New York Estimated Tax Form

What is the New York Estimated Tax

The New York Estimated Tax is a payment system that allows taxpayers to pay their income tax liabilities throughout the year, rather than in one lump sum at the end of the tax year. This system is particularly beneficial for individuals who receive income that is not subject to withholding, such as self-employed individuals, freelancers, and investors. By making estimated tax payments, taxpayers can avoid underpayment penalties and manage their cash flow more effectively.

How to complete the New York Estimated Tax

To complete the New York Estimated Tax, you need to follow several steps:

- Determine your estimated tax liability: Calculate your expected income, deductions, and credits for the year to arrive at your estimated tax amount.

- Use the appropriate form: Fill out the IT-2105 form for estimated tax payments. This form is specifically designed for New York State taxpayers.

- Choose your payment method: You can pay online, by mail, or in person at designated locations. Ensure you follow the instructions on the form for your chosen method.

- Keep records: Maintain copies of your completed forms and payment confirmations for your records and future reference.

Filing Deadlines / Important Dates

It is essential to adhere to the filing deadlines for the New York Estimated Tax to avoid penalties. The due dates for estimated tax payments are typically:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

Taxpayers should verify these dates annually, as they may change based on weekends or holidays.

Required Documents

When preparing to file the New York Estimated Tax, certain documents are necessary to ensure accurate calculations:

- Previous year’s tax return for reference

- Income statements such as W-2s or 1099s

- Documentation of deductions and credits you plan to claim

- Any additional income sources that may affect your tax liability

Having these documents ready will streamline the process and help ensure compliance with tax regulations.

Legal use of the New York Estimated Tax

The New York Estimated Tax is legally binding and must be used in accordance with state tax laws. Taxpayers are required to pay estimated taxes if they expect to owe a certain amount in taxes for the year. Compliance with the estimated tax payment schedule helps avoid penalties for underpayment and ensures that taxpayers meet their financial obligations to the state.

Who Issues the Form

The New York Estimated Tax form, known as IT-2105, is issued by the New York State Department of Taxation and Finance. This department is responsible for administering tax laws and ensuring compliance among taxpayers. The form can be obtained directly from their official website or through various tax preparation software that supports New York State tax filings.

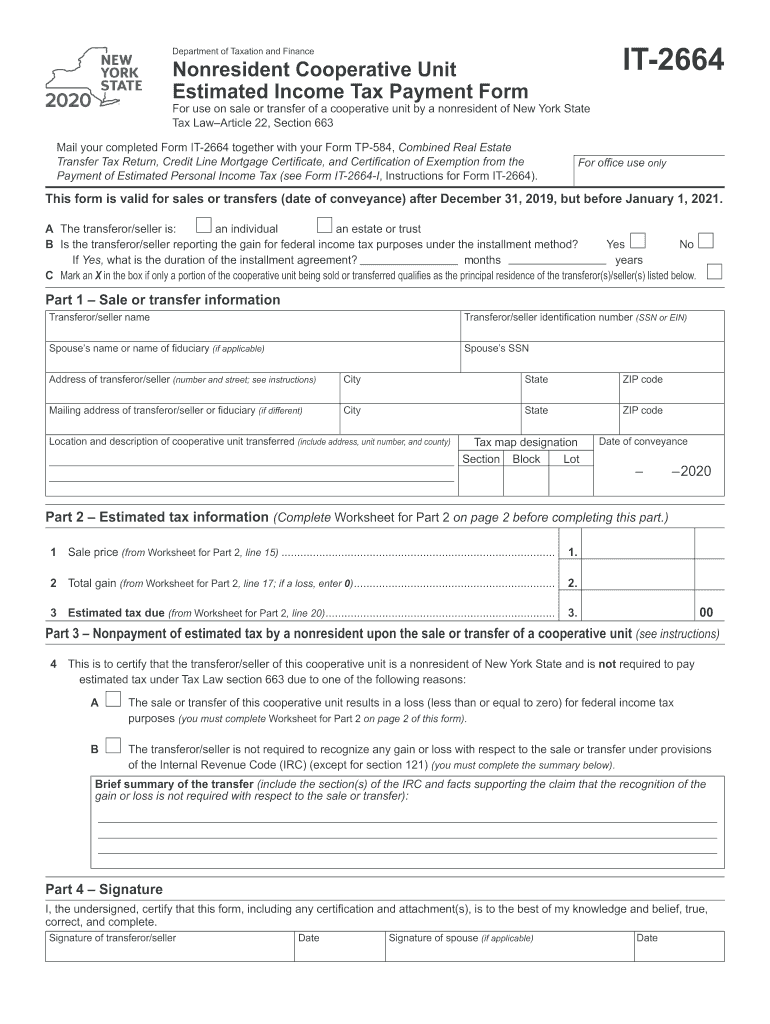

Quick guide on how to complete from it 26642020nonresident cooperative unit estimated income tax payment formit2664

Effortlessly Prepare New York Estimated Tax on Any Device

The management of online documents has become increasingly favored by companies and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage New York Estimated Tax on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and Electronically Sign New York Estimated Tax with Ease

- Obtain New York Estimated Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you prefer. Modify and electronically sign New York Estimated Tax to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from it 26642020nonresident cooperative unit estimated income tax payment formit2664

How to make an electronic signature for the From It 26642020nonresident Cooperative Unit Estimated Income Tax Payment Formit2664 in the online mode

How to generate an eSignature for your From It 26642020nonresident Cooperative Unit Estimated Income Tax Payment Formit2664 in Google Chrome

How to create an eSignature for putting it on the From It 26642020nonresident Cooperative Unit Estimated Income Tax Payment Formit2664 in Gmail

How to make an eSignature for the From It 26642020nonresident Cooperative Unit Estimated Income Tax Payment Formit2664 from your mobile device

How to create an eSignature for the From It 26642020nonresident Cooperative Unit Estimated Income Tax Payment Formit2664 on iOS devices

How to create an electronic signature for the From It 26642020nonresident Cooperative Unit Estimated Income Tax Payment Formit2664 on Android devices

People also ask

-

What is the 2020 form ny and why is it important?

The 2020 form ny is a critical tax document required by New York State for filing income tax returns. This form helps you report your income, deductions, and tax credits accurately to ensure compliance with state tax laws. Understanding its importance is essential for avoiding penalties and ensuring you receive any applicable refunds.

-

How can airSlate SignNow assist in eSigning the 2020 form ny?

airSlate SignNow provides an easy-to-use platform for eSigning the 2020 form ny quickly and securely. Our intuitive interface allows you to upload the form, add your signature, and send it directly to relevant parties without any hassle. This streamlines the filing process and eliminates the need for physical paperwork.

-

What features does airSlate SignNow offer for handling the 2020 form ny?

Our platform offers several features designed specifically for managing documents like the 2020 form ny. These include customizable templates, document tracking, reminders, and secure cloud storage, all of which enhance your productivity and organization when dealing with important tax documents.

-

Is there a cost associated with using airSlate SignNow for the 2020 form ny?

Yes, airSlate SignNow offers various pricing plans that cater to businesses of all sizes. Our cost-effective solutions are designed to fit your budget while providing you the tools needed to manage the 2020 form ny and other documents efficiently. You can choose a plan that meets your needs based on usage and features.

-

Can airSlate SignNow integrate with other tools for managing the 2020 form ny?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular applications to help you manage the 2020 form ny effortlessly. Whether you use accounting software, CRMs, or other document management tools, our integrations ensure that all your data works together efficiently.

-

What are the benefits of using airSlate SignNow for the 2020 form ny?

Using airSlate SignNow for the 2020 form ny offers numerous benefits, including enhanced security, time savings, and improved accuracy. Our solution reduces the risk of errors through automated features, while eSigning allows for immediate document processing. This leads to quicker turnaround times and an overall more efficient experience.

-

How secure is airSlate SignNow for completing the 2020 form ny?

Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the 2020 form ny. We employ advanced encryption methods and comply with industry standards to protect your information. You can eSign and store your documents with confidence, knowing they are safe and secure.

Get more for New York Estimated Tax

- Mhasibu sacco membership application form

- Customer information fnb zambia limited fnbzambia co

- Consultancy service contract template form

- Social media market contract template form

- Social media service contract template form

- Social work client contract template 787755453 form

- Social work contract template form

- Social work supervision contract template 787755455 form

Find out other New York Estimated Tax

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template