Refund under 2023

What is the Refund Under

The term "refund under" refers to the process by which taxpayers may receive a reimbursement from the Internal Revenue Service (IRS) for overpaid taxes. This typically occurs when individuals or businesses have made payments that exceed their actual tax liabilities. The refund process is crucial for maintaining accurate financial records and ensuring compliance with tax obligations.

How to use the Refund Under

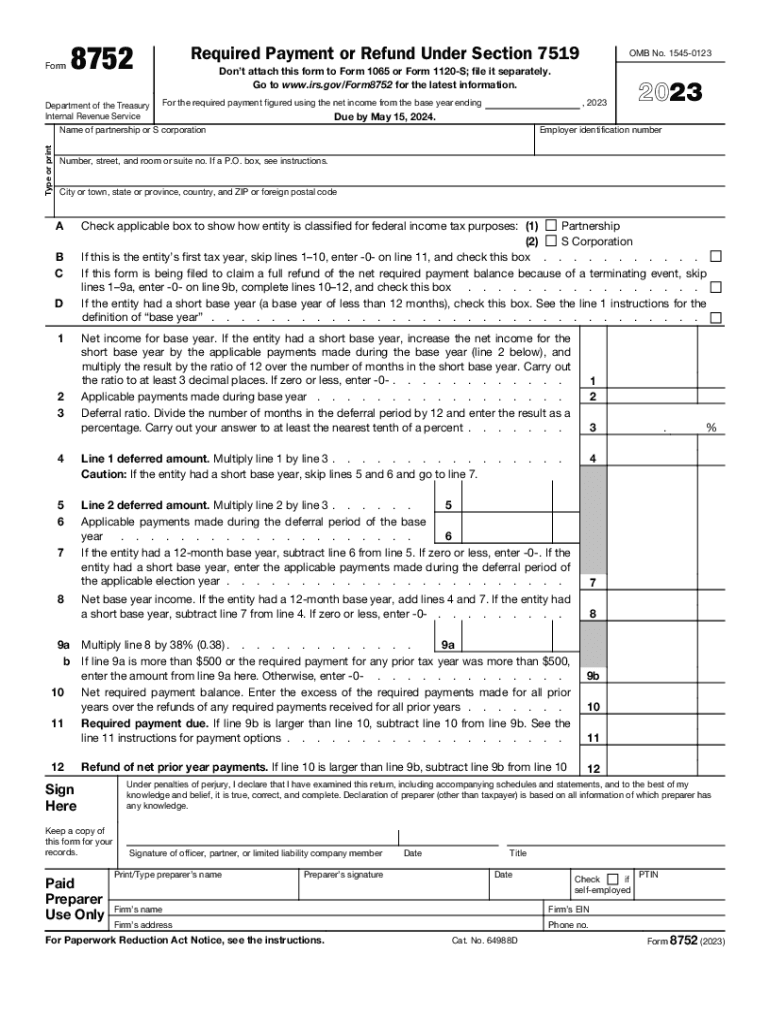

Using the refund under process involves several steps. First, taxpayers must determine their eligibility for a refund by reviewing their tax filings and payments. If an overpayment is identified, the taxpayer can file a claim for a refund using the appropriate forms, such as Form 8752. This form allows taxpayers to formally request their refund from the IRS.

Steps to complete the Refund Under

To successfully complete the refund under process, follow these steps:

- Review your tax returns and payment history to identify any overpayments.

- Gather necessary documentation, including previous tax returns and payment receipts.

- Complete Form 8752, ensuring all information is accurate and complete.

- Submit the form to the IRS via the designated submission method, either online, by mail, or in person.

- Monitor the status of your refund through the IRS website or by contacting the IRS directly.

Required Documents

When filing for a refund under the IRS guidelines, specific documents are necessary to support your claim. These typically include:

- Completed Form 8752.

- Copies of prior tax returns for the relevant years.

- Payment records that demonstrate overpayment.

- Any correspondence from the IRS regarding your tax situation.

IRS Guidelines

The IRS has established guidelines for claiming refunds, which include timelines for filing and criteria for eligibility. Taxpayers must file their refund claims within three years from the date the tax return was filed or within two years from the date the tax was paid, whichever is later. Understanding these guidelines is essential for ensuring that your claim is processed without delay.

Penalties for Non-Compliance

Failing to comply with IRS regulations regarding refunds can lead to penalties. This may include interest on unpaid taxes or denial of the refund claim. It is crucial to ensure that all forms are completed accurately and submitted on time to avoid potential issues. Taxpayers should also be aware of the implications of false claims, which can result in severe penalties.

Quick guide on how to complete refund under

Effortlessly Prepare Refund Under on Any Device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the features you require to create, modify, and electronically sign your documents quickly and without interruptions. Manage Refund Under on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The Easiest Way to Modify and Electronically Sign Refund Under with Ease

- Locate Refund Under and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Modify and electronically sign Refund Under to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct refund under

Create this form in 5 minutes!

How to create an eSignature for the refund under

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is certification debarment?

Certification debarment is a process that prohibits entities from participating in government contracts due to misconduct or non-compliance. This can affect businesses relying on federal contracts, making it crucial to ensure compliance with regulations to avoid certification debarment.

-

How can airSlate SignNow help in avoiding certification debarment?

AirSlate SignNow offers features that streamline the document compliance process, ensuring that all necessary certifications are in order. By maintaining proper records and facilitating secure e-signatures, our platform helps organizations mitigate the risks associated with certification debarment.

-

What are the pricing plans for airSlate SignNow?

AirSlate SignNow offers competitive pricing plans tailored to various business needs. Each plan provides essential features that help prevent issues like certification debarment, ensuring your organization remains compliant and capable of working on government contracts.

-

Can I integrate airSlate SignNow with other systems to manage certification debarment?

Yes, airSlate SignNow integrates seamlessly with various platforms such as CRM systems and project management tools. This integration enhances your ability to manage documents related to certification debarment and maintain compliance across different workflows.

-

What features of airSlate SignNow assist with certification debarment?

Our platform offers features such as document tracking, automated reminders, and secure e-signatures, which are essential in managing compliance. These tools ensure that your certifications are always current, reducing the risk of certification debarment.

-

Is airSlate SignNow compliant with current regulations concerning certification debarment?

Yes, airSlate SignNow is designed to comply with all relevant regulations surrounding certification debarment. Our commitment to compliance helps businesses maintain the necessary documentation and assurances to operate without interruption.

-

What benefits does airSlate SignNow provide for users concerned about certification debarment?

By using airSlate SignNow, businesses can streamline their documentation processes and enhance their compliance efforts, reducing the risk of certification debarment. Our user-friendly interface and cost-effective solutions empower teams to focus on core business operations.

Get more for Refund Under

Find out other Refund Under

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now