Form 940 Vision Payroll

Understanding Form 940 Vision Payroll

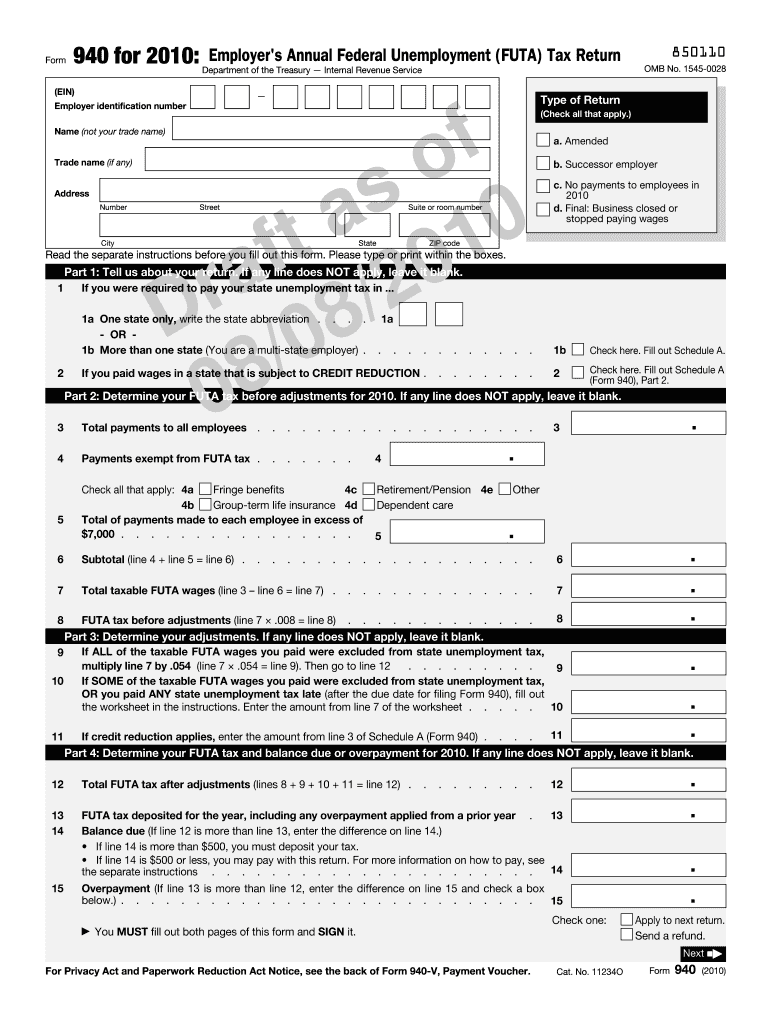

Form 940 Vision Payroll is a crucial document for employers in the United States, specifically designed for reporting annual Federal Unemployment Tax Act (FUTA) taxes. This form helps businesses calculate their unemployment tax liability and report it to the Internal Revenue Service (IRS). Employers use this form to ensure compliance with federal regulations regarding unemployment insurance. Understanding this form is essential for maintaining accurate payroll records and fulfilling tax obligations.

Steps to Complete Form 940 Vision Payroll

Filling out Form 940 Vision Payroll involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business's Employer Identification Number (EIN) and payroll records for the year. Next, follow these steps:

- Enter your business information, including the name and address.

- Report the total payments made to employees during the year.

- Calculate the FUTA tax based on the taxable wages.

- Complete the section for any adjustments or credits you may qualify for.

- Sign and date the form before submission.

Review the completed form for any errors before filing it with the IRS.

How to Obtain Form 940 Vision Payroll

Employers can easily obtain Form 940 Vision Payroll through the IRS website or by contacting the IRS directly. The form is available for download in PDF format, allowing for easy printing and completion. Additionally, many tax preparation software programs include the form, streamlining the filing process for businesses. Ensure you are using the most current version of the form to avoid any compliance issues.

Filing Deadlines for Form 940 Vision Payroll

Timely filing of Form 940 Vision Payroll is essential to avoid penalties. The form is typically due on January 31 of the following year, covering the previous calendar year's payroll. If January 31 falls on a weekend or holiday, the due date is extended to the next business day. Employers should also be aware of any potential extensions available if they meet certain criteria, allowing for additional time to file without incurring penalties.

Legal Use of Form 940 Vision Payroll

Form 940 Vision Payroll serves a legal purpose in the realm of employment and taxation. It is mandated by federal law for employers who pay wages subject to FUTA tax. Proper use of this form ensures that businesses comply with federal unemployment tax regulations, which helps fund unemployment benefits for eligible workers. Failure to file this form can result in significant penalties and interest on unpaid taxes.

Key Elements of Form 940 Vision Payroll

Understanding the key elements of Form 940 Vision Payroll is vital for accurate completion. Important sections include:

- Employer Information: Business name, address, and EIN.

- Payroll Information: Total wages paid and taxable wages.

- Tax Calculation: Total FUTA tax owed based on reported wages.

- Adjustments: Any credits or adjustments that affect the tax liability.

Each of these elements plays a significant role in determining the employer's tax responsibilities.

Examples of Using Form 940 Vision Payroll

Form 940 Vision Payroll is utilized in various scenarios by employers. For instance, a small business owner with a few employees must file this form annually to report unemployment taxes. Similarly, larger organizations with multiple locations may need to consolidate their payroll data to complete the form accurately. These examples illustrate the form's application across different business sizes and structures, highlighting its importance in maintaining compliance with federal tax laws.

Quick guide on how to complete form 940 vision payroll

Manage [SKS] seamlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as a stellar eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Handle [SKS] on any device with airSlate SignNow’s Android or iOS applications and simplify any document-related procedure today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to initiate.

- Utilize the tools provided to complete your document.

- Emphasize pertinent sections of the documents or mask sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to confirm your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Erase the worry of lost or misplaced documents, tedious form navigation, or mistakes requiring new document prints. airSlate SignNow meets your document management needs in just a few clicks from a device of your choosing. Edit and eSign [SKS] and ensure effective communication at every phase of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 940 Vision Payroll

Create this form in 5 minutes!

How to create an eSignature for the form 940 vision payroll

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 940 Vision Payroll?

Form 940 Vision Payroll is a comprehensive payroll solution designed to streamline the filing of your annual federal unemployment tax return. With airSlate SignNow, you can easily manage and eSign your Form 940, ensuring compliance and accuracy in your payroll processes.

-

How does airSlate SignNow simplify the Form 940 Vision Payroll process?

airSlate SignNow simplifies the Form 940 Vision Payroll process by providing an intuitive platform for document management and eSigning. Users can quickly fill out, sign, and send their Form 940 electronically, reducing paperwork and saving time.

-

What are the pricing options for using Form 940 Vision Payroll with airSlate SignNow?

airSlate SignNow offers flexible pricing plans for businesses of all sizes looking to utilize Form 940 Vision Payroll. You can choose from monthly or annual subscriptions, with options that cater to different needs and budgets, ensuring you get the best value for your payroll management.

-

Can I integrate Form 940 Vision Payroll with other software?

Yes, airSlate SignNow allows seamless integration with various accounting and payroll software, enhancing your Form 940 Vision Payroll experience. This integration ensures that your data flows smoothly between systems, reducing manual entry and potential errors.

-

What features does airSlate SignNow offer for Form 940 Vision Payroll?

airSlate SignNow provides a range of features for Form 940 Vision Payroll, including customizable templates, automated reminders, and secure cloud storage. These features help streamline the payroll process, making it easier to manage and eSign your documents.

-

How secure is the data when using Form 940 Vision Payroll with airSlate SignNow?

Data security is a top priority for airSlate SignNow. When using Form 940 Vision Payroll, your information is protected with advanced encryption and secure access controls, ensuring that your sensitive payroll data remains confidential and safe.

-

What are the benefits of using airSlate SignNow for Form 940 Vision Payroll?

Using airSlate SignNow for Form 940 Vision Payroll offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. The platform's user-friendly interface allows businesses to manage their payroll documents effortlessly, saving time and resources.

Get more for Form 940 Vision Payroll

Find out other Form 940 Vision Payroll

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online