential information about the business, including its name, address, and type of business entity. Understanding this form is vital for compliance with state tax regulations.

Steps to complete the Alabama Business Privilege Tax Initial Return Form

Completing the Alabama Business Privilege Tax Initial Return Form involves several key steps:

- Gather necessary information: Collect details such as your business name, address, federal employer identification number (EIN), and the type of business entity.

- Determine your tax obligation: Calculate the business privilege tax based on the entity type and gross receipts.

- Fill out the form: Accurately complete all sections of the form, ensuring all information is correct and up to date.

- Review the form: Double-check for any errors or omissions before submission.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

How to obtain the Alabama Business Privilege Tax Initial Return Form

The Alabama Business Privilege Tax Initial Return Form can be obtained through the Alabama Department of Revenue's official website. The form is available for download in PDF format, allowing businesses to print and fill it out. Additionally, businesses may also request a physical copy by contacting the Department of Revenue directly. Ensuring you have the correct and most current version of the form is essential for compliance.

Form Submission Methods (Online / Mail / In-Person)

Businesses have several options for submitting the Alabama Business Privilege Tax Initial Return Form:

- Online: The form can be submitted electronically through the Alabama Department of Revenue's online portal, which offers a convenient and efficient way to file.

- By Mail: Businesses may print the completed form and send it to the appropriate address provided by the Department of Revenue. Ensure to use the correct mailing address to avoid delays.

- In-Person: Some businesses may prefer to deliver the form in person at their local Department of Revenue office. This option allows for immediate confirmation of receipt.

Key elements of the Alabama Business Privilege Tax Initial Return Form

The Alabama Business Privilege Tax Initial Return Form includes several key elements that are essential for accurate reporting:

- Business Information: This section requires the business name, address, and EIN.

- Entity Type: Indicate whether the business is an LLC, corporation, partnership, or another type.

- Gross Receipts: Report the total gross receipts for the previous year, which is used to calculate the tax due.

- Signature: The form must be signed by an authorized representative of the business, confirming the accuracy of the information provided.

Filing Deadlines / Important Dates

It is important for businesses to be aware of the filing deadlines associated with the Alabama Business Privilege Tax Initial Return Form. Typically, the form must be filed annually, with deadlines varying based on the business entity type. Businesses should consult the Alabama Department of Revenue's website for specific dates and any changes to the filing schedule. Timely submission is crucial to avoid penalties and ensure compliance with state tax laws.

Quick guide on how to complete alabama business privilege tax initial return form

Prepare Alabama Business Privilege Tax Initial Return Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to easily find the necessary template and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Alabama Business Privilege Tax Initial Return Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The simplest way to alter and eSign Alabama Business Privilege Tax Initial Return Form effortlessly

- Find Alabama Business Privilege Tax Initial Return Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Alabama Business Privilege Tax Initial Return Form to ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct alabama business privilege tax initial return form

Create this form in 5 minutes!

How to create an eSignature for the alabama business privilege tax initial return form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alabama form BPT in 2023?

The Alabama form BPT in 2023 is the Business Privilege Tax Return required for Alabama businesses. It entails reporting business income, determining tax due, and ensuring compliance with state regulations. Filing this form is essential for maintaining good standing with the state.

-

How can airSlate SignNow help with the Alabama form BPT in 2023?

airSlate SignNow simplifies the process of preparing and submitting the Alabama form BPT in 2023 by offering electronic signatures and document management. You can easily create, send, and eSign your forms, ensuring faster processing and compliance. This streamlines your tax preparation efforts.

-

What are the pricing plans for airSlate SignNow when dealing with Alabama form BPT in 2023?

airSlate SignNow offers various pricing plans tailored for businesses of all sizes, starting with a free trial. Each plan provides features that can assist you in filing your Alabama form BPT in 2023 efficiently. Explore our pricing page for more details and choose the best plan that fits your needs.

-

What are the key features of airSlate SignNow for handling tax forms like the Alabama form BPT in 2023?

Key features of airSlate SignNow include customizable templates, electronic signatures, and real-time tracking. These tools enhance your experience when managing the Alabama form BPT in 2023, ensuring you remain organized and compliant. Our user-friendly interface makes document collaboration seamless.

-

Are there any benefits to using airSlate SignNow for the Alabama form BPT in 2023?

Using airSlate SignNow for the Alabama form BPT in 2023 offers numerous benefits, such as improved efficiency and reduced paper usage. It guarantees that your documents are securely eSigned and stored, minimizing the risk of errors and delays in submission. Experience a more streamlined tax filing process.

-

Can I integrate airSlate SignNow with other tools for managing the Alabama form BPT in 2023?

Yes, airSlate SignNow offers extensive integration capabilities with popular applications like Google Drive, Dropbox, and Zapier. This allows you to seamlessly manage and submit the Alabama form BPT in 2023 alongside your other business tools. Enhance productivity by connecting your workflows.

-

Is airSlate SignNow compliant with Alabama regulations for the form BPT in 2023?

Yes, airSlate SignNow is designed to comply with Alabama regulations, ensuring your Alabama form BPT in 2023 is managed according to state guidelines. Our platform provides security and compliance, giving you peace of mind while handling important tax documents. Protect your business with our reliable solution.

Get more for Alabama Business Privilege Tax Initial Return Form

- Financial responsibility agreement template form

- Approval form 1b 18905857

- Pay sheet template form

- 291 request for transcript wake technical community college forms waketech

- Annual reevaluation form managerial click here to

- Chapter 26 workbook causes of world war ii match up 103 form

- Asu transcripts form

- Wilson college print request form revised 2 my wilson

Find out other Alabama Business Privilege Tax Initial Return Form

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement

- eSignature Arkansas Doctors LLC Operating Agreement Later

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement