It 2663 Form

What is the IT 2663 Form

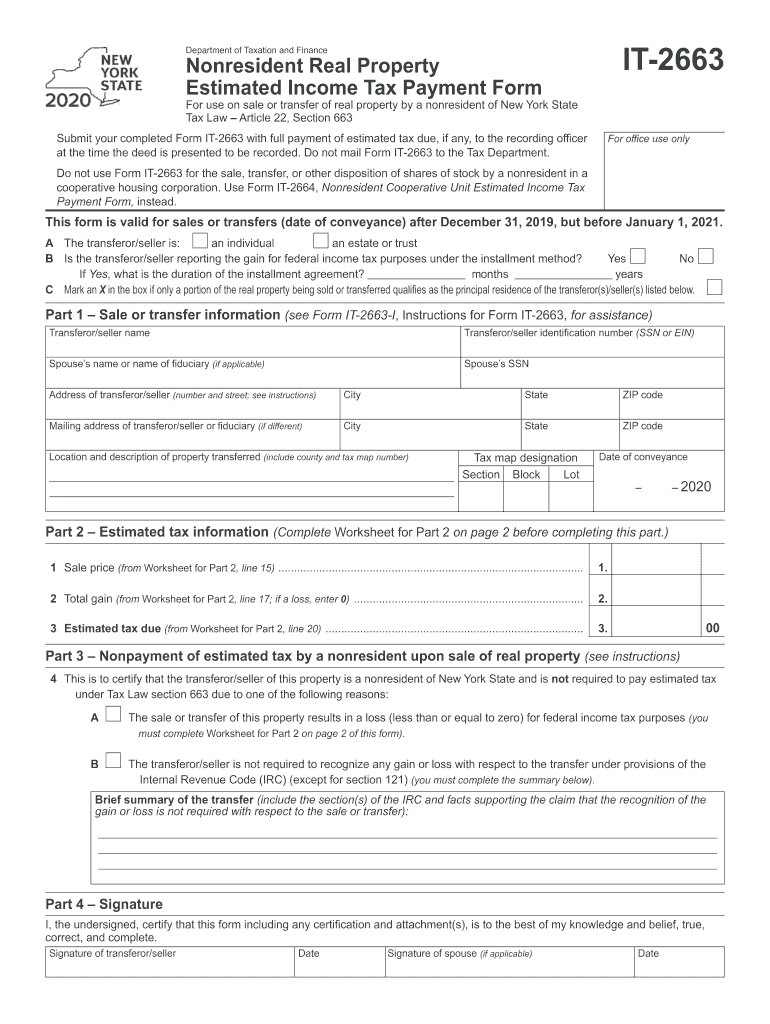

The IT 2663 form is a New York State tax form used to claim a refund of overpaid New York State personal income tax. This form is particularly relevant for individuals who have had taxes withheld from their income but are not required to file a tax return due to their income level or other factors. The IT 2663 form allows taxpayers to receive a refund for the excess amount withheld, ensuring they are not financially burdened by overpayment.

Steps to Complete the IT 2663 Form

Completing the IT 2663 form involves several key steps to ensure accuracy and compliance with New York State tax regulations. Start by gathering necessary information, including your Social Security number, income details, and any documentation of taxes withheld. Next, fill out the form with your personal information and the amounts you are claiming for refund. It is essential to double-check all entries for accuracy. Finally, sign and date the form before submission.

How to Obtain the IT 2663 Form

The IT 2663 form can be obtained easily through the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing taxpayers to print and fill out the form at their convenience. Additionally, the form can be requested by contacting the department directly if you prefer to receive a physical copy by mail.

Legal Use of the IT 2663 Form

The IT 2663 form is legally recognized for claiming refunds of overpaid taxes in New York State. To ensure the form's validity, it must be completed accurately and submitted within the designated time frame set by the state tax authority. Adhering to the legal guidelines associated with this form helps protect taxpayers from potential penalties or issues with their tax filings.

Filing Deadlines / Important Dates

Filing deadlines for the IT 2663 form are critical for taxpayers seeking refunds. Generally, the form must be submitted within three years from the date the tax was paid. It is advisable to keep track of any changes in deadlines announced by the New York State Department of Taxation and Finance, especially during tax season, to avoid missing out on potential refunds.

Form Submission Methods (Online / Mail / In-Person)

The IT 2663 form can be submitted in various ways to accommodate different preferences. Taxpayers can file the form online through the New York State Department of Taxation and Finance's e-filing system, which offers a quick and efficient process. Alternatively, the completed form can be mailed to the appropriate address specified on the form itself. In some cases, in-person submissions may be accepted at designated tax offices, providing another option for those who prefer direct interaction.

Quick guide on how to complete form it 26632020nonresident real property estimated income tax payment formit2663

Complete It 2663 Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to access the right form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly with no delays. Handle It 2663 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to alter and eSign It 2663 Form without hassle

- Obtain It 2663 Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow manages all your document management needs in just a few clicks from your chosen device. Edit and eSign It 2663 Form to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form it 26632020nonresident real property estimated income tax payment formit2663

How to generate an electronic signature for your Form It 26632020nonresident Real Property Estimated Income Tax Payment Formit2663 online

How to make an eSignature for your Form It 26632020nonresident Real Property Estimated Income Tax Payment Formit2663 in Chrome

How to create an eSignature for putting it on the Form It 26632020nonresident Real Property Estimated Income Tax Payment Formit2663 in Gmail

How to generate an electronic signature for the Form It 26632020nonresident Real Property Estimated Income Tax Payment Formit2663 from your smart phone

How to create an electronic signature for the Form It 26632020nonresident Real Property Estimated Income Tax Payment Formit2663 on iOS

How to create an eSignature for the Form It 26632020nonresident Real Property Estimated Income Tax Payment Formit2663 on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to IT NY 2020?

airSlate SignNow is an advanced eSignature solution designed to streamline document signing for businesses. In the context of IT NY 2020, it provides a powerful tool that meets the evolving demands of businesses looking to enhance their digital workflows while ensuring compliance and security.

-

What are the key features of airSlate SignNow that support businesses in IT NY 2020?

Key features of airSlate SignNow include customizable workflows, team collaboration tools, and real-time document tracking. These features specifically cater to the needs of businesses in IT NY 2020, allowing for efficient document management and seamless integration into existing processes.

-

How much does airSlate SignNow cost for businesses in IT NY 2020?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses in IT NY 2020. These plans are designed to provide cost-effective solutions whether you are a small startup or a large enterprise, ensuring that you receive maximum value for your investment.

-

Can airSlate SignNow integrate with other tools used in IT NY 2020?

Yes, airSlate SignNow seamlessly integrates with a variety of popular business applications and platforms. This capability is particularly critical for organizations operating in IT NY 2020 as it enhances productivity and streamlines workflows across different systems.

-

What benefits does airSlate SignNow offer to companies in IT NY 2020?

airSlate SignNow provides numerous benefits including increased efficiency, reduced turnaround time on documents, and improved security for sensitive information. For companies in IT NY 2020, these advantages can lead to enhanced operational performance and customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents in IT NY 2020?

Definitely. airSlate SignNow prioritizes security with advanced encryption protocols and compliance with major regulatory standards. For businesses concerned about safety in IT NY 2020, these measures ensure your sensitive documents are handled securely throughout the signing process.

-

How user-friendly is airSlate SignNow for new users in IT NY 2020?

airSlate SignNow is designed with user experience in mind, featuring an intuitive interface that makes it accessible for new users. This ease of use is particularly beneficial for businesses in IT NY 2020, allowing staff to adapt quickly and utilize the platform without extensive training.

Get more for It 2663 Form

- Gad 7 fill online printable fillable blank form

- Dry needling consent form orthopedic physical therapy inc

- Depth of knowledge dok levels windham schoolsorg form

- Travel diary tr5 university of new south wales form

- Sign permits applications and formsportland gov

- Social media manager contract template form

- Social media market agency contract template form

- Social media market service contract template form

Find out other It 2663 Form

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online