Reconciliation of Occupational License Tax Withheld 222 S Fcps Form

Understanding the Reconciliation Of Occupational License Tax Withheld 222 S Fcps

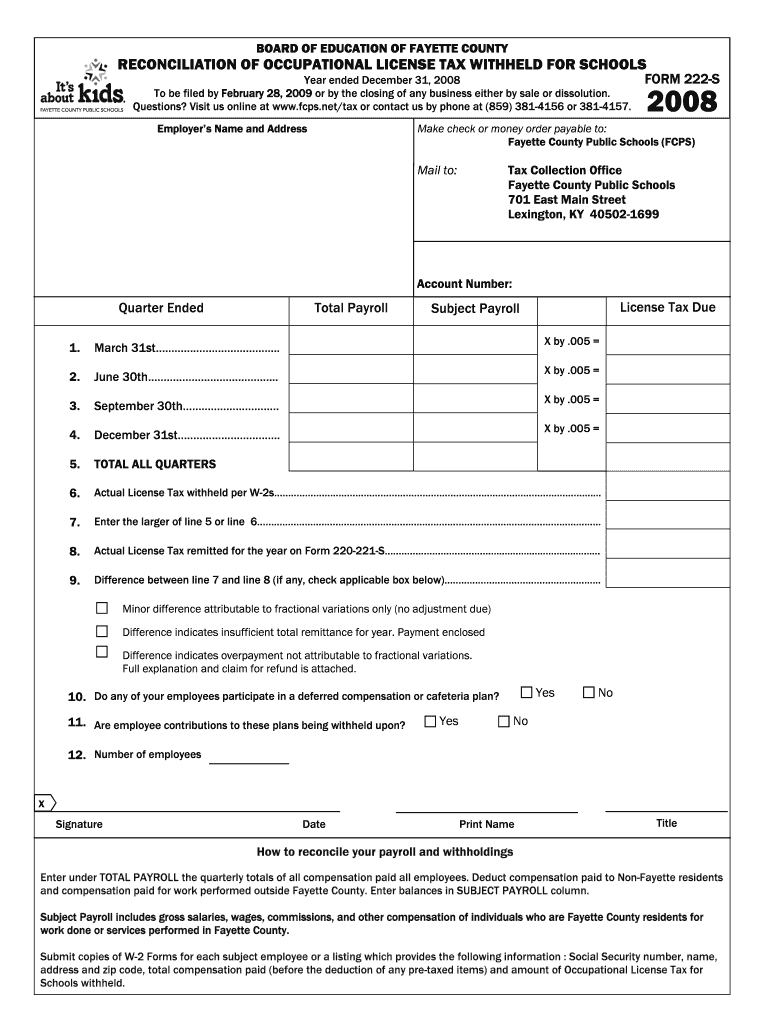

The Reconciliation Of Occupational License Tax Withheld 222 S Fcps is a specific form used by businesses to reconcile the occupational license tax that has been withheld from employees. This form is essential for ensuring compliance with local tax regulations and accurately reporting withheld amounts to the appropriate tax authorities. It serves as a record of the taxes collected and helps businesses determine if they have remitted the correct amounts throughout the tax year.

Steps to Complete the Reconciliation Of Occupational License Tax Withheld 222 S Fcps

Completing the Reconciliation Of Occupational License Tax Withheld 222 S Fcps involves several key steps:

- Gather all relevant financial records, including payroll reports and tax withholding statements.

- Calculate the total amount of occupational license tax withheld from employee wages during the reporting period.

- Compare the withheld amount to the taxes remitted to ensure accuracy.

- Fill out the form, ensuring all sections are completed with accurate figures.

- Review the form for any errors or omissions before submission.

Key Elements of the Reconciliation Of Occupational License Tax Withheld 222 S Fcps

The Reconciliation Of Occupational License Tax Withheld 222 S Fcps includes several important elements:

- Employer Information: Details about the business, including name, address, and tax identification number.

- Employee Information: Information regarding employees for whom the tax was withheld.

- Withholding Amounts: Total amounts withheld for the reporting period.

- Remittance Details: Information on amounts remitted to the tax authority.

- Signature Section: A declaration that the information provided is accurate, requiring the signature of an authorized representative.

Legal Use of the Reconciliation Of Occupational License Tax Withheld 222 S Fcps

The Reconciliation Of Occupational License Tax Withheld 222 S Fcps is legally required for businesses that withhold occupational license taxes from employees. Proper completion and submission of this form help businesses comply with local tax laws and avoid potential penalties. It is crucial for maintaining accurate records and ensuring that all tax obligations are met in a timely manner.

Filing Deadlines and Important Dates

Timely submission of the Reconciliation Of Occupational License Tax Withheld 222 S Fcps is essential to avoid penalties. Generally, the form must be filed by a specific deadline, often aligned with the end of the tax year or quarterly reporting periods. Businesses should be aware of these deadlines to ensure compliance and avoid late fees.

Required Documents for the Reconciliation Of Occupational License Tax Withheld 222 S Fcps

When preparing to complete the Reconciliation Of Occupational License Tax Withheld 222 S Fcps, businesses should gather the following documents:

- Payroll records for the reporting period.

- Previous tax withholding statements.

- Any correspondence from tax authorities regarding occupational license tax obligations.

- Bank statements showing tax payments made to local authorities.

Quick guide on how to complete reconciliation of occupational license tax withheld 222 s fcps

Complete [SKS] seamlessly on any device

Digital document management has become prevalent among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to adjust and electronically sign [SKS] effortlessly

- Find [SKS] and select Get Form to commence.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Produce your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Reconciliation Of Occupational License Tax Withheld 222 S Fcps

Create this form in 5 minutes!

How to create an eSignature for the reconciliation of occupational license tax withheld 222 s fcps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Reconciliation Of Occupational License Tax Withheld 222 S Fcps?

The Reconciliation Of Occupational License Tax Withheld 222 S Fcps refers to the process of ensuring that the occupational license taxes withheld from employees are accurately reported and reconciled with the appropriate tax authorities. This process is crucial for compliance and helps businesses avoid penalties.

-

How can airSlate SignNow assist with the Reconciliation Of Occupational License Tax Withheld 222 S Fcps?

airSlate SignNow provides a streamlined platform for managing and eSigning documents related to the Reconciliation Of Occupational License Tax Withheld 222 S Fcps. Our solution simplifies the documentation process, ensuring that all necessary forms are completed accurately and efficiently.

-

What features does airSlate SignNow offer for tax reconciliation?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure eSigning, all of which are beneficial for the Reconciliation Of Occupational License Tax Withheld 222 S Fcps. These tools help businesses save time and reduce errors in their tax documentation.

-

Is airSlate SignNow cost-effective for small businesses handling tax reconciliation?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing the Reconciliation Of Occupational License Tax Withheld 222 S Fcps. Our pricing plans are flexible and cater to various needs, ensuring that you get the best value for your investment.

-

Can airSlate SignNow integrate with accounting software for tax reconciliation?

Absolutely! airSlate SignNow can seamlessly integrate with various accounting software, making it easier to manage the Reconciliation Of Occupational License Tax Withheld 222 S Fcps. This integration allows for automatic data transfer, reducing manual entry and enhancing accuracy.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Reconciliation Of Occupational License Tax Withheld 222 S Fcps, offers numerous benefits such as improved efficiency, enhanced security, and reduced paperwork. Our platform ensures that your documents are handled securely and are easily accessible.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow prioritizes the security of sensitive tax documents through advanced encryption and secure cloud storage. When dealing with the Reconciliation Of Occupational License Tax Withheld 222 S Fcps, you can trust that your information is protected against unauthorized access.

Get more for Reconciliation Of Occupational License Tax Withheld 222 S Fcps

- Nhpri prior authorization forms

- Usa funds forbearance form

- Notice of family claim form f3 bc

- Logistics checklist template form

- Carroll county electrical license renewal form

- How to fill out third party financing addendum for conventional form

- Dir form a 1 131 instructions

- Flexible spending account fsa data collection worksheet benefits form

Find out other Reconciliation Of Occupational License Tax Withheld 222 S Fcps

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast