Schedule I 990 Ez Form

What is the Schedule I 990 EZ

The Schedule I 990 EZ is a supplementary form used by organizations that file the 990 EZ form, which is a short return for organizations exempt from income tax. This schedule provides additional information regarding the organization’s activities, governance, and financial status. It helps the IRS assess compliance with tax laws and ensures transparency in the operations of tax-exempt entities. Understanding this schedule is essential for any organization seeking to maintain its tax-exempt status while fulfilling its reporting obligations.

How to use the Schedule I 990 EZ

Using the Schedule I 990 EZ involves completing it alongside the main 990 EZ form. Organizations must provide detailed information about their programs, governance practices, and financial activities. This includes disclosing the organization’s mission, major programs, and the number of individuals served. Properly filling out this schedule is crucial, as it supports the main filing and provides the IRS with a clearer picture of the organization’s operations and impact.

Steps to complete the Schedule I 990 EZ

Completing the Schedule I 990 EZ requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary documentation, including financial statements and information about programs.

- Begin by filling out the basic identification information at the top of the form.

- Provide a clear description of the organization’s mission and major activities.

- Detail the governance structure, including board member information and policies.

- Report financial data, including revenue, expenses, and assets related to the programs.

- Review the completed schedule for accuracy and completeness before submission.

Legal use of the Schedule I 990 EZ

The Schedule I 990 EZ must be used in accordance with IRS guidelines to ensure its legal validity. Organizations are required to file this schedule annually if they meet specific criteria, such as gross receipts thresholds. Compliance with the instructions provided by the IRS is essential, as failure to do so can result in penalties or loss of tax-exempt status. Organizations should also be aware of any state-specific regulations that may apply to their filings.

Filing Deadlines / Important Dates

Organizations must adhere to strict deadlines when filing the Schedule I 990 EZ. Typically, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if an organization’s fiscal year ends on December thirty-first, the form would be due by May fifteenth of the following year. It is crucial to monitor these deadlines to avoid late filing penalties and maintain compliance with IRS regulations.

Required Documents

To complete the Schedule I 990 EZ, organizations should prepare the following documents:

- Financial statements, including balance sheets and income statements.

- Detailed descriptions of programs and activities.

- Information on governance, including board member names and roles.

- Any previous year’s filings that may provide context or necessary information.

Form Submission Methods (Online / Mail / In-Person)

Organizations have several options for submitting the Schedule I 990 EZ. The form can be filed electronically through the IRS e-file system, which is often the preferred method due to its speed and efficiency. Alternatively, organizations can mail a paper copy of the completed form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for this form. It is important to ensure that the form is submitted by the deadline to avoid penalties.

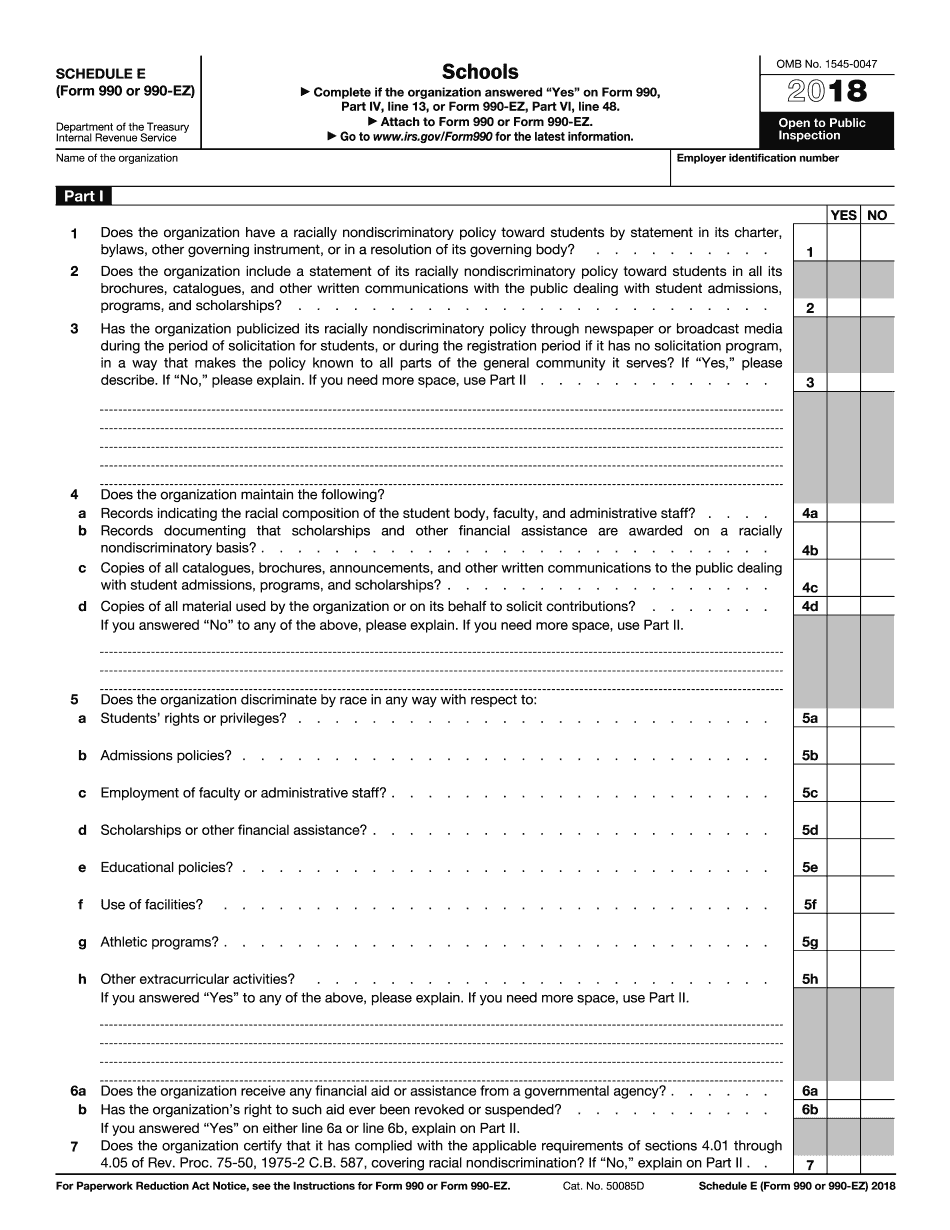

Quick guide on how to complete form 990 or 990 ez sch e

Easily Prepare Schedule I 990 Ez on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Handle Schedule I 990 Ez on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Alter and eSign Schedule I 990 Ez Effortlessly

- Find Schedule I 990 Ez and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your alterations.

- Choose how you wish to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or mistakes necessitating the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Schedule I 990 Ez to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 990 or 990 ez sch e

How to make an eSignature for your Form 990 Or 990 Ez Sch E in the online mode

How to generate an eSignature for your Form 990 Or 990 Ez Sch E in Chrome

How to generate an eSignature for signing the Form 990 Or 990 Ez Sch E in Gmail

How to create an eSignature for the Form 990 Or 990 Ez Sch E right from your smart phone

How to create an eSignature for the Form 990 Or 990 Ez Sch E on iOS devices

How to create an electronic signature for the Form 990 Or 990 Ez Sch E on Android

People also ask

-

What is Schedule I 990 Ez and how does it relate to airSlate SignNow?

Schedule I 990 Ez is a form used by tax-exempt organizations to report their financial information to the IRS. With airSlate SignNow, you can easily eSign and manage your Schedule I 990 Ez documents, ensuring compliance and simplifying the filing process.

-

How can airSlate SignNow help streamline the Schedule I 990 Ez filing process?

airSlate SignNow provides an intuitive platform that allows you to eSign your Schedule I 990 Ez quickly and securely. By digitizing your workflow, you can reduce paperwork, save time, and enhance collaboration among team members involved in the filing process.

-

What features does airSlate SignNow offer for managing Schedule I 990 Ez documents?

AirSlate SignNow offers a variety of features for managing your Schedule I 990 Ez documents, including customizable templates, audit trails, and automated reminders. These tools help ensure that your documents are completed accurately and submitted on time.

-

Is airSlate SignNow cost-effective for filing Schedule I 990 Ez?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing to file Schedule I 990 Ez. With flexible pricing plans, you can choose an option that fits your budget while benefiting from its robust eSignature capabilities.

-

Does airSlate SignNow integrate with other software for Schedule I 990 Ez processing?

Absolutely! airSlate SignNow seamlessly integrates with various software applications that you may use for Schedule I 990 Ez processing, such as accounting and document management systems. This integration enhances your workflow and ensures easy access to your documents.

-

Can I access my Schedule I 990 Ez documents from any device using airSlate SignNow?

Yes, airSlate SignNow is cloud-based, which means you can access your Schedule I 990 Ez documents from any device with internet connectivity. Whether you are in the office or on the go, you can manage your documents anytime, anywhere.

-

What security measures does airSlate SignNow implement for Schedule I 990 Ez documentation?

AirSlate SignNow prioritizes your security with advanced encryption and secure storage for your Schedule I 990 Ez documents. You can rest assured that your sensitive information is protected throughout the eSigning process.

Get more for Schedule I 990 Ez

- Www countyoffice orglyndhurst police departmentlyndhurst police department lyndhurst nj address and phone form

- Www centuryfarmmeridian com09century farm acc formacc request form centuryfarmmeridian com

- Vendor hold harmless indemnity agreement form

- Get nrr swim test v3 navesink river rowing us legal forms

- Wall ayf cheer registration form bwallknightsayfbborgb

- Dwight morrow high school academies englewood form

- Rental co inspection application borough of seaside heights form

- Jersey city water and sewage services jcmua form

Find out other Schedule I 990 Ez

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney