Gsa Form 1627

What is the GSA Form 1627?

The GSA Form 1627, also known as the GSA Form 1627 proof of insurance, is a document utilized by businesses to demonstrate their insurance coverage. This form is often required when engaging in contracts with the federal government or other entities that necessitate proof of liability coverage. The form serves to protect both the contractor and the government by ensuring that adequate insurance is in place to cover potential liabilities that may arise during the performance of a contract.

How to Use the GSA Form 1627

Using the GSA Form 1627 involves several steps to ensure compliance with the requirements set forth by the government. First, obtain the form from a reliable source, such as the official GSA website. Next, fill out the required fields accurately, providing details about the insurance provider, coverage amounts, and policy numbers. After completing the form, it must be signed by an authorized representative of the insurance company. Finally, submit the completed form to the relevant agency or contracting officer as part of your contract documentation.

Steps to Complete the GSA Form 1627

Completing the GSA Form 1627 requires careful attention to detail. Follow these steps for successful completion:

- Download the GSA Form 1627 PDF from a trusted source.

- Provide the name and address of the contractor and the insurance provider.

- Indicate the type of insurance coverage being provided and the policy number.

- Specify the coverage limits and effective dates of the policy.

- Ensure the form is signed by an authorized representative of the insurance company.

- Review the completed form for accuracy before submission.

Legal Use of the GSA Form 1627

The legal use of the GSA Form 1627 is critical for ensuring compliance with federal contracting requirements. This form must be filled out accurately and submitted in a timely manner to avoid any legal repercussions. Failure to provide adequate proof of insurance can lead to contract disputes or penalties. It is essential to understand that the form must meet the standards set by the government and adhere to relevant laws governing insurance and contracting.

Key Elements of the GSA Form 1627

Several key elements are essential for the GSA Form 1627 to be considered valid. These include:

- The contractor's name and contact information.

- The insurance company’s name and address.

- Details of the insurance policy, including coverage limits and effective dates.

- A signature from an authorized representative of the insurance provider.

Each of these elements must be accurately completed to ensure the form meets legal requirements.

Form Submission Methods

The GSA Form 1627 can typically be submitted through various methods, depending on the requirements of the contracting agency. Common submission methods include:

- Online submission through the agency’s designated portal.

- Mailing the completed form to the contracting officer.

- In-person delivery to the agency office.

It is important to verify the preferred submission method for the specific contract to ensure compliance.

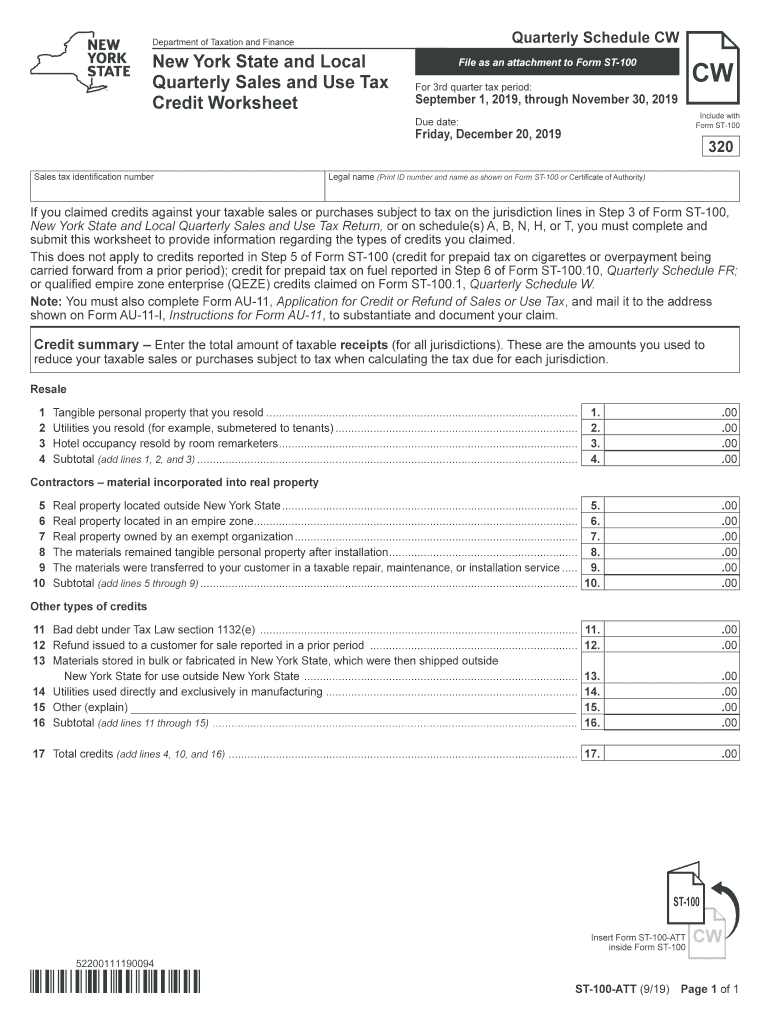

Quick guide on how to complete form st 100 att919new york state and local quarterly sales and use tax credit worksheetst100att

Complete Gsa Form 1627 effortlessly on any device

Digital document management has become increasingly popular with enterprises and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Gsa Form 1627 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign Gsa Form 1627 with ease

- Find Gsa Form 1627 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form: by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device of your preference. Modify and eSign Gsa Form 1627 and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form st 100 att919new york state and local quarterly sales and use tax credit worksheetst100att

How to create an electronic signature for the Form St 100 Att919new York State And Local Quarterly Sales And Use Tax Credit Worksheetst100att online

How to make an eSignature for the Form St 100 Att919new York State And Local Quarterly Sales And Use Tax Credit Worksheetst100att in Google Chrome

How to generate an electronic signature for signing the Form St 100 Att919new York State And Local Quarterly Sales And Use Tax Credit Worksheetst100att in Gmail

How to create an eSignature for the Form St 100 Att919new York State And Local Quarterly Sales And Use Tax Credit Worksheetst100att from your mobile device

How to generate an electronic signature for the Form St 100 Att919new York State And Local Quarterly Sales And Use Tax Credit Worksheetst100att on iOS

How to generate an eSignature for the Form St 100 Att919new York State And Local Quarterly Sales And Use Tax Credit Worksheetst100att on Android devices

People also ask

-

What is Form 1627 and why is it important?

Form 1627 is a vital document used in various business processes. It ensures that all necessary details are captured accurately, streamlining operations and maintaining compliance. Using airSlate SignNow to manage Form 1627 can enhance efficiency through digital workflows.

-

How can airSlate SignNow help me fill out Form 1627?

airSlate SignNow simplifies the process of filling out Form 1627 with an intuitive interface. Users can easily input information and avoid common errors, making the completion of this form quicker and hassle-free. Our platform also allows for templates that can be reused, saving time in the future.

-

Is airSlate SignNow compatible with Form 1627?

Yes, airSlate SignNow is fully compatible with Form 1627. Our platform allows you to upload, fill, and send this form digitally while ensuring that the signing process is secure and compliant. This compatibility ensures a seamless experience from form completion to document e-signature.

-

What are the pricing options for using airSlate SignNow with Form 1627?

airSlate SignNow offers competitive pricing plans that vary based on features and user needs. Whether you are an individual or a business, we provide tailored solutions that make managing Form 1627 cost-effective. Review our pricing page for more detailed information on different plans available.

-

Can I integrate airSlate SignNow with other applications to manage Form 1627?

Absolutely! airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage Form 1627. Whether you're using CRM tools or document management systems, our integrations ensure that your workflow remains uninterrupted and efficient.

-

What are the benefits of using airSlate SignNow for Form 1627?

Using airSlate SignNow for Form 1627 offers numerous benefits, including reduced processing time and improved accuracy. The electronic signature feature enhances security and ensures that your documents are legally binding. Additionally, our platform allows for easy tracking and management of your forms.

-

Is there a mobile app for airSlate SignNow to handle Form 1627?

Yes, airSlate SignNow offers a mobile application that lets you manage Form 1627 on the go. With this app, you can fill out, sign, and send your forms directly from your mobile device. This flexibility ensures that you can handle your documentation needs anytime and anywhere.

Get more for Gsa Form 1627

- Form it 236 credit for taxicabs and livery service vehicles accessible to persons with disabilities tax year

- Haslam resume template form

- Social media consultant contract template form

- Social media brand ambassador contract template form

- Social media contract template form

- Social media influencer influencer contract template form

- Social media influencer contract template form

- Social media management contract template form

Find out other Gsa Form 1627

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT