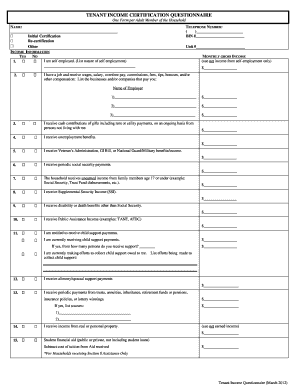

Ticq Form

What is the Ticq

The Ticq form is a specific document used primarily for tax-related purposes in the United States. It serves as a means for individuals and businesses to report certain financial information to the Internal Revenue Service (IRS). Understanding the purpose of the Ticq is essential for compliance with federal tax laws, as it helps ensure accurate reporting and accountability.

How to use the Ticq

Using the Ticq form involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents that pertain to the reporting period. Next, carefully fill out the form, ensuring that each section is completed with accurate data. Once completed, the form can be submitted electronically or by mail, depending on the specific requirements set forth by the IRS.

Steps to complete the Ticq

Completing the Ticq form requires attention to detail. Follow these steps for a successful submission:

- Collect all relevant financial documents, such as income statements and expense reports.

- Fill out the Ticq form, ensuring that all sections are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form electronically through a secure platform or mail it to the appropriate IRS address.

Legal use of the Ticq

The legal use of the Ticq form is governed by IRS regulations. It is crucial to ensure that the form is filled out truthfully and submitted within the designated deadlines to avoid penalties. Compliance with tax laws not only protects individuals and businesses but also helps maintain the integrity of the tax system.

Required Documents

To complete the Ticq form, certain documents are necessary. These typically include:

- Income statements, such as W-2s or 1099s.

- Expense records that support deductions claimed.

- Any previous tax returns that may provide context for the current filing.

Filing Deadlines / Important Dates

Filing deadlines for the Ticq form can vary based on the type of taxpayer and the specific tax year. It is essential to stay informed about these dates to ensure timely submission. Generally, the deadline for filing individual tax returns is April 15, while businesses may have different deadlines based on their fiscal year.

Who Issues the Form

The Ticq form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to obtain and submit the form, ensuring that taxpayers have access to the necessary resources for compliance.

Quick guide on how to complete ticq

Complete Ticq effortlessly on any device

Online document management has gained considerable traction among organizations and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed paperwork, as it allows you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, revise, and eSign your documents swiftly and without complications. Handle Ticq on any platform with airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to alter and eSign Ticq with ease

- Locate Ticq and click on Get Form to begin.

- Take advantage of the tools we provide to fill out your document.

- Emphasize key sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes mere seconds and bears the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you'd like to share your form, through email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Alter and eSign Ticq and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ticq

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ticq and how does it relate to airSlate SignNow?

Ticq is a tool that can enhance your document management experience. With airSlate SignNow, ticq integrates seamlessly to help streamline eSigning and document workflows, making it easier for businesses to manage their documents from start to finish.

-

How does airSlate SignNow’s pricing compare for ticq users?

The pricing for airSlate SignNow is designed to provide great value for ticq users. With flexible subscription plans, you can choose the option that best fits your budget while taking full advantage of the features that ticq offers.

-

What key features does airSlate SignNow offer for ticq?

AirSlate SignNow offers a variety of features ideal for ticq, including customizable templates, real-time collaboration, and advanced security measures. These features ensure that your documents are not only signed efficiently but also securely managed throughout the process.

-

What are the benefits of using ticq with airSlate SignNow?

Using ticq with airSlate SignNow enhances productivity by reducing the time and effort needed for document signing processes. Additionally, the integration allows for better tracking and management of your documents, providing a simplified user experience.

-

Can airSlate SignNow integrate with other tools besides ticq?

Yes, airSlate SignNow can integrate with various tools beyond ticq, including CRMs, email platforms, and project management software. This flexibility allows businesses to create a cohesive workflow that meets their specific needs.

-

Is airSlate SignNow suitable for small businesses using ticq?

Absolutely! AirSlate SignNow is an excellent solution for small businesses utilizing ticq. Its cost-effective pricing and user-friendly interface make it accessible for organizations of all sizes looking to streamline their document workflows.

-

How does airSlate SignNow ensure the security of documents signed through ticq?

AirSlate SignNow places high importance on document security for ticq users. It employs advanced encryption methods, multi-factor authentication, and secure cloud storage to ensure that all documents remain safe from unauthorized access.

Get more for Ticq

Find out other Ticq

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors