Florida Franchise Tax Return Form

What is the Florida Franchise Tax Return

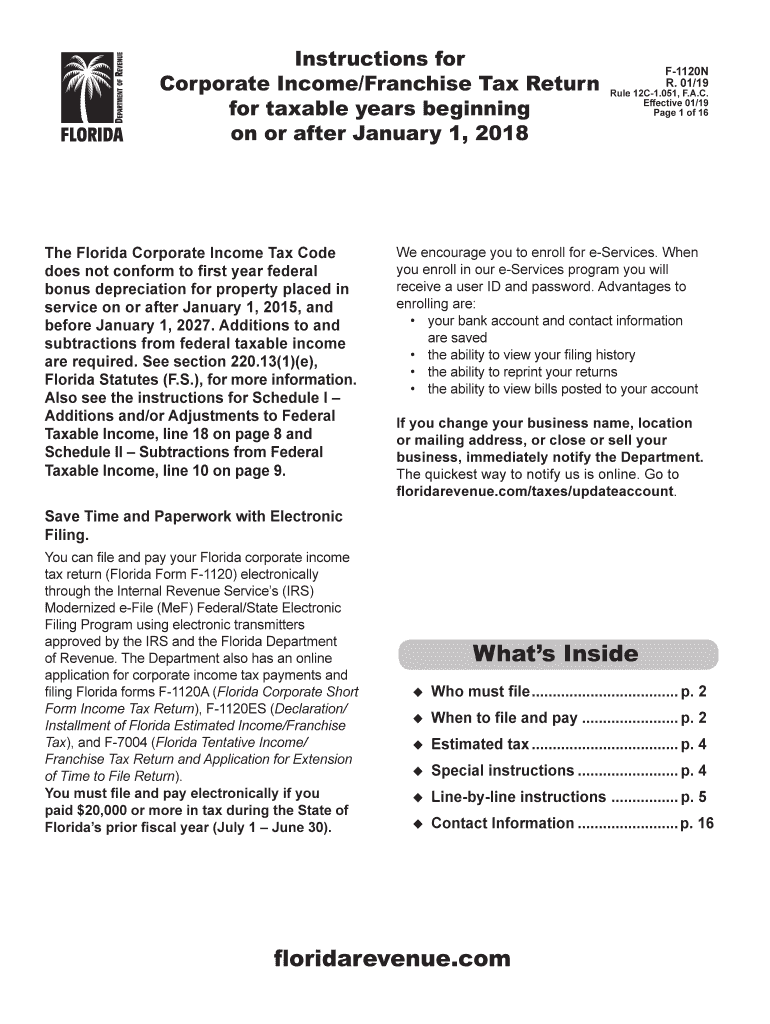

The Florida Franchise Tax Return, known as the Florida F-1120N, is a tax form that corporations must file to report their income and calculate their franchise tax liability. This return is essential for corporations operating in Florida, as it ensures compliance with state tax laws. The franchise tax is based on the corporation's net income, and it is crucial for maintaining good standing with the Florida Department of Revenue.

Steps to complete the Florida Franchise Tax Return

Completing the Florida Franchise Tax Return involves several key steps:

- Gather necessary documents: Collect financial statements, income records, and any other relevant documentation.

- Fill out the form: Complete the Florida F-1120N with accurate financial information, including gross income, deductions, and credits.

- Review for accuracy: Ensure all information is correct and complete to avoid penalties.

- Sign and date the return: An authorized officer must sign the return to validate it.

- Submit the return: File the completed form electronically or by mail, following the guidelines provided by the Florida Department of Revenue.

Legal use of the Florida Franchise Tax Return

The Florida Franchise Tax Return is legally binding when properly completed and submitted. To ensure its validity, the return must be signed by an authorized representative of the corporation. Additionally, compliance with eSignature laws is essential when submitting electronically. Using a reliable eSignature platform can enhance the legal standing of the document by providing a digital certificate and maintaining compliance with relevant regulations.

Filing Deadlines / Important Dates

Corporations must be aware of the filing deadlines for the Florida Franchise Tax Return to avoid penalties. The return is typically due on the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by April fifteenth. It is important to stay informed about any changes to deadlines or requirements by consulting the Florida Department of Revenue's official communications.

Form Submission Methods (Online / Mail / In-Person)

The Florida Franchise Tax Return can be submitted through various methods, ensuring flexibility for corporations. Options include:

- Online submission: Corporations can file electronically through the Florida Department of Revenue's e-filing system, which offers a streamlined process.

- Mail: The completed return can be mailed to the designated address provided by the Florida Department of Revenue. Ensure that the return is postmarked by the due date.

- In-person submission: Corporations may also choose to deliver the return directly to a local Department of Revenue office, although this option may be less common.

Required Documents

To complete the Florida Franchise Tax Return, certain documents are required. These include:

- Financial statements: Balance sheets and income statements that reflect the corporation's financial position.

- Tax identification number: The corporation's federal Employer Identification Number (EIN).

- Previous tax returns: Copies of prior year returns may be useful for reference and consistency.

- Supporting documentation: Any additional paperwork that supports income, deductions, or credits claimed on the return.

Key elements of the Florida Franchise Tax Return

The Florida Franchise Tax Return includes several key elements that must be accurately reported. These elements typically consist of:

- Gross income: Total revenue generated by the corporation before any deductions.

- Deductions: Allowable expenses that can be subtracted from gross income to determine taxable income.

- Tax credits: Any applicable credits that can reduce the overall tax liability.

- Franchise tax calculation: The formula used to determine the amount of tax owed based on the corporation's net income.

Quick guide on how to complete bonus depreciation for property placed in

Effortlessly Prepare Florida Franchise Tax Return on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents promptly without delays. Handle Florida Franchise Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The Simplest Way to Modify and Electronically Sign Florida Franchise Tax Return with Ease

- Find Florida Franchise Tax Return and click on Get Form to commence.

- Make use of the tools provided to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, text (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Modify and electronically sign Florida Franchise Tax Return while ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the bonus depreciation for property placed in

How to make an electronic signature for your Bonus Depreciation For Property Placed In online

How to create an eSignature for the Bonus Depreciation For Property Placed In in Chrome

How to generate an eSignature for signing the Bonus Depreciation For Property Placed In in Gmail

How to make an eSignature for the Bonus Depreciation For Property Placed In from your smartphone

How to generate an electronic signature for the Bonus Depreciation For Property Placed In on iOS devices

How to generate an electronic signature for the Bonus Depreciation For Property Placed In on Android devices

People also ask

-

What is the process for filing a 2017 Florida corporate return using airSlate SignNow?

To file your 2017 Florida corporate return using airSlate SignNow, simply upload your completed tax documents to our platform. You can then eSign them securely and submit them directly to the Florida Department of Revenue. Our user-friendly interface simplifies this process, making it efficient for all businesses.

-

How does airSlate SignNow ensure the security of my 2017 Florida corporate return?

airSlate SignNow prioritizes the security of your sensitive information, including your 2017 Florida corporate return. We implement advanced encryption protocols and secure storage solutions to protect your documents. Additionally, our platform complies with industry standards to ensure your data remains safe.

-

What are the pricing options for using airSlate SignNow for my 2017 Florida corporate return?

airSlate SignNow offers flexible pricing plans tailored to different business needs. For tackling your 2017 Florida corporate return, you can choose from our various subscription tiers that provide cost-effective solutions without sacrificing features. Visit our pricing page for detailed information.

-

Can I integrate airSlate SignNow with my accounting software for the 2017 Florida corporate return?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions. This allows you to manage your financial records and prepare your 2017 Florida corporate return more efficiently. Our integrations facilitate a streamlined workflow for your business.

-

What features does airSlate SignNow offer for preparing the 2017 Florida corporate return?

With airSlate SignNow, you have access to features such as document templates, collaborative editing, and e-signature capabilities to expedite the preparation of your 2017 Florida corporate return. These tools enhance productivity and ensure you meet all filing deadlines with ease.

-

Is airSlate SignNow suitable for small businesses filing a 2017 Florida corporate return?

Absolutely! airSlate SignNow is designed to cater to businesses of all sizes, including small enterprises. With our easy-to-use platform, small businesses can efficiently manage their documentation and filing processes for the 2017 Florida corporate return without incurring signNow expenses.

-

What are the benefits of using airSlate SignNow for my 2017 Florida corporate return?

The main benefits of using airSlate SignNow for your 2017 Florida corporate return include increased efficiency, cost savings, and enhanced security. Our platform simplifies the e-signing process and helps ensure timely submissions, allowing you to focus on your core business activities.

Get more for Florida Franchise Tax Return

- Fundraising proposal form lifeline aotearoa lifeline org

- How to get new zealand citizenship the ultimate guide form

- Maine bureau of motor vehicles 3q21 ifta 100 page 1 motor carrier services form

- Return of earnings 484010098 form

- New jersey authorization direct deposit form

- Contract to buy and sell real estate form

- Pennsylvania high school graduate form

- Ohio form

Find out other Florida Franchise Tax Return

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement