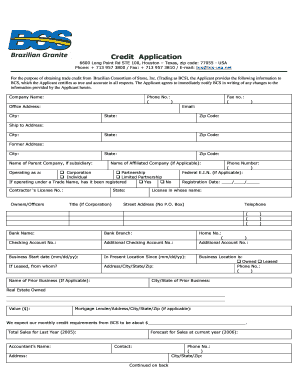

Credit Application BCS Form

What is the Credit Application BCS

The Credit Application BCS is a formal document used by businesses to assess the creditworthiness of potential clients or customers. This application collects essential financial information, allowing companies to make informed decisions regarding credit limits and payment terms. It typically includes details such as the applicant's business structure, financial history, and references. By utilizing this form, businesses can mitigate risks associated with extending credit and ensure a smoother transaction process.

Key elements of the Credit Application BCS

Understanding the key elements of the Credit Application BCS is crucial for both applicants and businesses. The form generally includes:

- Business Information: Name, address, and contact details of the applicant.

- Financial Statements: Recent financial statements, including balance sheets and income statements.

- Credit References: Names and contact information of other businesses that can vouch for the applicant's credit history.

- Ownership Details: Information about the business owners, including their personal credit history if necessary.

These elements help businesses evaluate the risk involved in extending credit and establish a trustworthy relationship with clients.

Steps to complete the Credit Application BCS

Completing the Credit Application BCS involves several straightforward steps:

- Gather Required Information: Collect all necessary financial documents and business details.

- Fill Out the Application: Accurately complete each section of the form, ensuring all information is current and truthful.

- Review for Accuracy: Double-check all entries for accuracy to prevent delays in processing.

- Submit the Application: Send the completed form to the designated contact, either electronically or via mail.

Following these steps can help streamline the credit application process and improve the chances of approval.

Legal use of the Credit Application BCS

The Credit Application BCS must be used in compliance with applicable laws and regulations. This includes adhering to the Fair Credit Reporting Act (FCRA), which governs how businesses can collect and use credit information. It is essential for companies to obtain consent from applicants before accessing their credit reports. Additionally, businesses should ensure that the information collected is used solely for the purpose of evaluating creditworthiness, safeguarding sensitive data, and maintaining confidentiality.

Eligibility Criteria

Eligibility for the Credit Application BCS typically depends on several factors, including:

- Business Type: The applicant must be a registered business entity, such as an LLC, corporation, or partnership.

- Credit History: A positive credit history is often required, with minimal outstanding debts.

- Financial Stability: Applicants should demonstrate financial stability through recent financial statements.

Meeting these criteria can enhance the likelihood of approval and favorable credit terms.

Form Submission Methods

The Credit Application BCS can be submitted through various methods, allowing flexibility for applicants. Common submission methods include:

- Online Submission: Many businesses offer online portals for electronic submission, which can expedite processing.

- Mail: Applicants can send a hard copy of the completed form to the business's physical address.

- In-Person Submission: Some businesses may allow applicants to submit the form directly at their office.

Choosing the appropriate submission method can depend on the applicant's preferences and the specific requirements of the business.

Quick guide on how to complete credit application bcs

Prepare [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely archive it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose provided by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Put aside worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Credit Application BCS

Create this form in 5 minutes!

How to create an eSignature for the credit application bcs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Credit Application BCS?

A Credit Application BCS is a digital form that allows businesses to collect and process credit applications efficiently. With airSlate SignNow, you can create, send, and eSign these applications seamlessly, ensuring a smooth experience for both you and your clients.

-

How does airSlate SignNow enhance the Credit Application BCS process?

airSlate SignNow streamlines the Credit Application BCS process by providing an easy-to-use platform for document management. You can automate workflows, track application statuses, and ensure compliance, all while reducing the time spent on manual tasks.

-

What are the pricing options for using airSlate SignNow for Credit Application BCS?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from various subscription options that provide access to features specifically designed for managing Credit Application BCS efficiently.

-

Can I integrate airSlate SignNow with other software for Credit Application BCS?

Yes, airSlate SignNow supports integrations with various third-party applications, enhancing your Credit Application BCS workflow. This allows you to connect with CRM systems, accounting software, and more, ensuring a seamless data flow across platforms.

-

What features does airSlate SignNow offer for Credit Application BCS?

airSlate SignNow provides a range of features for Credit Application BCS, including customizable templates, automated reminders, and real-time tracking. These tools help you manage applications more effectively and improve overall efficiency.

-

How secure is the Credit Application BCS process with airSlate SignNow?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption and compliance measures to protect your Credit Application BCS data, ensuring that sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for Credit Application BCS?

Using airSlate SignNow for Credit Application BCS offers numerous benefits, including faster processing times, reduced paperwork, and improved customer satisfaction. By digitizing the application process, you can focus more on your business and less on administrative tasks.

Get more for Credit Application BCS

Find out other Credit Application BCS

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free

- Can I eSign Virginia Recruitment Proposal Template

- How To eSign Texas Temporary Employment Contract Template

- eSign Virginia Temporary Employment Contract Template Online

- eSign North Dakota Email Cover Letter Template Online

- eSign Alabama Independent Contractor Agreement Template Fast

- eSign New York Termination Letter Template Safe

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report