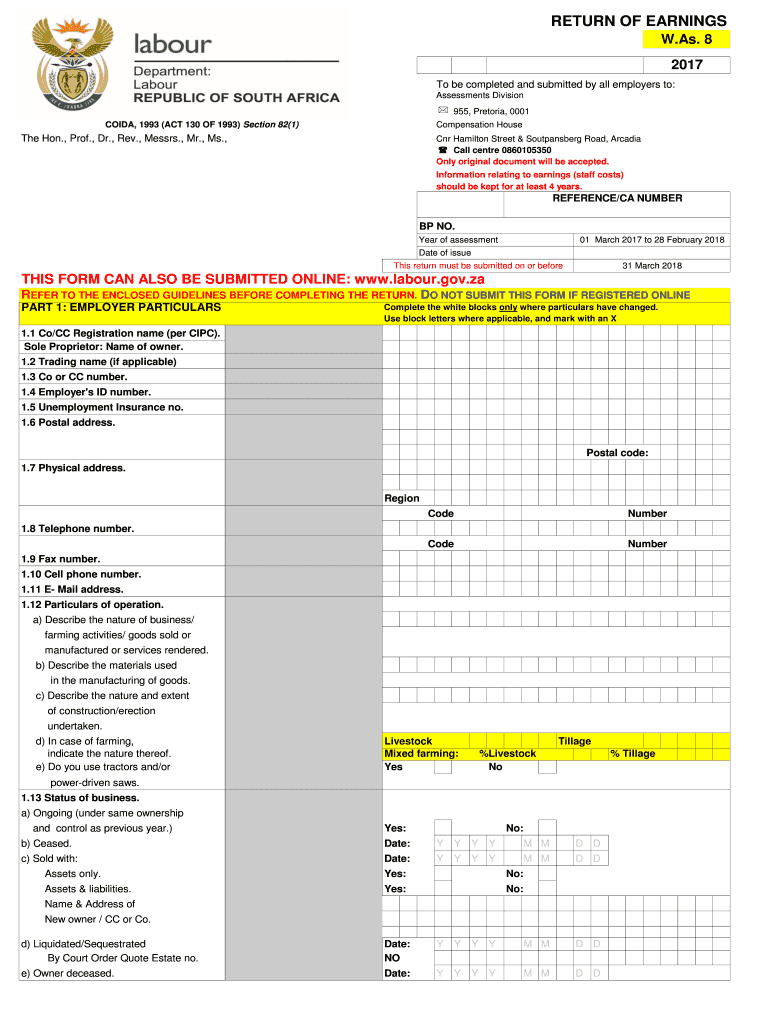

RETURN of EARNINGS 2017-2026

What is the Return of Earnings?

The Return of Earnings, often referred to as the was8 form, is a crucial document used for reporting earnings and compensation for employees or contractors. This form is particularly relevant for businesses and individuals who need to disclose their earnings to tax authorities. It provides a summary of the income received during a specific period, typically aligning with the tax year. Understanding this form is essential for compliance with federal and state tax regulations.

How to Use the Return of Earnings

Using the Return of Earnings involves accurately filling out the was8 form to reflect all applicable earnings. This includes wages, bonuses, and other forms of compensation. It is important to ensure that all figures are correct and supported by appropriate documentation. Once completed, the form is submitted to the relevant tax authority, ensuring that all income is reported accurately for tax purposes.

Steps to Complete the Return of Earnings

Completing the was8 form requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation, including pay stubs and records of bonuses.

- Fill out personal information, including name, address, and Social Security number.

- Report all earnings accurately, ensuring that totals match your records.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority.

Legal Use of the Return of Earnings

The was8 form must be used in compliance with legal requirements set forth by tax authorities. It is essential for businesses to understand the legal implications of reporting earnings accurately. Failure to submit the form or providing incorrect information can lead to penalties or audits. Therefore, maintaining accurate records and ensuring timely submission is vital for legal compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Return of Earnings can vary based on state regulations and the specific tax year. Typically, forms must be submitted by the end of the tax year, with some states requiring earlier submission. It is crucial to stay informed about these deadlines to avoid late fees or penalties. Keeping a calendar of important dates related to tax filings can help ensure compliance.

Required Documents

To complete the was8 form accurately, several documents are necessary. These may include:

- W-2 forms for employees.

- 1099 forms for independent contractors.

- Pay stubs or earnings statements.

- Any additional documentation that verifies income received.

Penalties for Non-Compliance

Non-compliance with the filing requirements of the Return of Earnings can result in significant penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is important for individuals and businesses to understand these risks and prioritize timely and accurate submissions to avoid complications with tax authorities.

Quick guide on how to complete return of earnings 484010098

Finalize RETURN OF EARNINGS seamlessly on any device

Electronic document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, as you can locate the right form and securely archive it online. airSlate SignNow equips you with all the resources necessary to construct, modify, and eSign your documents rapidly without interruptions. Handle RETURN OF EARNINGS on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The simplest way to modify and eSign RETURN OF EARNINGS effortlessly

- Find RETURN OF EARNINGS and click Get Form to commence.

- Utilize the tools we provide to finalize your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this reason.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device you prefer. Alter and eSign RETURN OF EARNINGS and guarantee excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct return of earnings 484010098

Create this form in 5 minutes!

How to create an eSignature for the return of earnings 484010098

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the w as 8 form used for?

The w as 8 form is a tax form used by foreign entities and individuals to signNow their status for withholding purposes. By utilizing the w as 8 form, businesses can ensure compliance with IRS regulations while handling international transactions.

-

How can airSlate SignNow help with the w as 8 form?

airSlate SignNow streamlines the process of filling out and signing the w as 8 form digitally. With our user-friendly interface, you can easily create, send, and eSign the w as 8 form, saving both time and effort.

-

Is airSlate SignNow cost-effective for managing the w as 8 form?

Yes, airSlate SignNow offers a cost-effective solution for managing the w as 8 form. Our pricing plans cater to businesses of all sizes, ensuring that you can efficiently manage your document needs without breaking the bank.

-

What features does airSlate SignNow offer for the w as 8 form?

airSlate SignNow provides numerous features ideal for the w as 8 form, including customizable templates, secure eSignatures, and cloud storage. These features enhance efficiency and security while processing tax-related documents.

-

Can I integrate airSlate SignNow with other software for the w as 8 form?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to seamlessly manage the w as 8 form in conjunction with your existing workflows. This ensures a more streamlined experience and improved productivity.

-

How secure is the information on the w as 8 form with airSlate SignNow?

Security is a priority at airSlate SignNow. We implement advanced encryption and security measures to protect all information, including details on the w as 8 form. You can eSign and manage documents with confidence knowing your data is safe.

-

What are the benefits of using airSlate SignNow for the w as 8 form?

Using airSlate SignNow for the w as 8 form offers numerous benefits, such as increased efficiency, enhanced compliance, and reduced paper usage. Our platform simplifies the process, helping businesses save time and resources.

Get more for RETURN OF EARNINGS

- Ftc sem 17b 2 109 foreign national request for access alertconference form

- Slavery and sectionalism worksheet answers form

- Ohio burn injury report ohio department of commerce form

- Optional form 5

- 4k2co3 coefficient form

- Avis zur grenzberschreitenden nutzung marktfhiger wertpapiere nach dem korrespondenz zentralbankmodell ccbm form

- Wehrmed defuehrung organisationreserve im sreserve im sanittsdienst der bundeswehrfachportal fr form

- Angaben ber zeichnungsberechtigte des instandhaltungsbetriebes fr die form

Find out other RETURN OF EARNINGS

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online