Form it 272 Claim for College Tuition Credit or Itemized Deduction Tax Year 2023-2026

Understanding the Form IT-272 for College Tuition Credit

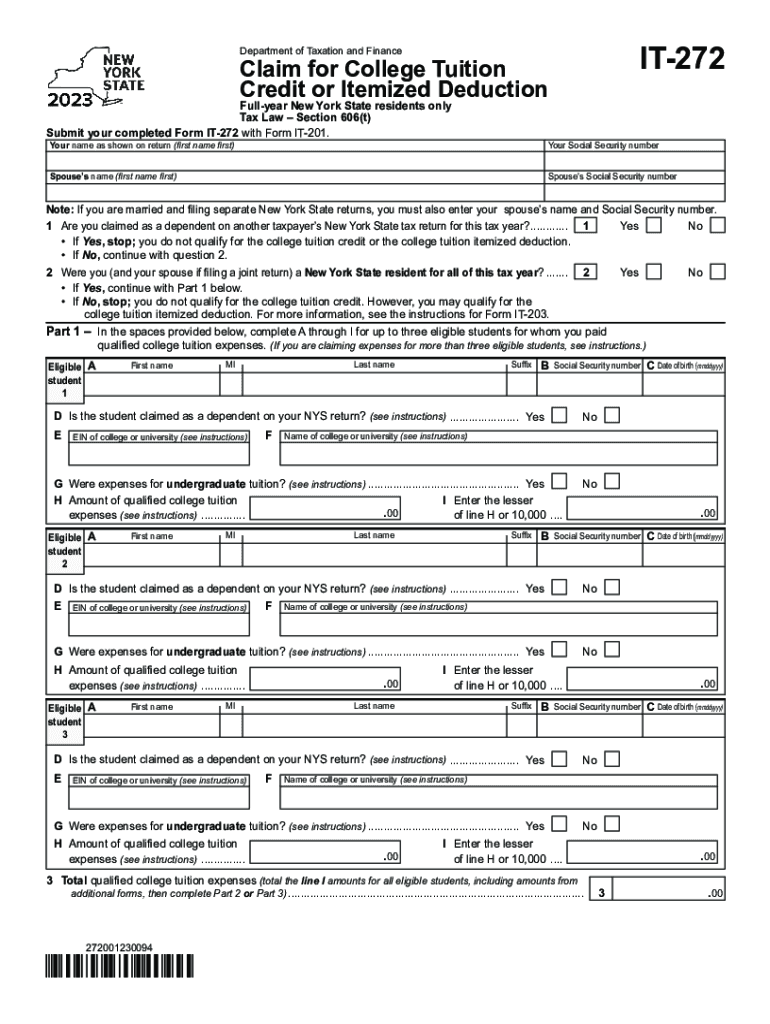

The Form IT-272 is essential for taxpayers in New York who wish to claim a college tuition credit or an itemized deduction for eligible educational expenses. This form allows individuals to report tuition payments made for themselves or dependents attending qualified institutions. The credit can significantly reduce the amount of state tax owed, making it a valuable resource for families investing in education.

Steps to Complete the Form IT-272

Completing the Form IT-272 involves several key steps:

- Gather all necessary documentation, including receipts for tuition payments and any relevant financial statements.

- Fill out personal information, such as name, address, and Social Security number, at the top of the form.

- Report the amount of tuition paid during the tax year in the designated section.

- Indicate whether you are claiming the credit or the itemized deduction, and complete the corresponding calculations.

- Review the completed form for accuracy before submitting it.

Eligibility Criteria for the Form IT-272

To qualify for the college tuition credit or itemized deduction using Form IT-272, certain criteria must be met:

- The taxpayer must be a resident of New York State.

- Tuition payments must be made to a qualified institution, which includes colleges, universities, and other accredited educational entities.

- Eligible expenses must be incurred for the tax year in which the credit or deduction is claimed.

- Income limits may apply, which can affect the amount of credit or deduction available.

Required Documents for Form IT-272

When preparing to file Form IT-272, it is important to have the following documents on hand:

- Receipts or statements from educational institutions showing tuition payments.

- Taxpayer's previous year tax return, if applicable, for reference.

- Any additional documentation that supports the claim, such as proof of residency or dependency status.

Common Filing Methods for Form IT-272

Taxpayers can submit Form IT-272 through various methods:

- Online submission via the New York State Department of Taxation and Finance website.

- Mailing the completed form to the appropriate tax office address as specified in the form instructions.

- In-person submission at designated tax offices, if preferred.

State-Specific Rules for Form IT-272

New York has specific regulations that govern the use of Form IT-272. It is crucial for taxpayers to be aware of these rules to ensure compliance:

- Only tuition paid for qualified programs can be claimed.

- Taxpayers must retain documentation for at least three years in case of an audit.

- Changes in state tax laws may affect eligibility and credit amounts, so staying informed is essential.

Quick guide on how to complete form it 272 claim for college tuition credit or itemized deduction tax year

Prepare Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents efficiently without delays. Manage Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year with ease

- Locate Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year and ensure smooth communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 272 claim for college tuition credit or itemized deduction tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 272 claim for college tuition credit or itemized deduction tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is credit deduction in the context of airSlate SignNow?

Credit deduction refers to the process by which you can reduce your overall expenses through effective use of airSlate SignNow's eSignature services. When utilizing our platform, you may find signNow savings on document handling and processing costs, aligning with your financial planning for credit deduction. This can help your business stay financially efficient.

-

How does airSlate SignNow support credit deduction for businesses?

airSlate SignNow helps businesses achieve credit deduction by streamlining the document signing process, thereby reducing costs associated with physical printing and mailing. With our digital solutions, businesses can also claim certain deductions related to electronic signatures under applicable tax codes, enhancing overall savings.

-

What are the pricing plans for airSlate SignNow, and how do they relate to credit deduction?

Our pricing plans for airSlate SignNow are structured to offer cost-effective solutions for businesses of all sizes, which can lead to potential credit deduction benefits. By opting for one of our tiered plans, companies can manage their signing processes more efficiently, enabling better financial controls and opportunities for credit deduction on expenses.

-

Can I integrate airSlate SignNow with other tools to enhance credit deduction opportunities?

Yes, airSlate SignNow offers integrations with various business applications, which can enhance your ability to achieve credit deduction. By connecting with tools like CRM systems and accounting software, you can optimize your workflows and improve your financial reporting, ultimately maximizing your credit deduction potential.

-

What are the key features of airSlate SignNow that facilitate credit deduction?

Key features of airSlate SignNow that facilitate credit deduction include customizable templates, automated workflows, and secure data management. These features help reduce turnaround times and administrative costs, allowing businesses to claim deductions more effectively on their tax filings.

-

How can airSlate SignNow improve my business's cash flow in relation to credit deduction?

By using airSlate SignNow, businesses can improve their cash flow as the speed of document processing increases, leading to quicker payments. When documents are handled efficiently, it allows for better expense tracking, facilitating accurate credit deduction claims which can positively affect your financial health.

-

Is there customer support available for queries regarding credit deduction with airSlate SignNow?

Absolutely! Our dedicated customer support team is available to assist users with any questions related to credit deduction and how to utilize airSlate SignNow effectively. Whether you're inquiring about features or pricing plans that impact your credit deduction, we’re here to help.

Get more for Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year

- Watervliet pistol permit application process veterans gun depot form

- Virginia declaration of candidacy form

- Smart champ insurance plan form

- Toys and games archives spanish playground form

- Fdic certificate number 57053 form

- Wire transfer receipt wells fargo form

- Certified copy of a marriage license request form teton county wy

- Coach and mentor contract template form

Find out other Form IT 272 Claim For College Tuition Credit Or Itemized Deduction Tax Year

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed