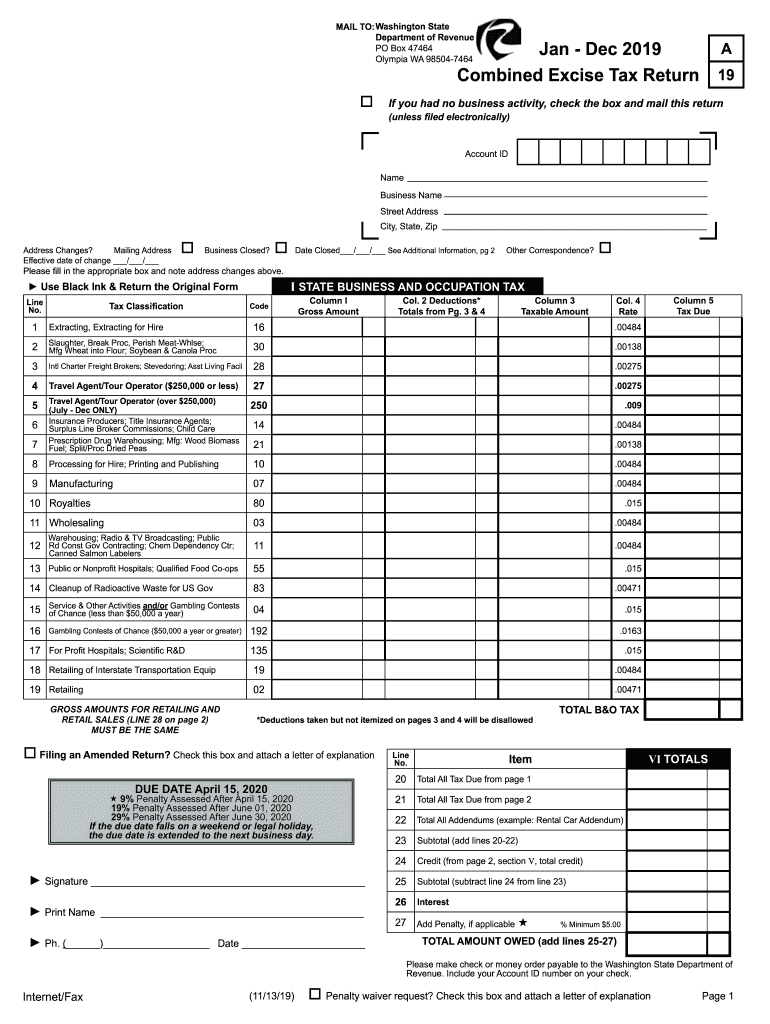

Combined Excise Tax Return Form

What is the combined excise tax return?

The combined excise tax return is a crucial document used by businesses in Washington State to report and pay various excise taxes. These taxes may include sales tax, use tax, and other specific taxes applicable to certain industries. By filing this return, businesses ensure compliance with state tax regulations and contribute to public services funded by these taxes. The return consolidates multiple tax obligations into a single form, simplifying the filing process for taxpayers.

Steps to complete the combined excise tax return

Completing the combined excise tax return involves several key steps:

- Gather relevant financial records, including sales receipts and expense documentation.

- Determine the appropriate reporting period, which may vary based on your business's tax classification.

- Calculate the total taxable sales and any applicable deductions.

- Fill out the combined excise tax return form accurately, ensuring all figures are correct.

- Review the form for completeness and accuracy before submission.

- Submit the return by the specified deadline, either online or via mail.

Legal use of the combined excise tax return

The combined excise tax return is legally binding when completed and submitted according to state regulations. To ensure its legal validity, businesses must adhere to specific requirements, such as providing accurate information and maintaining proper records. Additionally, electronic signatures are recognized under U.S. law, provided they meet established standards for authenticity and security. Utilizing a trusted digital platform can enhance compliance and provide necessary documentation for future reference.

Filing deadlines / important dates

Timely filing of the combined excise tax return is essential to avoid penalties. Key deadlines typically include:

- Monthly filers: Returns are due on the last day of the month following the reporting period.

- Quarterly filers: Returns are due on the last day of the month following the end of the quarter.

- Annual filers: Returns are generally due on January 31 of the following year.

It is important to verify specific deadlines as they may vary based on individual business circumstances or changes in state regulations.

Required documents

When preparing to file the combined excise tax return, businesses should gather the following documents:

- Sales records, including invoices and receipts.

- Purchase records for any deductions claimed.

- Previous tax returns for reference.

- Any correspondence from the Washington State Department of Revenue.

Having these documents readily available can streamline the filing process and ensure accuracy in reporting.

Form submission methods (online / mail / in-person)

Businesses have several options for submitting the combined excise tax return:

- Online: The most efficient method, allowing for immediate processing and confirmation of submission.

- Mail: Businesses can send a printed copy of the completed form to the appropriate tax office, though this method may result in delays.

- In-person: Some businesses may choose to deliver their return directly to a local tax office for assistance and immediate feedback.

Choosing the right submission method can depend on the business's preferences and the urgency of the filing.

Quick guide on how to complete search this sitewashington department of revenue

Complete Combined Excise Tax Return effortlessly on any device

Online document handling has become favored among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed forms, as you can easily find the right template and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly and without holdups. Manage Combined Excise Tax Return on any gadget with airSlate SignNow Android or iOS applications and enhance any document-driven procedure today.

How to alter and eSign Combined Excise Tax Return with ease

- Find Combined Excise Tax Return and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Combined Excise Tax Return and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the search this sitewashington department of revenue

How to generate an electronic signature for your Search This Sitewashington Department Of Revenue online

How to create an electronic signature for the Search This Sitewashington Department Of Revenue in Chrome

How to generate an electronic signature for signing the Search This Sitewashington Department Of Revenue in Gmail

How to create an electronic signature for the Search This Sitewashington Department Of Revenue right from your smartphone

How to generate an eSignature for the Search This Sitewashington Department Of Revenue on iOS

How to generate an electronic signature for the Search This Sitewashington Department Of Revenue on Android OS

People also ask

-

What is the jan dec 2019 combined excise tax return?

The jan dec 2019 combined excise tax return is a tax document that businesses must file to report and pay various excise taxes for the specified period. This return consolidates tax liabilities and provides a comprehensive overview of a business's excise tax obligations during that timeframe. Properly filing this return is crucial to avoid penalties.

-

How can airSlate SignNow assist with the jan dec 2019 combined excise tax return?

airSlate SignNow streamlines the process of preparing and submitting the jan dec 2019 combined excise tax return by allowing you to eSign important documents electronically. This not only saves time but also ensures that your submissions are secure and legally binding. Additionally, our solution helps reduce errors associated with manual processes.

-

What features of airSlate SignNow can help with tax return management?

airSlate SignNow offers features such as document templates, cloud storage, and tracking capabilities to enhance your tax return management. These features enable easy access to previous returns, allowing you to efficiently fill out and submit your jan dec 2019 combined excise tax return. You can also monitor your document's status in real-time.

-

Is there a cost associated with using airSlate SignNow for tax document handling?

Yes, there are various pricing plans available for using airSlate SignNow, tailored to meet different business needs. These plans are cost-effective and designed to provide value, especially when managing important documents like the jan dec 2019 combined excise tax return. You can choose a plan that aligns with your volume of document handling.

-

Are there any integration capabilities with airSlate SignNow for tax software?

Yes, airSlate SignNow integrates seamlessly with popular tax software and accounting systems to facilitate smoother workflows. These integrations help ensure that your jan dec 2019 combined excise tax return is completed accurately and efficiently. You can easily sync data between platforms for a streamlined experience.

-

What benefits does airSlate SignNow provide for filing tax returns?

Using airSlate SignNow for filing your jan dec 2019 combined excise tax return offers multiple benefits, including enhanced security, ease of use, and time savings. With our electronic signature feature, you can finalize documents quickly without the hassle of printing and mailing. This modern approach reduces the risk of errors and speeds up the filing process.

-

Can I access airSlate SignNow from mobile devices?

Yes, airSlate SignNow is accessible from mobile devices, allowing you to manage your jan dec 2019 combined excise tax return on the go. This mobility means you can eSign and submit documents wherever you are, ensuring that important deadlines are never missed. Mobile access enhances flexibility and convenience for busy professionals.

Get more for Combined Excise Tax Return

- F 5720 state of minnesota department of form

- Claim for payment from form

- Frassati 5k runwalk ampamp kidfamily fun run in person registration form

- Hononegah phone app form

- Tryout registration form

- Cook county assessors officevacancyoccupancy af form

- Community garage sale registration form saturday may 7 romeoville

- Return to school form sfhscollegeprep

Find out other Combined Excise Tax Return

- Sign Pennsylvania Courts Quitclaim Deed Mobile

- eSign Washington Car Dealer Bill Of Lading Mobile

- eSign Wisconsin Car Dealer Resignation Letter Myself

- eSign Wisconsin Car Dealer Warranty Deed Safe

- eSign Business Operations PPT New Hampshire Safe

- Sign Rhode Island Courts Warranty Deed Online

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now