Form W 8BEN Rev February Kccllc

What is the Form W-8BEN Rev February Kccllc

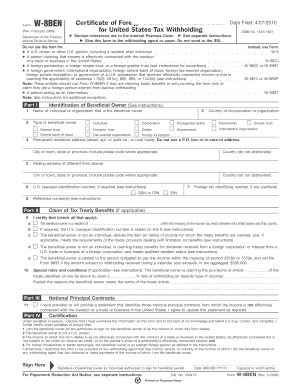

The Form W-8BEN Rev February Kccllc is a tax form used by foreign individuals and entities to certify their foreign status and claim benefits under an income tax treaty. This form is essential for non-U.S. persons receiving income from U.S. sources, as it helps them avoid or reduce withholding taxes on certain types of income, such as dividends, interest, and royalties. By providing this form, the individual or entity confirms that they are not subject to U.S. taxation on the income received, provided they meet the eligibility criteria outlined by the IRS.

How to use the Form W-8BEN Rev February Kccllc

To use the Form W-8BEN Rev February Kccllc effectively, individuals and entities must complete the form accurately and submit it to the withholding agent or financial institution that requests it. This form is not submitted directly to the IRS; instead, it serves as documentation for the payer to determine the appropriate withholding tax rate. It is important to ensure that all information provided is correct and up-to-date, as errors can lead to incorrect tax withholding or penalties.

Steps to complete the Form W-8BEN Rev February Kccllc

Completing the Form W-8BEN Rev February Kccllc involves several key steps:

- Provide personal information: Fill in your name, country of citizenship, and address.

- Claim tax treaty benefits: Indicate your eligibility for benefits under an applicable tax treaty by providing the relevant information.

- Sign and date the form: Ensure that you sign and date the form to certify that the information is accurate and complete.

Once completed, submit the form to the withholding agent or financial institution, keeping a copy for your records.

Eligibility Criteria

To be eligible to use the Form W-8BEN Rev February Kccllc, the individual or entity must be a non-U.S. person. This includes foreign individuals, foreign corporations, and foreign partnerships. Additionally, the applicant must not be engaged in a trade or business within the United States and must meet the requirements of any applicable tax treaty to claim reduced withholding rates. It is essential to review the specific criteria outlined by the IRS to ensure compliance.

Required Documents

When submitting the Form W-8BEN Rev February Kccllc, it is important to have certain documents ready to support your claims. These may include:

- Proof of foreign status: This can include a passport or other government-issued identification.

- Tax identification number: Some countries require a tax identification number to be included on the form.

- Documentation of tax treaty eligibility: If claiming benefits under a tax treaty, relevant documentation may be necessary.

Having these documents prepared can help facilitate the process and ensure accurate submission.

Filing Deadlines / Important Dates

While the Form W-8BEN Rev February Kccllc does not have a specific filing deadline, it is crucial to submit the form before receiving any U.S. source income to avoid higher withholding tax rates. The form remains valid for three years from the date it is signed, after which a new form must be submitted. Keeping track of these timelines helps ensure compliance and optimal tax treatment.

Quick guide on how to complete form w 8ben rev february kccllc

Prepare [SKS] seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form W 8BEN Rev February Kccllc

Create this form in 5 minutes!

How to create an eSignature for the form w 8ben rev february kccllc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form W 8BEN Rev February Kccllc?

The Form W 8BEN Rev February Kccllc is a tax form used by foreign individuals and entities to signNow their foreign status and claim tax treaty benefits. This form is essential for businesses engaging with international clients to ensure compliance with U.S. tax regulations.

-

How can airSlate SignNow help with the Form W 8BEN Rev February Kccllc?

airSlate SignNow provides a streamlined platform for businesses to easily send, receive, and eSign the Form W 8BEN Rev February Kccllc. Our solution simplifies the document management process, ensuring that your forms are completed accurately and securely.

-

What are the pricing options for using airSlate SignNow for Form W 8BEN Rev February Kccllc?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you require basic features or advanced functionalities for managing the Form W 8BEN Rev February Kccllc, we have a plan that fits your budget.

-

What features does airSlate SignNow offer for managing Form W 8BEN Rev February Kccllc?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning capabilities specifically designed for the Form W 8BEN Rev February Kccllc. These tools enhance efficiency and ensure that your documents are processed quickly and securely.

-

Are there any benefits to using airSlate SignNow for Form W 8BEN Rev February Kccllc?

Using airSlate SignNow for the Form W 8BEN Rev February Kccllc offers numerous benefits, including reduced turnaround times, improved accuracy, and enhanced security. Our solution helps businesses maintain compliance while simplifying the document signing process.

-

Can airSlate SignNow integrate with other software for Form W 8BEN Rev February Kccllc?

Yes, airSlate SignNow seamlessly integrates with various software applications, allowing you to manage the Form W 8BEN Rev February Kccllc alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in one place.

-

Is airSlate SignNow secure for handling Form W 8BEN Rev February Kccllc?

Absolutely! airSlate SignNow employs advanced security measures to protect your data when handling the Form W 8BEN Rev February Kccllc. Our platform is compliant with industry standards, ensuring that your sensitive information remains safe and confidential.

Get more for Form W 8BEN Rev February Kccllc

Find out other Form W 8BEN Rev February Kccllc

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself