Tr 579 it Form

What is the 2019 Form TR-579 IT?

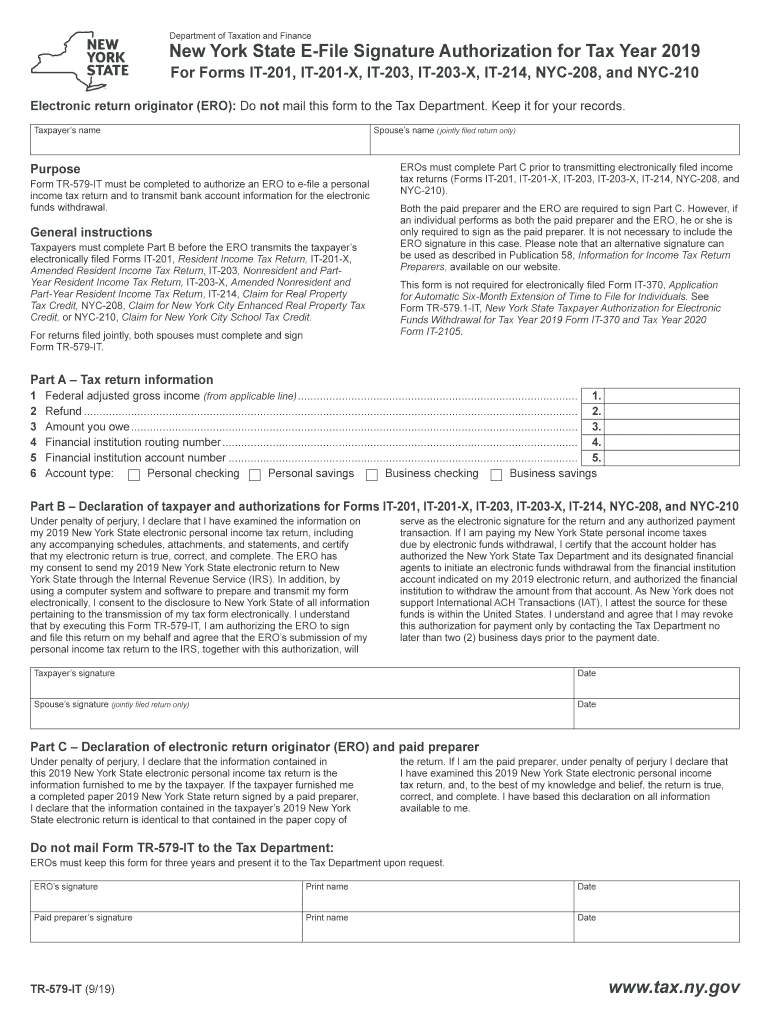

The 2019 Form TR-579 IT is a tax-related document used in New York State. It serves as a means for taxpayers to authorize electronic filing of their tax returns. This form is particularly relevant for individuals and businesses that wish to streamline their tax submission process through digital means. Understanding the purpose and function of the TR-579 IT is essential for ensuring compliance with state tax regulations.

How to Use the 2019 Form TR-579 IT

Using the 2019 Form TR-579 IT involves several straightforward steps. First, gather all necessary information, including your tax identification number and details from your tax return. Next, fill out the form accurately, ensuring that all fields are completed as required. After completing the form, you can submit it electronically alongside your tax return, which facilitates a smoother filing process. It is crucial to keep a copy of the submitted form for your records.

Steps to Complete the 2019 Form TR-579 IT

Completing the 2019 Form TR-579 IT involves a series of methodical steps:

- Obtain the form from the New York State Department of Taxation and Finance website or through your tax software.

- Provide your personal information, including your name, address, and Social Security number.

- Indicate the tax year for which you are filing.

- Review the form for accuracy to avoid any potential issues during processing.

- Submit the completed form electronically with your tax return.

Legal Use of the 2019 Form TR-579 IT

The legal use of the 2019 Form TR-579 IT is governed by specific regulations set forth by the New York State Department of Taxation and Finance. This form must be filled out and submitted in accordance with state laws to ensure that electronic filing is recognized as valid. Compliance with these regulations is essential for the form to be accepted by tax authorities, ensuring that your electronic submission is legally binding.

Required Documents for the 2019 Form TR-579 IT

When completing the 2019 Form TR-579 IT, certain documents are necessary to provide the required information. These include:

- Your completed tax return for the relevant year.

- Your Social Security number or Employer Identification Number (EIN).

- Any supporting documentation that may be required for your specific tax situation.

Having these documents on hand will facilitate the accurate completion of the form and ensure that your electronic filing process goes smoothly.

Filing Deadlines for the 2019 Form TR-579 IT

Filing deadlines for the 2019 Form TR-579 IT align with the general tax filing deadlines established by the IRS and New York State. Typically, individual taxpayers must file their returns by April fifteenth of the following year. It is important to be aware of any extensions or specific deadlines that may apply to your situation to avoid penalties and ensure timely submission.

Quick guide on how to complete new york state e file signature authorization for tax year 2019 for forms it 201 it 201 x it 203 it 203 x it 214 nyc 208 and

Effortlessly Prepare Tr 579 It on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Handle Tr 579 It on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Tr 579 It with Ease

- Locate Tr 579 It and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you want to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and electronically sign Tr 579 It and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the new york state e file signature authorization for tax year 2019 for forms it 201 it 201 x it 203 it 203 x it 214 nyc 208 and

How to create an eSignature for your New York State E File Signature Authorization For Tax Year 2019 For Forms It 201 It 201 X It 203 It 203 X It 214 Nyc 208 And in the online mode

How to create an electronic signature for your New York State E File Signature Authorization For Tax Year 2019 For Forms It 201 It 201 X It 203 It 203 X It 214 Nyc 208 And in Google Chrome

How to create an eSignature for signing the New York State E File Signature Authorization For Tax Year 2019 For Forms It 201 It 201 X It 203 It 203 X It 214 Nyc 208 And in Gmail

How to make an eSignature for the New York State E File Signature Authorization For Tax Year 2019 For Forms It 201 It 201 X It 203 It 203 X It 214 Nyc 208 And right from your smart phone

How to generate an electronic signature for the New York State E File Signature Authorization For Tax Year 2019 For Forms It 201 It 201 X It 203 It 203 X It 214 Nyc 208 And on iOS devices

How to generate an eSignature for the New York State E File Signature Authorization For Tax Year 2019 For Forms It 201 It 201 X It 203 It 203 X It 214 Nyc 208 And on Android devices

People also ask

-

What is the 2019 form tr 579 it, and why is it important?

The 2019 form tr 579 it is a critical document for businesses and individuals for reporting specific tax information. Understanding this form is essential to ensure compliance with tax regulations and avoid potential penalties. By using airSlate SignNow, you can easily complete and eSign your 2019 form tr 579 it, streamlining your documentation process.

-

How does airSlate SignNow help with filling out the 2019 form tr 579 it?

airSlate SignNow provides a user-friendly platform allowing you to fill out the 2019 form tr 579 it efficiently. The step-by-step guidance and customizable fields help ensure you complete the form accurately. Additionally, the software automatically saves your progress, making it easy to return and finish at your convenience.

-

What are the pricing plans for using airSlate SignNow for the 2019 form tr 579 it?

airSlate SignNow offers competitive pricing plans designed to cater to various business needs, starting from a basic subscription to more advanced packages. These plans include features specifically beneficial for managing the 2019 form tr 579 it, such as unlimited document storage and template creation. You can select a plan that best fits your requirements and budget.

-

Are there any integrations available for managing the 2019 form tr 579 it?

Yes, airSlate SignNow seamlessly integrates with popular applications such as Google Drive, Dropbox, and Microsoft Office, enhancing your ability to manage the 2019 form tr 579 it. These integrations allow you to import necessary documents directly into the platform, making it easier to create and eSign forms in one place. This saves time and ensures accuracy.

-

What are the benefits of using airSlate SignNow for the 2019 form tr 579 it?

Using airSlate SignNow for the 2019 form tr 579 it offers numerous benefits, including increased efficiency and reduced workflow bottlenecks. The platform ensures secure eSignature functionality, allowing for legally binding agreements. Additionally, the ability to organize and track your documents simplifies the often complex process of filing important forms.

-

Is airSlate SignNow suitable for small businesses needing to manage the 2019 form tr 579 it?

Absolutely! airSlate SignNow is designed with small businesses in mind, providing an affordable and efficient way to manage the 2019 form tr 579 it. Features such as easy document sharing and electronic signatures cater specifically to small-scale operations, ensuring that even those with limited resources can meet their compliance needs effectively.

-

Can I automate the process of filling out the 2019 form tr 579 it with airSlate SignNow?

Yes, airSlate SignNow allows users to automate the data entry process for the 2019 form tr 579 it through its advanced workflows. You can create templates that save commonly used information, reducing redundancy and minimizing errors. This automation not only speeds up the process but also enhances accuracy in document management.

Get more for Tr 579 It

- Refund under form

- Bureti tti admission form pdf

- Please wait if this message is not eventually r 578433907 form

- Service for it contract template form

- Service invoice contract template form

- Service hvac contract template form

- Service level contract template form

- Service maintenance contract template form

Find out other Tr 579 It

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form