Grantor Form

What is the Grantor Form

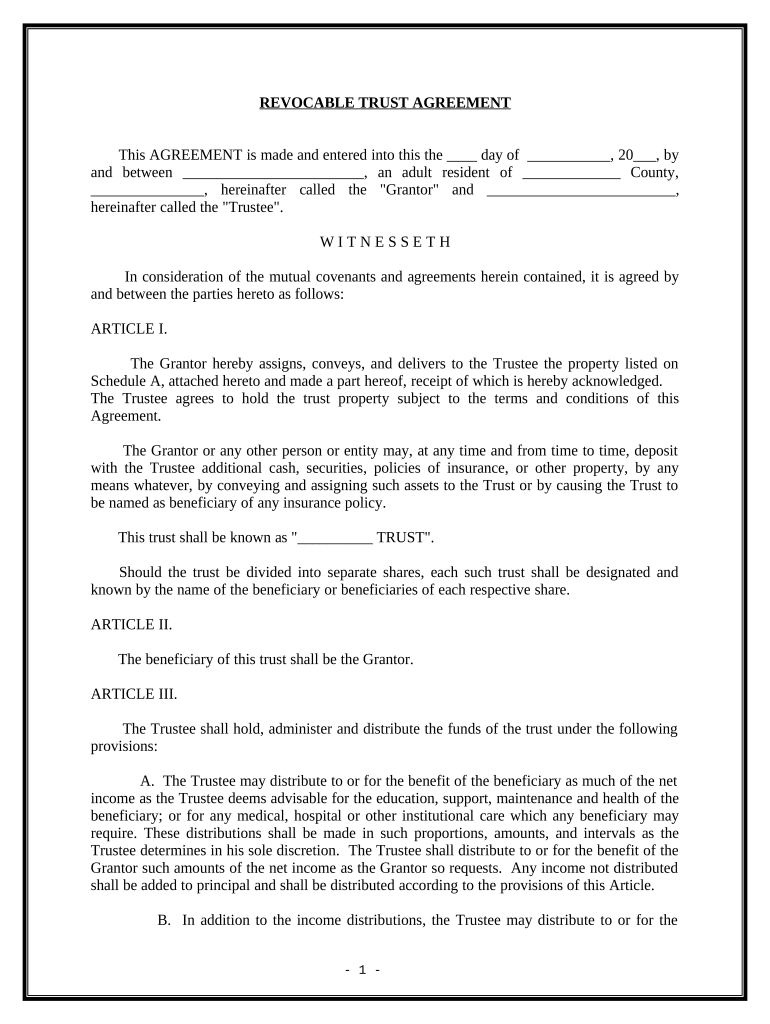

The grantor form is a legal document used to establish the terms of a trust or to transfer property ownership. It is essential for individuals looking to designate how their assets will be managed and distributed during their lifetime and after their passing. This form outlines the responsibilities of the grantor, the trustee, and the beneficiaries involved in the trust arrangement. Understanding the purpose and implications of the grantor form is crucial for effective estate planning.

Steps to complete the Grantor Form

Completing the grantor form involves several key steps to ensure accuracy and legal compliance. Here’s a simplified process:

- Identify the type of trust you wish to create, as this will influence the information required.

- Gather necessary information, including details about the grantor, trustee, and beneficiaries.

- Clearly define the assets being placed into the trust, including real estate, bank accounts, and personal property.

- Fill out the grantor form, ensuring all sections are completed accurately.

- Review the form for completeness and correctness before signing.

- Have the form notarized if required by state law to enhance its legal standing.

Legal use of the Grantor Form

The grantor form is legally binding when executed correctly, adhering to state laws governing trusts and property transfers. It must be signed by the grantor and may require witnesses or notarization depending on jurisdiction. This form is crucial for ensuring that the grantor's intentions are honored and that the trust operates according to the specified terms. Non-compliance with legal requirements can result in the form being deemed invalid, which may complicate estate management.

Key elements of the Grantor Form

Several key elements must be included in the grantor form to ensure its effectiveness:

- Grantor Information: Full name and address of the person creating the trust.

- Trustee Details: Name and address of the individual or institution managing the trust.

- Beneficiaries: Names and contact information of individuals or entities that will benefit from the trust.

- Asset Description: Detailed list of assets being transferred into the trust.

- Terms of the Trust: Specific instructions on how the assets should be managed and distributed.

How to obtain the Grantor Form

The grantor form can typically be obtained through various channels. Many legal websites offer downloadable templates that comply with state laws. Additionally, consulting with an attorney specializing in estate planning can provide personalized assistance and ensure that the form meets all legal requirements. Local government offices or libraries may also have copies of the form available for public use.

Examples of using the Grantor Form

There are several scenarios in which a grantor form may be utilized:

- Creating a living trust to manage assets during the grantor's lifetime.

- Establishing a testamentary trust that comes into effect upon the grantor's death.

- Transferring property to a trust to protect assets from creditors.

- Designating a trust for minor children to ensure their financial needs are met.

Quick guide on how to complete grantor form

Complete Grantor Form effortlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can obtain the correct version and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Grantor Form on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Grantor Form with ease

- Find Grantor Form and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this task.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, drawn-out form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Grantor Form and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a grantor form?

A grantor form is a legal document that establishes the terms under which a grantor transfers assets to a grantee. This form is essential for ensuring that the intentions of the grantor are clearly communicated and legally binding. By using airSlate SignNow, you can easily create, send, and eSign grantor forms.

-

How does airSlate SignNow simplify the grantor form process?

airSlate SignNow simplifies the grantor form process by providing an intuitive platform that allows users to create and manage documents effortlessly. With features like templates and electronic signatures, you can save time and reduce errors. This streamlined approach ensures that your grantor forms are processed swiftly and accurately.

-

What are the pricing options for using airSlate SignNow for grantor forms?

airSlate SignNow offers various pricing plans designed to suit different business needs. Whether you're a small business or a larger enterprise, you can find a plan that accommodates your requirements for managing grantor forms efficiently. Each plan includes features that enhance your document signing experience.

-

Are there any integrations available for grantor form management with airSlate SignNow?

Yes, airSlate SignNow integrates with numerous third-party applications, which makes managing grantor forms even easier. You can connect with popular CRMs, cloud storage services, and other business tools. This flexibility allows you to streamline your workflow around grantor forms and improve overall productivity.

-

Can I customize my grantor form using airSlate SignNow?

Absolutely! airSlate SignNow provides customizable templates that are perfect for creating your grantor form. You can add specific clauses, modify fields, and adjust the layout to meet your specific needs. This customization ensures that your grantor form reflects your business requirements.

-

What security measures are in place for grantor forms signed with airSlate SignNow?

airSlate SignNow takes the security of your grantor forms seriously, employing industry-standard encryption and authentication protocols. All documents are securely stored, ensuring that private information remains confidential. You can sign grantor forms with the peace of mind that your data is protected.

-

How can I track the status of my grantor form sent through airSlate SignNow?

Tracking the status of your grantor form is easy with airSlate SignNow's built-in notification system. You will receive updates when the form is viewed and signed by the recipient. This feature helps you stay informed about your document's progress, making the process seamless.

Get more for Grantor Form

Find out other Grantor Form

- Sign Indiana Healthcare / Medical Moving Checklist Safe

- Sign Wisconsin Government Cease And Desist Letter Online

- Sign Louisiana Healthcare / Medical Limited Power Of Attorney Mobile

- Sign Healthcare / Medical PPT Michigan Now

- Sign Massachusetts Healthcare / Medical Permission Slip Now

- Sign Wyoming Government LLC Operating Agreement Mobile

- Sign Wyoming Government Quitclaim Deed Free

- How To Sign Nebraska Healthcare / Medical Living Will

- Sign Nevada Healthcare / Medical Business Plan Template Free

- Sign Nebraska Healthcare / Medical Permission Slip Now

- Help Me With Sign New Mexico Healthcare / Medical Medical History

- Can I Sign Ohio Healthcare / Medical Residential Lease Agreement

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online