P87 Form

What is the P87 Form

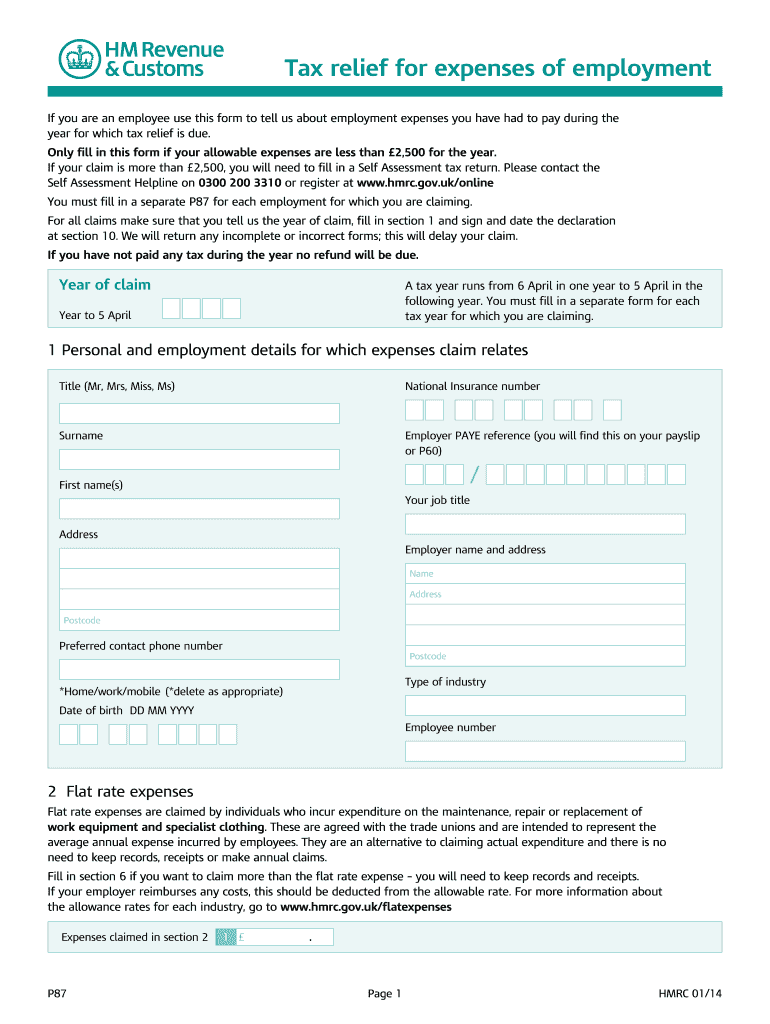

The P87 form is a tax document used in the United Kingdom, specifically designed for employees to claim back expenses incurred while performing their job duties. This form allows individuals to report costs related to uniforms, tools, and other necessary expenses that are not reimbursed by their employers. The HMRC P87 claim form is particularly useful for those who want to ensure they are not paying more tax than necessary due to work-related expenses.

How to Use the P87 Form

Using the P87 form involves several steps to ensure that all relevant expenses are accurately reported. First, gather all necessary documentation, such as receipts and records of expenses. Next, fill out the form with personal information, including your name, address, and National Insurance number. Then, detail the expenses you are claiming, providing clear descriptions and amounts. Once completed, submit the form to HMRC either online or by mail, depending on your preference.

Steps to Complete the P87 Form

Completing the P87 form requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant receipts and documentation for expenses.

- Fill in your personal information accurately.

- List each expense separately, including the date, description, and amount.

- Check for any additional sections that may apply to your specific situation.

- Review the form for accuracy before submission.

Legal Use of the P87 Form

The P87 form is legally recognized for claiming tax relief on work-related expenses. To ensure compliance, it is essential to provide accurate information and retain supporting documentation. The form must be submitted within the specified time frame to avoid penalties. Understanding the legal implications of the P87 form helps taxpayers navigate the process confidently and ensures that their claims are valid.

Required Documents

When filling out the P87 form, certain documents are required to substantiate your claims. These may include:

- Receipts for purchased items related to your work.

- Proof of payment, such as bank statements or credit card statements.

- Any correspondence from your employer regarding reimbursements.

Having these documents ready can facilitate a smoother filing process and support your claims if necessary.

Form Submission Methods

The P87 form can be submitted through various methods, allowing flexibility for taxpayers. You can choose to complete the form online via the HMRC website or download a PDF version to fill out manually. If opting for the paper version, ensure it is mailed to the correct HMRC address. Each submission method has its own processing times, so consider this when filing your claim.

Quick guide on how to complete p87 form

Effortlessly Prepare P87 Form on Any Device

Managing documents online has become increasingly popular among organizations and individuals alike. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle P87 Form on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Modify and eSign P87 Form with Ease

- Obtain P87 Form and click on Get Form to begin.

- Employ the tools we offer to fill out your form.

- Mark important sections of the documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you would prefer to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate reprinting new copies of documents. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and eSign P87 Form and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the p87 form

How to generate an eSignature for the P87 Form online

How to generate an electronic signature for your P87 Form in Google Chrome

How to make an eSignature for signing the P87 Form in Gmail

How to create an eSignature for the P87 Form straight from your smartphone

How to generate an electronic signature for the P87 Form on iOS

How to make an eSignature for the P87 Form on Android

People also ask

-

What is a P87 Form and how is it used?

The P87 Form is a tax form used in the UK to claim tax relief for expenses incurred during employment. It allows individuals to report expenses that are not reimbursed by their employer, such as travel or equipment costs. By using the P87 Form, you can potentially receive a tax refund, making it essential for employees with out-of-pocket expenses.

-

How does airSlate SignNow simplify the process of completing a P87 Form?

airSlate SignNow streamlines the process of completing a P87 Form by providing an intuitive platform for eSigning documents. Users can easily fill out the P87 Form electronically, ensuring accuracy and saving time. With features like templates and cloud storage, airSlate SignNow helps you manage your tax forms efficiently.

-

Is there a cost associated with using airSlate SignNow for the P87 Form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. With a focus on being cost-effective, users can access features that simplify the completion of forms like the P87 Form at competitive rates. Explore our pricing page to find a plan that suits your requirements.

-

What features does airSlate SignNow offer for handling documents like the P87 Form?

airSlate SignNow provides robust features for handling documents such as the P87 Form, including eSigning, document templates, and secure cloud storage. These features ensure that your P87 Form is processed quickly and securely, enhancing your overall document management experience. Additionally, integration with other tools allows for seamless workflow.

-

Can I integrate airSlate SignNow with other software to manage my P87 Form?

Absolutely! airSlate SignNow supports integrations with various applications, making it easy to manage your P87 Form alongside other business processes. Whether you use CRM systems, accounting software, or project management tools, our platform can be integrated to streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my P87 Form submissions?

Using airSlate SignNow for your P87 Form submissions offers numerous benefits, including faster processing times and reduced paperwork. The eSigning feature allows you to complete forms remotely, which is particularly useful for busy professionals. Moreover, our solution enhances security and compliance, ensuring your information is protected.

-

Is airSlate SignNow suitable for small businesses needing to manage P87 Forms?

Yes, airSlate SignNow is an excellent choice for small businesses looking to manage P87 Forms efficiently. Our user-friendly platform is designed to accommodate businesses of all sizes, providing cost-effective solutions that simplify document management. Small businesses can benefit from reduced administrative overhead and faster turnaround times.

Get more for P87 Form

- Planting plan questionnaire portland nursery form

- Tree felling permit city of springfield oregon form

- Simple site erosion control requirements form

- New products letter cwk wp modern fan company form

- Memorandum official web site of the city of berkeley form

- Npinventory form last xlsx

- Arizona biofuel annual report form

- Application for a sale health certificate list of ingestible form

Find out other P87 Form

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online