St 100 Form

What is the St 100?

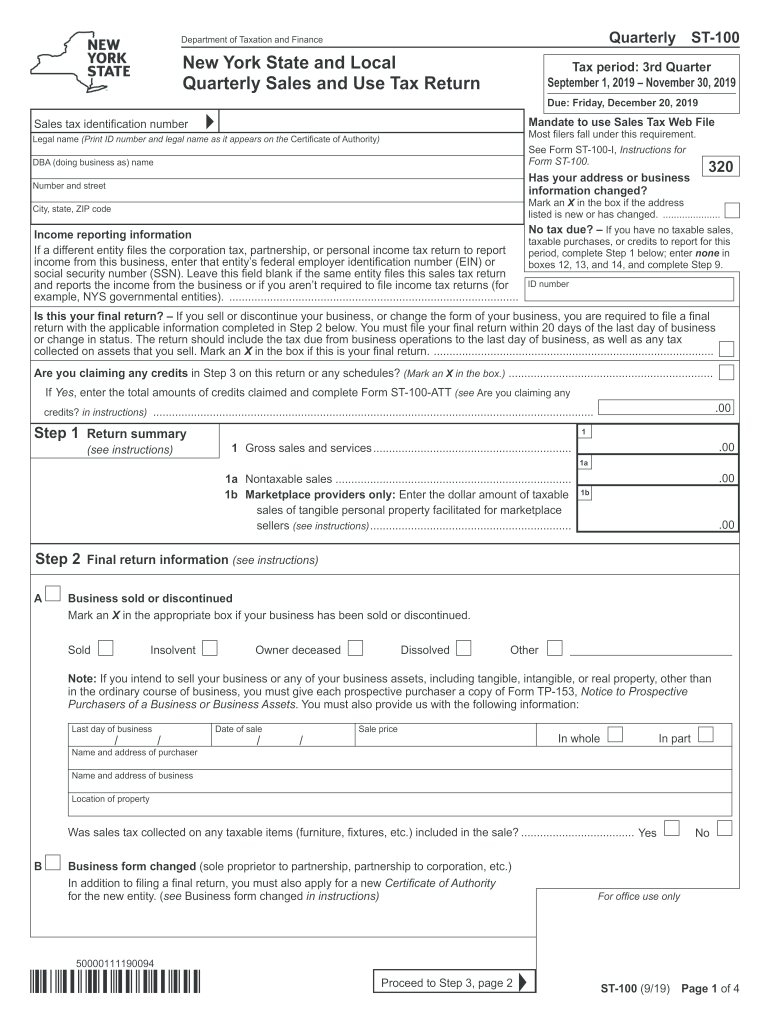

The St 100 is a New York State sales tax form used by businesses to report and pay sales tax collected from customers. This form is essential for businesses operating in New York, as it helps ensure compliance with state tax laws. The 2019 St 100 specifically pertains to the tax year 2019 and includes various sections for reporting taxable sales, exempt sales, and the total sales tax due. Understanding the St 100 is crucial for accurate tax reporting and avoiding penalties.

Steps to complete the St 100

Completing the 2019 St 100 involves several key steps:

- Gather necessary documents, including sales records and previous tax returns.

- Fill in your business information, including your name, address, and sales tax identification number.

- Report total sales for the period, distinguishing between taxable and exempt sales.

- Calculate the total sales tax collected and any adjustments for prior periods.

- Sign and date the form to certify that the information provided is accurate.

Each step must be completed carefully to ensure compliance with New York tax regulations.

Legal use of the St 100

The 2019 St 100 is legally binding when completed and submitted according to New York State tax laws. To ensure its legal validity, businesses must provide accurate information and adhere to filing deadlines. The form must be signed by an authorized representative of the business, confirming that the details are true and correct. Failure to comply with these requirements may result in penalties or audits by the New York State Department of Taxation and Finance.

How to obtain the St 100

The St 100 form can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing businesses to print and complete the form manually. Additionally, businesses can access the form through various tax preparation software that supports New York State tax forms, making it easier to fill out electronically.

Filing Deadlines / Important Dates

For the 2019 St 100, businesses must be aware of specific filing deadlines to avoid penalties. Typically, the form is due on the 20th day of the month following the end of the reporting period. For example, the deadline for the January 2019 reporting period would be February 20, 2019. It is essential to keep track of these dates to ensure timely submission and compliance with state regulations.

Examples of using the St 100

Businesses of various types use the 2019 St 100 to report sales tax. For instance, a retail store collecting sales tax on merchandise sales must report this on the St 100. Similarly, a restaurant that charges sales tax on food and beverages is required to file this form. Each business must accurately report its sales tax liability based on its specific sales activities to maintain compliance with New York tax laws.

Quick guide on how to complete form st 1001215new york state and local quarterly sales

Complete St 100 effortlessly on any device

Digital document management has become popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the right form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage St 100 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign St 100 without a hassle

- Find St 100 and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you want to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device of your choice. Edit and eSign St 100 to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 1001215new york state and local quarterly sales

How to create an electronic signature for the Form St 1001215new York State And Local Quarterly Sales online

How to generate an electronic signature for the Form St 1001215new York State And Local Quarterly Sales in Google Chrome

How to create an eSignature for signing the Form St 1001215new York State And Local Quarterly Sales in Gmail

How to generate an electronic signature for the Form St 1001215new York State And Local Quarterly Sales right from your smartphone

How to create an eSignature for the Form St 1001215new York State And Local Quarterly Sales on iOS devices

How to generate an eSignature for the Form St 1001215new York State And Local Quarterly Sales on Android devices

People also ask

-

What is the st 100 2019 form and why is it important?

The st 100 2019 form is a sales tax return used in various states, which helps businesses report and remit their sales and use tax. Understanding the st 100 2019 is crucial for ensuring compliance with state tax regulations. Using airSlate SignNow to eSign this document streamlines the filing process, making it easier and more efficient for businesses.

-

How can airSlate SignNow help with the st 100 2019 filing process?

airSlate SignNow simplifies the st 100 2019 filing process by allowing businesses to prepare, sign, and submit their documents electronically. This eliminates the need for paper forms, reducing the risk of errors and ensuring timely submissions. With our user-friendly interface, you can complete your st 100 2019 quickly and efficiently.

-

Is airSlate SignNow cost-effective for filing the st 100 2019?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to file the st 100 2019. Our pricing plans are designed to accommodate businesses of all sizes while providing great value for the features offered. By using SignNow, you can save on printing and postage costs associated with traditional filing methods.

-

What features does airSlate SignNow offer for managing the st 100 2019?

airSlate SignNow offers features like document templates, customizable workflows, and automated reminders for the st 100 2019. These tools help you stay organized and ensure that your documents are completed accurately and on time. Additionally, you can track the status of your filings in real-time, providing peace of mind.

-

Can airSlate SignNow integrate with my accounting software for st 100 2019 filing?

Absolutely! airSlate SignNow can integrate seamlessly with popular accounting software, making the st 100 2019 filing less daunting. This integration helps you import necessary data directly into the form, reducing manual entry errors. Streamlining your workflow ultimately saves time and boosts productivity.

-

How does eSigning the st 100 2019 with airSlate SignNow work?

eSigning the st 100 2019 with airSlate SignNow is straightforward. You can upload the document, add the necessary signers, and send it for eSignature through our platform. Once all parties have signed, the final document is securely stored and can be submitted to the relevant authorities.

-

What benefits can I expect from using airSlate SignNow for st 100 2019?

Using airSlate SignNow for your st 100 2019 filings offers numerous benefits, including enhanced security, quicker processing times, and reduced paperwork. Our platform bolsters efficiency by allowing you to revisit and track your documents easily. Ultimately, you can focus on your business rather than getting bogged down in administrative tasks.

Get more for St 100

- Trial by declaration sample letter form

- Home superior court of california county of san luis obispo form

- Form 3005 california deed of trust information

- Ca trust form

- Reporter transcript request superior court of california form

- California husband 495567678 form

- California declaration due diligence form

- Revised 041423 form

Find out other St 100

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement