Beneficiary Designation Form Diversified Capital Management

What is the Beneficiary Designation Form Diversified Capital Management

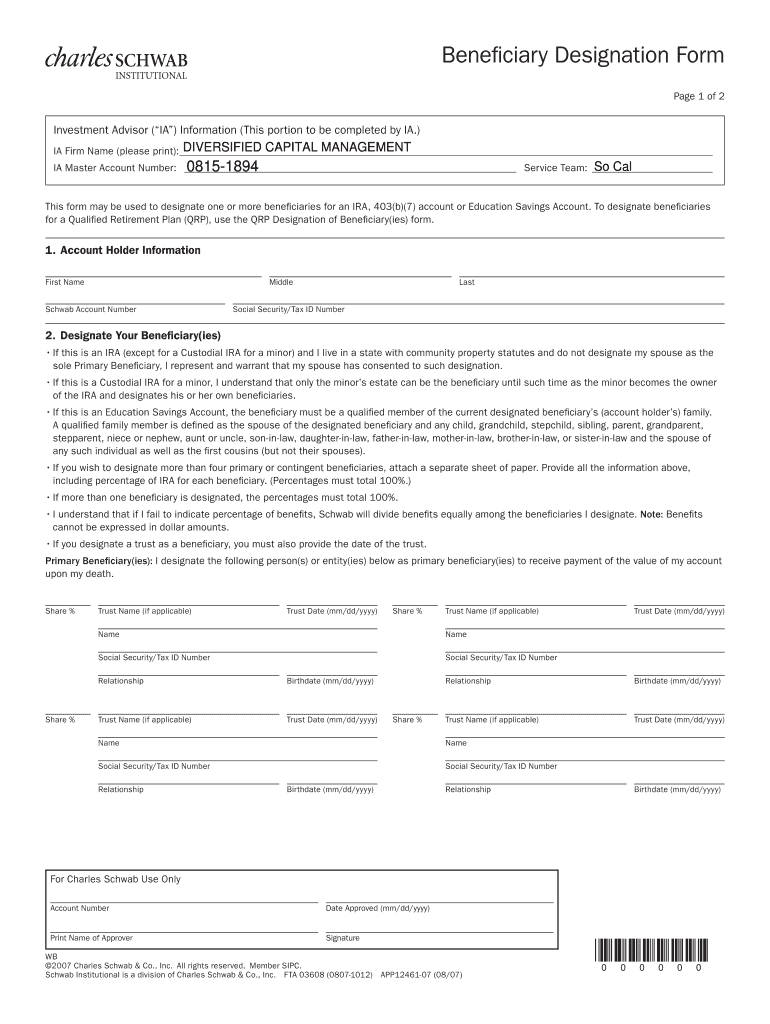

The Beneficiary Designation Form for Diversified Capital Management is a crucial document that allows individuals to specify who will receive their assets upon their passing. This form is particularly important for retirement accounts, life insurance policies, and other financial products. By clearly indicating beneficiaries, individuals can ensure that their assets are distributed according to their wishes, avoiding potential disputes among heirs.

How to use the Beneficiary Designation Form Diversified Capital Management

Using the Beneficiary Designation Form involves several straightforward steps. First, obtain the form from Diversified Capital Management, which can typically be accessed through their website or customer service. Next, carefully fill out the required fields, including personal information and the names of beneficiaries. It is essential to double-check the accuracy of the information provided to prevent any issues in the future. Once completed, the form must be submitted according to the guidelines provided by Diversified Capital Management.

Steps to complete the Beneficiary Designation Form Diversified Capital Management

Completing the Beneficiary Designation Form requires careful attention to detail. Follow these steps for a successful submission:

- Obtain the form from Diversified Capital Management.

- Provide your personal information, including your name, address, and account number.

- List the beneficiaries, including their names, relationships to you, and contact information.

- Specify the percentage of assets each beneficiary will receive.

- Sign and date the form to validate your choices.

- Submit the completed form as directed by Diversified Capital Management.

Key elements of the Beneficiary Designation Form Diversified Capital Management

The Beneficiary Designation Form includes several key elements that are essential for its validity. These elements typically consist of:

- Your personal identification details, such as name and account number.

- Information about the beneficiaries, including their names and relationships.

- Clear instructions on how assets should be divided among the beneficiaries.

- A signature line to confirm that the information is accurate and reflects your wishes.

Legal use of the Beneficiary Designation Form Diversified Capital Management

The legal use of the Beneficiary Designation Form is governed by state laws and regulations. It is essential to ensure that the form complies with any applicable laws in your state to avoid complications during the distribution of assets. Properly designating beneficiaries can help streamline the probate process and ensure that your assets are transferred according to your wishes without unnecessary delays or disputes.

Form Submission Methods

Submitting the Beneficiary Designation Form can typically be done through various methods. Common submission options include:

- Online submission through the Diversified Capital Management website, if available.

- Mailing the completed form to the designated address provided by Diversified Capital Management.

- In-person submission at a local office, if applicable.

Quick guide on how to complete beneficiary designation form diversified capital management

Complete [SKS] easily on any device

Online document management has become increasingly favored by businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly and without delays. Manage [SKS] on any system with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The simplest way to edit and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to store your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Beneficiary Designation Form Diversified Capital Management

Create this form in 5 minutes!

How to create an eSignature for the beneficiary designation form diversified capital management

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Beneficiary Designation Form Diversified Capital Management?

The Beneficiary Designation Form Diversified Capital Management is a crucial document that allows individuals to specify who will receive their assets upon their passing. This form ensures that your wishes are clearly communicated and legally recognized, providing peace of mind for you and your beneficiaries.

-

How can I access the Beneficiary Designation Form Diversified Capital Management?

You can easily access the Beneficiary Designation Form Diversified Capital Management through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and you will find the necessary documents ready for you to complete and eSign.

-

Is there a cost associated with the Beneficiary Designation Form Diversified Capital Management?

The cost of using the Beneficiary Designation Form Diversified Capital Management through airSlate SignNow is part of our subscription plans. We offer various pricing tiers to accommodate different business needs, ensuring that you receive a cost-effective solution for your document management.

-

What features does the Beneficiary Designation Form Diversified Capital Management offer?

The Beneficiary Designation Form Diversified Capital Management includes features such as customizable templates, secure eSigning, and real-time tracking of document status. These features streamline the process, making it easier for you to manage your beneficiary designations efficiently.

-

How does the Beneficiary Designation Form Diversified Capital Management benefit my estate planning?

Utilizing the Beneficiary Designation Form Diversified Capital Management enhances your estate planning by ensuring that your assets are distributed according to your wishes. This form minimizes potential disputes among heirs and simplifies the transfer process, making it a vital part of your overall estate strategy.

-

Can I integrate the Beneficiary Designation Form Diversified Capital Management with other tools?

Yes, the Beneficiary Designation Form Diversified Capital Management can be integrated with various third-party applications and tools. airSlate SignNow supports seamless integrations, allowing you to enhance your workflow and improve efficiency in managing your documents.

-

What security measures are in place for the Beneficiary Designation Form Diversified Capital Management?

The security of your Beneficiary Designation Form Diversified Capital Management is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure cloud storage to protect your sensitive information, ensuring that your documents are safe from unauthorized access.

Get more for Beneficiary Designation Form Diversified Capital Management

Find out other Beneficiary Designation Form Diversified Capital Management

- Sign Hawaii Rental Invoice Template Simple

- Sign California Commercial Lease Agreement Template Free

- Sign New Jersey Rental Invoice Template Online

- Sign Wisconsin Rental Invoice Template Online

- Can I Sign Massachusetts Commercial Lease Agreement Template

- Sign Nebraska Facility Rental Agreement Online

- Sign Arizona Sublease Agreement Template Fast

- How To Sign Florida Sublease Agreement Template

- Sign Wyoming Roommate Contract Safe

- Sign Arizona Roommate Rental Agreement Template Later

- How Do I Sign New York Sublease Agreement Template

- How To Sign Florida Roommate Rental Agreement Template

- Can I Sign Tennessee Sublease Agreement Template

- Sign Texas Sublease Agreement Template Secure

- How Do I Sign Texas Sublease Agreement Template

- Sign Iowa Roommate Rental Agreement Template Now

- How Do I Sign Louisiana Roommate Rental Agreement Template

- Sign Maine Lodger Agreement Template Computer

- Can I Sign New Jersey Lodger Agreement Template

- Sign New York Lodger Agreement Template Later