399 New York Form

What is the 399 New York?

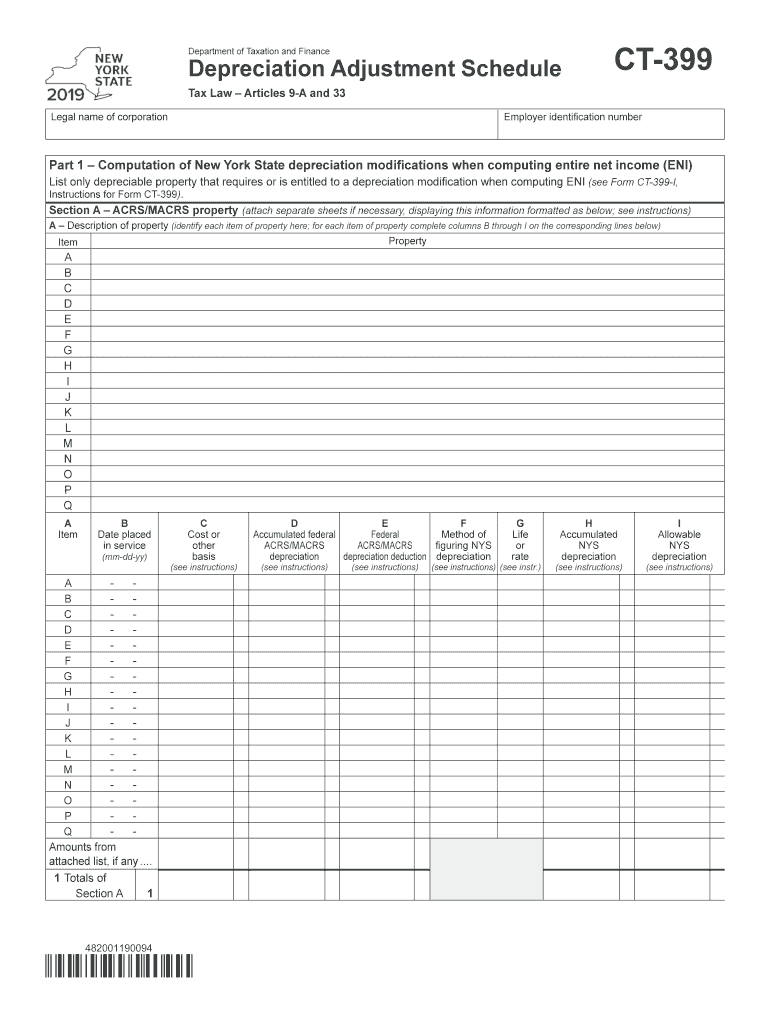

The 399 New York form, also known as the 399 state ct399 form, is a tax document used primarily for reporting specific financial information related to property depreciation in New York. This form is crucial for individuals and businesses seeking to claim depreciation deductions on their state tax returns. Understanding the purpose and requirements of the 399 form is essential for ensuring compliance with New York tax regulations.

How to use the 399 New York

Using the 399 New York form involves several steps to ensure accurate reporting. First, gather all necessary financial documents that detail your property’s acquisition cost, improvements, and prior depreciation. Next, complete the form by entering relevant information in the designated fields, ensuring that all calculations are accurate. After filling out the form, review it for completeness and accuracy before submission to avoid any delays or issues with your tax return.

Steps to complete the 399 New York

Completing the 399 New York form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name, address, and taxpayer identification number.

- Detail the property for which you are claiming depreciation, including its location and acquisition date.

- Calculate the depreciation amount based on the property's cost and applicable depreciation methods.

- Ensure all calculations are accurate and that you have included any necessary supporting documentation.

- Review the completed form for errors before submitting it.

Legal use of the 399 New York

The 399 New York form must be used in accordance with New York state tax laws. It is legally binding when completed accurately and submitted on time. Failure to comply with the legal requirements associated with this form can result in penalties or audits. Therefore, it is essential to understand the legal implications of the information provided on the form and to ensure that all entries are truthful and supported by relevant documentation.

Filing Deadlines / Important Dates

Filing deadlines for the 399 New York form typically align with the state tax return due dates. It is important to submit the form by the specified deadline to avoid late fees or penalties. Generally, the deadline for filing state income tax returns in New York is April fifteenth. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Always verify current deadlines to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The 399 New York form can be submitted through various methods, depending on your preference and the requirements set by the New York State Department of Taxation and Finance. Options typically include:

- Online submission through the state’s tax portal, which allows for quick processing.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices, which may provide immediate feedback on your filing.

Who Issues the Form

The 399 New York form is issued by the New York State Department of Taxation and Finance. This agency is responsible for overseeing tax compliance and ensuring that all tax-related documents are processed according to state regulations. It is important to refer to the official guidelines provided by this department when completing the form to ensure adherence to all requirements.

Quick guide on how to complete form ct 3992019depreciation adjustment schedulect399

Complete 399 New York effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and eSign your documents promptly without delays. Manage 399 New York on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related operation today.

The most efficient method to modify and eSign 399 New York effortlessly

- Locate 399 New York and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using the specific tools that airSlate SignNow provides for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Adjust and eSign 399 New York to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3992019depreciation adjustment schedulect399

How to make an electronic signature for your Form Ct 3992019depreciation Adjustment Schedulect399 online

How to generate an eSignature for your Form Ct 3992019depreciation Adjustment Schedulect399 in Chrome

How to create an eSignature for signing the Form Ct 3992019depreciation Adjustment Schedulect399 in Gmail

How to create an eSignature for the Form Ct 3992019depreciation Adjustment Schedulect399 right from your smartphone

How to create an eSignature for the Form Ct 3992019depreciation Adjustment Schedulect399 on iOS

How to generate an eSignature for the Form Ct 3992019depreciation Adjustment Schedulect399 on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to 399 New York?

airSlate SignNow is a powerful eSignature solution that enables businesses in 399 New York to send and sign documents seamlessly. It offers an intuitive interface for managing electronic signatures, ensuring compliance and security for your documents. This makes it an ideal tool for businesses looking to streamline their operations in the vibrant market of 399 New York.

-

What pricing plans does airSlate SignNow offer for users in 399 New York?

airSlate SignNow provides several flexible pricing plans tailored for businesses in 399 New York, ensuring that you can find a plan that fits your budget and needs. Each plan offers a range of features, from basic eSigning to advanced workflow automation. You can easily choose a plan that suits your business size and requirements in 399 New York.

-

What features does airSlate SignNow include for businesses in 399 New York?

Businesses in 399 New York can take advantage of features such as customizable templates, team collaboration tools, and comprehensive audit trails with airSlate SignNow. These features enhance document management and ensure that your signing processes are efficient and secure. With airSlate SignNow, you can effectively handle all your electronic signing needs.

-

How can airSlate SignNow benefit my business in 399 New York?

By using airSlate SignNow, businesses in 399 New York can signNowly reduce the time and costs associated with traditional document signing. The platform allows for quick turnaround times, which is crucial in fast-paced environments. Additionally, it helps to enhance customer satisfaction by providing a seamless signing experience.

-

What integrations does airSlate SignNow offer for companies in 399 New York?

airSlate SignNow integrates with a variety of popular applications and platforms used by businesses in 399 New York, including Google Workspace, Salesforce, and Microsoft Office. These integrations help streamline your workflows and enhance productivity by connecting your existing tools with the eSigning process. This means you can work smarter, not harder, in 399 New York.

-

Is airSlate SignNow compliant with regulations in 399 New York?

Yes, airSlate SignNow is compliant with various legal regulations, including the ESIGN Act and UETA, which are essential for businesses operating in 399 New York. This compliance ensures that your electronic signatures are legally binding and secure. You can trust airSlate SignNow to keep your documents safe and compliant with industry standards.

-

Can I use airSlate SignNow for remote work in 399 New York?

Absolutely! airSlate SignNow is designed for remote work, making it an excellent choice for businesses in 399 New York that require flexibility. With its cloud-based platform, you can send and eSign documents from anywhere, enabling your team to collaborate effectively whether they are in the office or working remotely.

Get more for 399 New York

- Form it 272 claim for college tuition credit or itemized deduction tax year

- Fbi report template form

- Example contract template form

- Signed contract template form

- Signed email contract template form

- Silent investor contract template form

- Site manager contract template form

- Silent partner contract template form

Find out other 399 New York

- Electronic signature Indiana Sponsorship Agreement Free

- Can I Electronic signature Vermont Bulk Sale Agreement

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template