for Information Only Govuk 2015-2026

What is the P45 downloadable form?

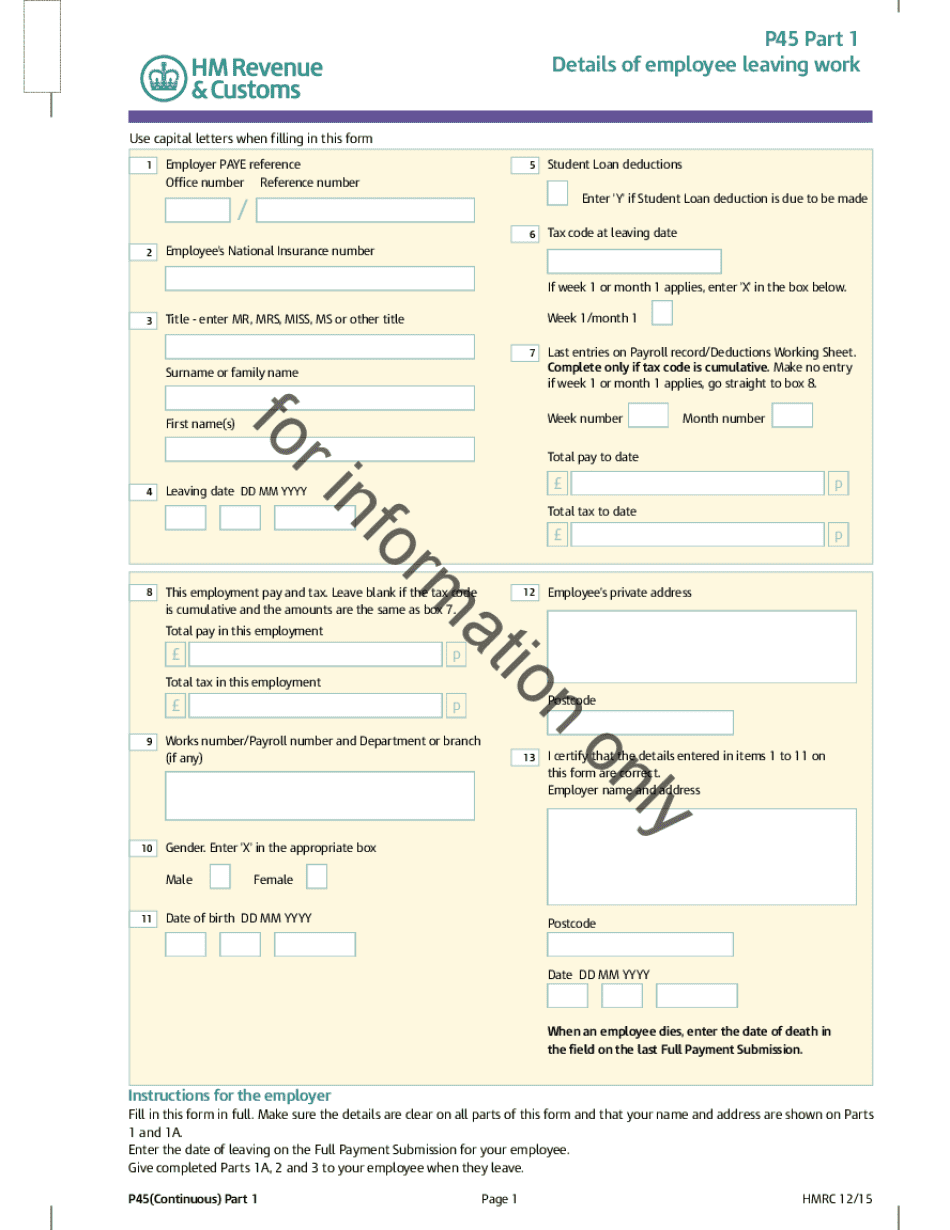

The P45 downloadable form is an important document used in the United Kingdom, primarily for tax purposes. It is issued by an employer when an employee leaves their job. The form provides essential information about the employee's tax status, including the total earnings and the amount of tax deducted during their employment. This information is crucial for both the employee and the new employer to ensure accurate tax calculations and compliance with HMRC regulations.

Steps to complete the P45 downloadable form

Completing the P45 form involves several straightforward steps:

- Gather necessary information, including personal details, employment dates, and tax codes.

- Fill out the sections of the form accurately, ensuring all information is current and correct.

- Provide details about your earnings and the tax deducted during your employment period.

- Review the completed form for any errors or omissions before submission.

Legal use of the P45 downloadable form

The P45 form has legal significance in the UK tax system. It serves as proof of employment and tax contributions, which can affect future tax liabilities. Employers are legally required to issue a P45 to employees upon termination of employment. Employees should retain this document for their records, as it may be needed for future tax returns or when starting a new job.

Who issues the P45 form?

The P45 form is issued by employers when an employee leaves their job. It is the employer's responsibility to complete and provide this form to the employee. The form must be filled out accurately to reflect the employee's earnings and tax deductions. If an employee does not receive a P45 upon leaving a job, they should request it from their employer, as it is a legal requirement.

Examples of using the P45 downloadable form

The P45 form is primarily used in various scenarios, including:

- When an employee starts a new job, the new employer requires the P45 to calculate the correct tax code.

- For self-assessment tax returns, individuals may need to reference their P45 to report income accurately.

- When applying for tax refunds, the P45 can provide necessary documentation to support claims.

Filing deadlines and important dates

While the P45 form itself does not have specific filing deadlines, it is important for employees to submit it to their new employer promptly. This ensures that the new employer can use the correct tax code and avoid overtaxing the employee. Additionally, employees should keep track of important tax deadlines, such as the self-assessment filing date, to ensure compliance with HMRC regulations.

Quick guide on how to complete for information only govuk

Easily Prepare For Information Only Govuk on Any Device

Digital document management has surged in popularity among businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to swiftly create, modify, and electronically sign your documents without any delays. Handle For Information Only Govuk on any device using the airSlate SignNow apps for Android or iOS and enhance any document-focused operation today.

How to Modify and Electronically Sign For Information Only Govuk Effortlessly

- Locate For Information Only Govuk and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes only a few seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, cumbersome form searches, or inaccuracies that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and electronically sign For Information Only Govuk and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for information only govuk

Create this form in 5 minutes!

How to create an eSignature for the for information only govuk

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a P45 downloadable form?

A P45 downloadable form is an official document issued by an employer when an employee leaves a job. It details the employee's tax code, earnings, and tax paid during the employment period. With airSlate SignNow, you can easily create, send, and eSign your P45 downloadable form securely.

-

How can I obtain a P45 downloadable form using airSlate SignNow?

To obtain a P45 downloadable form using airSlate SignNow, simply log in to your account and select the option to create a new document. You can customize the P45 form as needed and then download it for your records or send it directly to your employees for eSigning.

-

Is there a cost associated with using the P45 downloadable form feature?

airSlate SignNow offers various pricing plans that include access to the P45 downloadable form feature. Depending on your chosen plan, you can enjoy cost-effective solutions for document management and eSigning, ensuring you get the best value for your business needs.

-

What are the benefits of using airSlate SignNow for P45 downloadable forms?

Using airSlate SignNow for P45 downloadable forms streamlines the process of document management. It allows for quick eSigning, reduces paperwork, and ensures compliance with legal requirements. Additionally, it enhances efficiency by enabling easy tracking and storage of signed documents.

-

Can I integrate airSlate SignNow with other software for managing P45 downloadable forms?

Yes, airSlate SignNow offers integrations with various software applications, allowing you to manage your P45 downloadable forms seamlessly. Whether you use HR software or accounting tools, you can connect them with airSlate SignNow to enhance your workflow and document management.

-

How secure is the P45 downloadable form process with airSlate SignNow?

The P45 downloadable form process with airSlate SignNow is highly secure. We utilize advanced encryption and security protocols to protect your documents and personal information. You can trust that your P45 forms are handled with the utmost care and confidentiality.

-

Can I customize my P45 downloadable form in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your P45 downloadable form to meet your specific needs. You can add your company logo, modify fields, and adjust the layout to ensure the form aligns with your branding and requirements.

Get more for For Information Only Govuk

- Amendment of residential lease north carolina form

- Agreement payment form

- Commercial lease assignment from tenant to new tenant north carolina form

- Tenant consent to background and reference check north carolina form

- Residential lease or rental agreement for month to month north carolina form

- Residential rental lease agreement north carolina form

- Tenant welcome letter north carolina form

- Warning of default on commercial lease north carolina form

Find out other For Information Only Govuk

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF