Form Otc 994

What is the Form OTC 994

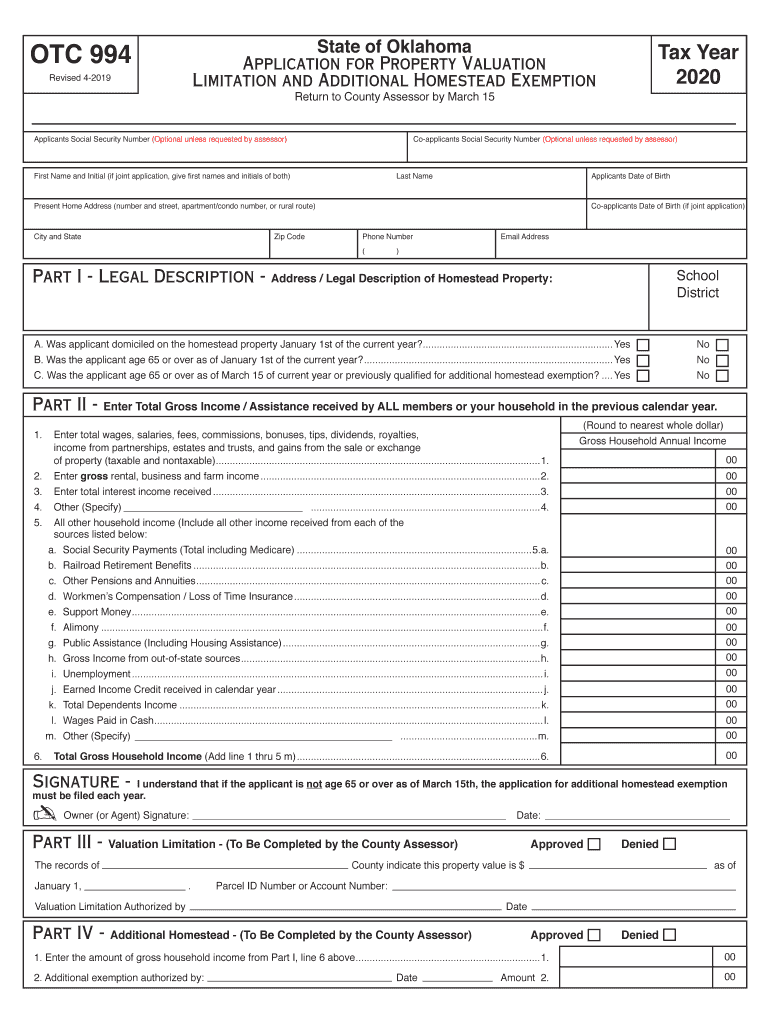

The Oklahoma Form OTC 994 is a state-specific document used primarily for claiming the homestead exemption. This exemption reduces the taxable value of a property, thereby lowering the property taxes owed by eligible homeowners. The form is essential for individuals who own and occupy their primary residence in Oklahoma and wish to benefit from this tax relief. Understanding the purpose and requirements of the OTC 994 is crucial for homeowners seeking to maximize their tax savings.

How to use the Form OTC 994

To effectively use the Oklahoma Form OTC 994, homeowners must first ensure they meet the eligibility criteria for the homestead exemption. This includes owning and residing in the property as their primary home. Once eligibility is confirmed, the form should be filled out with accurate information regarding the property and the homeowner's details. After completing the form, it must be submitted to the appropriate county assessor's office to process the exemption request.

Steps to complete the Form OTC 994

Completing the Oklahoma Form OTC 994 involves several key steps:

- Gather necessary documentation, including proof of ownership and residency.

- Fill in the required fields, ensuring all information is accurate and up-to-date.

- Review the form for any errors or omissions.

- Submit the completed form to your local county assessor's office by the specified deadline.

Following these steps can help ensure that your application for the homestead exemption is processed smoothly.

Legal use of the Form OTC 994

The legal use of the Oklahoma Form OTC 994 is governed by state laws regarding property taxation and exemptions. When properly completed and submitted, the form serves as a formal request for the homestead exemption, which must be honored by the county assessor. Homeowners should be aware that providing false information on the form can lead to penalties, including the denial of the exemption and potential legal repercussions.

Key elements of the Form OTC 994

Key elements of the Oklahoma Form OTC 994 include:

- Property details, including address and legal description.

- Homeowner information, such as name and contact details.

- Certification of residency, confirming that the property is the primary residence.

- Signature of the homeowner, attesting to the accuracy of the information provided.

Each of these elements plays a vital role in ensuring the form is valid and meets the requirements for the homestead exemption.

Filing Deadlines / Important Dates

Filing deadlines for the Oklahoma Form OTC 994 are critical for homeowners seeking the homestead exemption. The application must typically be submitted by March 15 of the tax year for which the exemption is being claimed. Missing this deadline may result in the loss of the exemption for that year, so it is important to stay informed about these dates and plan accordingly.

Eligibility Criteria

To qualify for the homestead exemption using the Oklahoma Form OTC 994, homeowners must meet specific eligibility criteria, including:

- Ownership of the property as of January 1 of the tax year.

- Occupying the property as their primary residence.

- Meeting any additional local requirements set by the county assessor.

Understanding these criteria ensures that applicants can accurately determine their eligibility for the exemption.

Quick guide on how to complete get and sign oklahoma tax homestead exemption 2016 form

Prepare Form Otc 994 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and electronically sign your documents swiftly and without obstacles. Manage Form Otc 994 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-focused task today.

How to modify and eSign Form Otc 994 with ease

- Find Form Otc 994 and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or cover sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Form Otc 994 and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the get and sign oklahoma tax homestead exemption 2016 form

How to create an eSignature for your Get And Sign Oklahoma Tax Homestead Exemption 2016 Form online

How to make an eSignature for the Get And Sign Oklahoma Tax Homestead Exemption 2016 Form in Google Chrome

How to create an electronic signature for signing the Get And Sign Oklahoma Tax Homestead Exemption 2016 Form in Gmail

How to generate an electronic signature for the Get And Sign Oklahoma Tax Homestead Exemption 2016 Form from your smartphone

How to create an electronic signature for the Get And Sign Oklahoma Tax Homestead Exemption 2016 Form on iOS devices

How to generate an electronic signature for the Get And Sign Oklahoma Tax Homestead Exemption 2016 Form on Android devices

People also ask

-

What is the oklahoma form otc 994?

The Oklahoma Form OTC 994 is a tax form used in Oklahoma for various tax-related submissions. It is essential for individuals and businesses to complete this form accurately to ensure compliance with state regulations. Utilizing tools like airSlate SignNow can streamline the signing and submission process for the oklahoma form otc 994.

-

How can I eSign the oklahoma form otc 994 easily?

With airSlate SignNow, you can eSign the oklahoma form otc 994 quickly and securely. Our platform allows you to upload the document, add signature fields, and send it to relevant parties for signing, all without needing to print or scan. This saves you time and ensures that your form is submitted promptly.

-

Is there a cost associated with using airSlate SignNow for the oklahoma form otc 994?

airSlate SignNow offers a cost-effective solution for managing documents like the oklahoma form otc 994. Pricing plans vary depending on your needs, but many users find that the savings from reduced paper use and faster processing time justify the minimal expense. You can choose a plan that fits your business requirements.

-

What features are available for managing the oklahoma form otc 994 with airSlate SignNow?

airSlate SignNow offers several features specifically designed to help manage the oklahoma form otc 994 efficiently. These include template creation, in-app signatures, real-time tracking of the document status, and reminders for signers. These functionalities make it easier to ensure all necessary actions are completed on time.

-

Can I integrate airSlate SignNow with other applications for the oklahoma form otc 994?

Yes, airSlate SignNow supports integrations with various applications that can be beneficial for managing the oklahoma form otc 994. Whether it's your CRM, accounting software, or other business tools, our platform is designed to connect seamlessly, streamlining your workflow and enhancing efficiency.

-

What are the benefits of using airSlate SignNow for the oklahoma form otc 994?

Using airSlate SignNow for the oklahoma form otc 994 provides several benefits, including enhanced speed for document processing, improved compliance through tracking features, and the elimination of paper clutter. Our solution also helps you keep documents secure and organized, making it easier to find important forms when needed.

-

How secure is the signing process for the oklahoma form otc 994 on airSlate SignNow?

The security of your documents, including the oklahoma form otc 994, is a top priority at airSlate SignNow. We utilize encryption and adhere to strict data protection regulations to ensure that your information remains confidential and secure throughout the signing process. You can have peace of mind knowing your documents are safe.

Get more for Form Otc 994

- 000 0500109 ite oklahoma individual estimated tax first quarter ow 8 es revised 10 a for tax year b quarter c taxpayers ssn d form

- Uscg sar addendum form

- Su plan de accin contra el eccema form

- Does electronic authorization for payroll deduction massachusetts form

- Affidavit of unauthorizedfraudulent use form

- Sole proprietorship contract template form

- Solidity contract template form

- Songwriter contract template form

Find out other Form Otc 994

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer

- eSign Virginia Sales Invoice Template Computer

- eSign Oregon Assignment of Mortgage Online

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive