Minnesota Tax Forms M4

What is the Minnesota Tax Forms M4

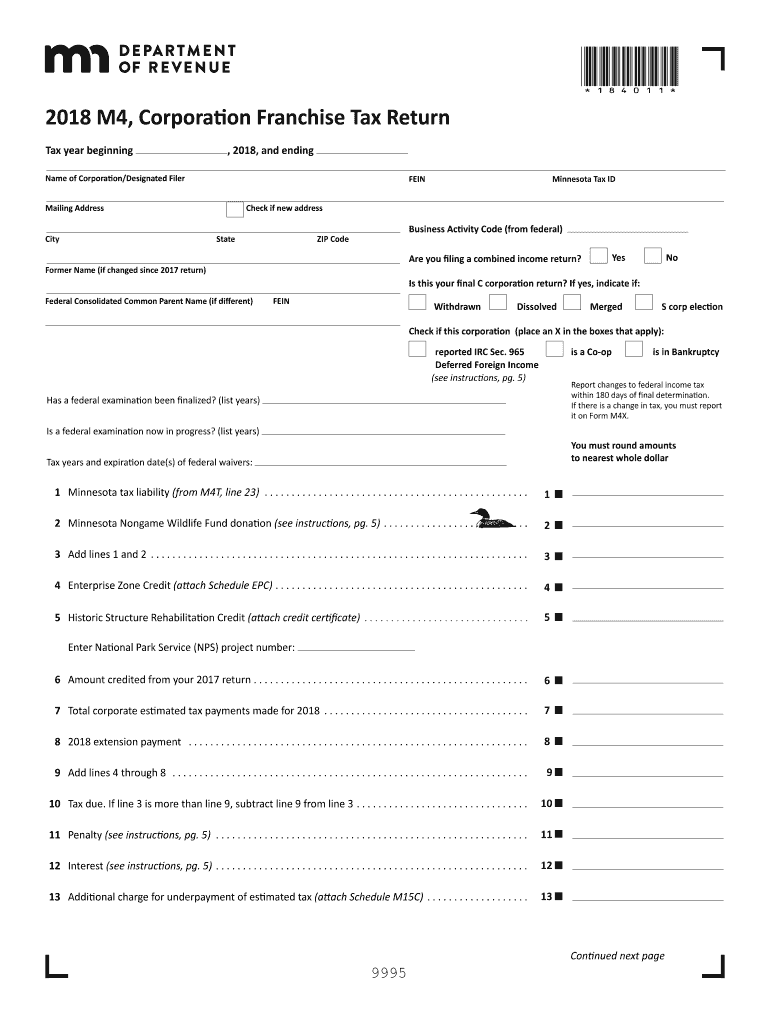

The Minnesota Tax Forms M4 is a specific tax form used for reporting franchise taxes for certain business entities operating in Minnesota. This form is essential for corporations, partnerships, and limited liability companies that are subject to the state's franchise tax regulations. The M4 form allows these entities to calculate their tax liabilities based on their income, ensuring compliance with Minnesota tax laws.

Steps to complete the Minnesota Tax Forms M4

Completing the Minnesota Tax Forms M4 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, including income statements and expense reports. Next, follow these steps:

- Provide basic information about your business, including the name, address, and federal employer identification number (EIN).

- Calculate your taxable income by subtracting allowable deductions from your total revenue.

- Apply the appropriate tax rate to your taxable income to determine your franchise tax liability.

- Complete any additional schedules required for specific deductions or credits.

- Review the completed form for accuracy before submission.

Legal use of the Minnesota Tax Forms M4

The Minnesota Tax Forms M4 is legally binding when completed correctly and submitted on time. The form must adhere to the guidelines established by the Minnesota Department of Revenue, which includes accurate reporting of income and compliance with state tax laws. Failure to properly complete or submit the M4 form can result in penalties, including fines or interest on unpaid taxes.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Minnesota Tax Forms M4 is crucial for compliance. Typically, the form must be filed by the fifteenth day of the fourth month following the end of your tax year. For most businesses operating on a calendar year, this means the deadline is April 15. It is also important to stay updated on any changes to these deadlines, as they can vary based on specific circumstances or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

The Minnesota Tax Forms M4 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Businesses can file electronically through the Minnesota Department of Revenue’s online portal, which offers a streamlined process.

- Mail Submission: Completed forms can be mailed to the appropriate address provided by the Minnesota Department of Revenue. Ensure that the form is postmarked by the filing deadline.

- In-Person Submission: For those who prefer face-to-face assistance, forms can be submitted in person at designated Minnesota Department of Revenue offices.

Required Documents

To complete the Minnesota Tax Forms M4, certain documents are required. These typically include:

- Financial statements that detail income and expenses.

- Prior year tax returns for reference.

- Any schedules or forms that support deductions or credits claimed.

- Documentation related to business operations, such as partnership agreements or corporate bylaws.

Quick guide on how to complete 2018 m4 corporation franchise tax return corporation franchise tax return 2018

Manage Minnesota Tax Forms M4 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly, without any hold-ups. Handle Minnesota Tax Forms M4 across any platform using the airSlate SignNow apps for Android or iOS and simplify your document-related tasks today.

The simplest way to modify and electronically sign Minnesota Tax Forms M4 with ease

- Locate Minnesota Tax Forms M4 and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, tedious form hunting, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Minnesota Tax Forms M4 to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 m4 corporation franchise tax return corporation franchise tax return 2018

How to make an eSignature for your 2018 M4 Corporation Franchise Tax Return Corporation Franchise Tax Return 2018 online

How to generate an electronic signature for your 2018 M4 Corporation Franchise Tax Return Corporation Franchise Tax Return 2018 in Chrome

How to generate an electronic signature for putting it on the 2018 M4 Corporation Franchise Tax Return Corporation Franchise Tax Return 2018 in Gmail

How to generate an electronic signature for the 2018 M4 Corporation Franchise Tax Return Corporation Franchise Tax Return 2018 right from your mobile device

How to generate an eSignature for the 2018 M4 Corporation Franchise Tax Return Corporation Franchise Tax Return 2018 on iOS devices

How to generate an electronic signature for the 2018 M4 Corporation Franchise Tax Return Corporation Franchise Tax Return 2018 on Android OS

People also ask

-

What are the key features of the mn m4 instructions 2020?

The mn m4 instructions 2020 include comprehensive guidance on document preparation, submission, and signing processes. These features ensure a smooth workflow for users, making it easy to navigate through the eSigning and document management process.

-

How can I access the mn m4 instructions 2020?

You can access the mn m4 instructions 2020 directly through the airSlate SignNow dashboard. Simply log in to your account, and you'll find the documentation readily available for you to download and consult at any time.

-

Is there a cost associated with the mn m4 instructions 2020?

The mn m4 instructions 2020 are provided as part of your subscription to airSlate SignNow. Our pricing plans are designed to be cost-effective, ensuring that you get comprehensive support without additional costs for the instructions.

-

What are the benefits of using airSlate SignNow with the mn m4 instructions 2020?

Using airSlate SignNow alongside the mn m4 instructions 2020 provides a streamlined experience for eSigning documents. These instructions help users understand the entire process, reducing errors and enhancing efficiency in document handling.

-

Can airSlate SignNow integrate with other software when using the mn m4 instructions 2020?

Yes, airSlate SignNow offers seamless integration with various tools and platforms while utilizing the mn m4 instructions 2020. This ensures you can incorporate eSigning capabilities into your existing workflows without any hassle.

-

What types of documents can I manage using the mn m4 instructions 2020?

The mn m4 instructions 2020 apply to a wide range of documents, including contracts, agreements, and forms. airSlate SignNow allows you to manage these documents efficiently, ensuring they are signed and processed seamlessly.

-

Are there any compliance considerations in the mn m4 instructions 2020?

Absolutely, the mn m4 instructions 2020 cover compliance aspects essential for eSignature legality. airSlate SignNow adheres to industry standards, ensuring that your signed documents are legally binding and compliant with regulations.

Get more for Minnesota Tax Forms M4

- Child protection intake documents form

- Wolf chiropractic confidential health information

- Gicp health hx form 2 seattle cancer care alliance seattlecca

- Developmental disabilities administration ddanot form

- Pediatric eye exam 1 hour specialty eyecare group form

- Affidavit for correctional tothis is a legal docu form

- Alternating acetaminophen and ibuprofen for pain in children form

- Mhs dental dental screening consent form

Find out other Minnesota Tax Forms M4

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template