Ct300 Form

What is the CT-300?

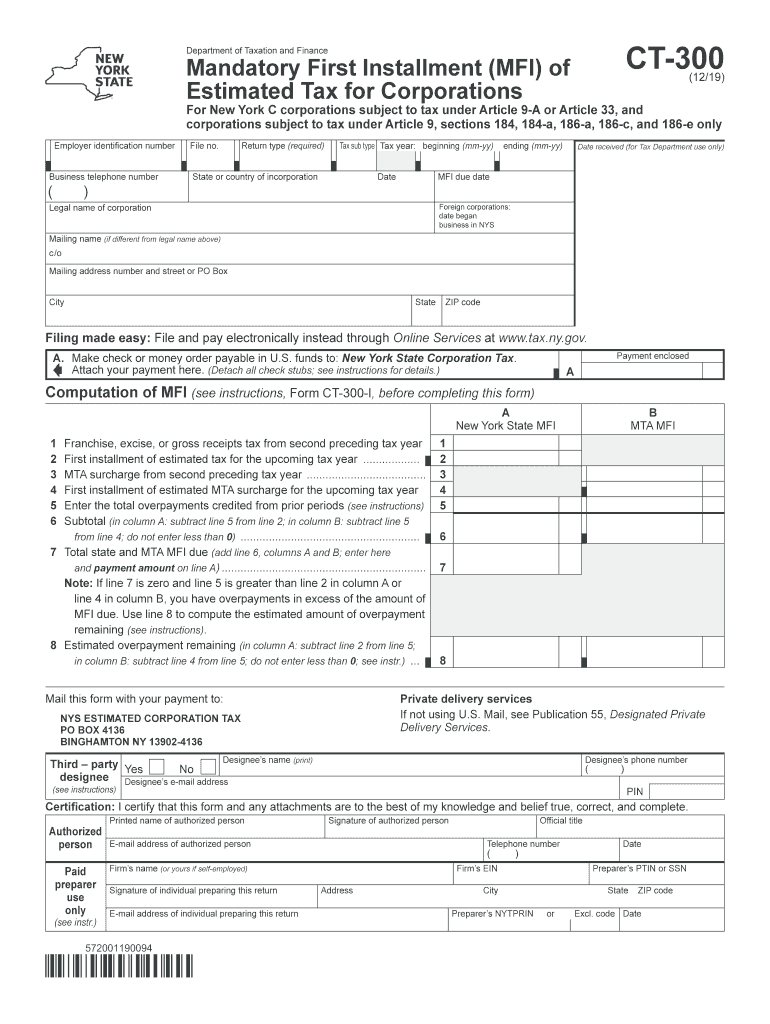

The CT-300 is a form used in New York for corporate tax purposes. Specifically, it is designed for corporations that are subject to the franchise tax under Article 9-A of the New York State Tax Law. This form allows corporations to report their income, calculate their tax liability, and claim any applicable credits. Understanding the CT-300 is essential for compliance with state tax regulations and for ensuring that corporations fulfill their tax obligations accurately.

How to Use the CT-300

Using the CT-300 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and any relevant tax records. Next, fill out the form accurately, ensuring that all sections are completed as required. It's important to double-check calculations to avoid errors that could lead to penalties. Once completed, the form can be submitted electronically or by mail, depending on your preference and the specific guidelines provided by the New York State Department of Taxation and Finance.

Steps to Complete the CT-300

Completing the CT-300 requires careful attention to detail. Follow these steps to ensure accuracy:

- Start by entering the corporation's name, address, and identification number at the top of the form.

- Fill in the income details for the reporting period, including gross receipts and any deductions.

- Calculate the franchise tax based on the provided tax rates and guidelines.

- Claim any available credits that may reduce your tax liability.

- Review the entire form for completeness and accuracy before submission.

Legal Use of the CT-300

The CT-300 must be used in compliance with New York State tax laws. This means that the information provided must be truthful and accurate, as any misrepresentation can lead to legal consequences, including fines or audits. Corporations are legally obligated to file this form within the specified deadlines to avoid penalties. Understanding the legal implications of the CT-300 is crucial for maintaining compliance and avoiding potential issues with tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the CT-300 are critical to ensure compliance with tax regulations. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. It is advisable to mark these dates on your calendar to avoid late submissions, which can result in penalties and interest charges.

Form Submission Methods

Corporations can submit the CT-300 through various methods. The form can be filed electronically via the New York State Department of Taxation and Finance's online portal, which is often the preferred method for its convenience and speed. Alternatively, corporations may choose to mail the completed form to the appropriate address provided in the filing instructions. In-person submissions are generally not recommended but may be possible in certain circumstances.

Quick guide on how to complete form ct 3001219mandatory first installment mfi of estimated tax for corporationsct300

Effortlessly Prepare Ct300 on Any Device

Digital document management has gained popularity among enterprises and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, enabling you to find the right template and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Ct300 on any device using the airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The Simplest Way to Modify and eSign Ct300 with Ease

- Obtain Ct300 and click on Get Form to initiate.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Ct300 to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form ct 3001219mandatory first installment mfi of estimated tax for corporationsct300

How to create an eSignature for your Form Ct 3001219mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 in the online mode

How to make an electronic signature for the Form Ct 3001219mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 in Google Chrome

How to make an eSignature for putting it on the Form Ct 3001219mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 in Gmail

How to create an electronic signature for the Form Ct 3001219mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 from your smartphone

How to create an electronic signature for the Form Ct 3001219mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 on iOS

How to make an eSignature for the Form Ct 3001219mandatory First Installment Mfi Of Estimated Tax For Corporationsct300 on Android devices

People also ask

-

What are the key features of the airSlate SignNow platform related to CT 300 instructions?

The airSlate SignNow platform offers several key features that enhance the experience of using CT 300 instructions. Users can easily create, edit, and share documents while ensuring secure electronic signatures. With its user-friendly interface, navigating through CT 300 instructions becomes a simple task for businesses of all sizes.

-

How can I save money while using airSlate SignNow for CT 300 instructions?

airSlate SignNow provides cost-effective pricing plans designed to fit any budget, making it easier to utilize CT 300 instructions without breaking the bank. By offering different subscription tiers, businesses can select the plan that best meets their needs. This ensures that users can manage their document signing costs efficiently.

-

What integrations does airSlate SignNow offer to enhance the use of CT 300 instructions?

airSlate SignNow seamlessly integrates with various applications, improving the effectiveness of CT 300 instructions. Whether you use CRM systems, cloud storage, or productivity tools, integration allows for smooth data transfer and enhanced workflow. This ensures that your document signing process is as efficient as possible.

-

Are there any benefits to using airSlate SignNow specifically for handling CT 300 instructions?

Using airSlate SignNow for CT 300 instructions brings numerous benefits, including time savings and improved accuracy. Automated workflows reduce manual errors, allowing for quicker processing of documents. Additionally, the platform’s mobile compatibility lets users sign and manage documents from anywhere.

-

How can I get support for using CT 300 instructions with airSlate SignNow?

airSlate SignNow offers robust support options for users needing assistance with CT 300 instructions. You can access a comprehensive knowledge base, tutorials, and customer service representatives who can help. This support ensures that users can navigate any challenges effectively.

-

Is airSlate SignNow compliant with legal requirements for CT 300 instructions?

Yes, airSlate SignNow complies with all legal requirements necessary for handling CT 300 instructions. The platform adheres to industry standards for electronic signatures, ensuring that all signed documents are legally binding and secure. This compliance offers peace of mind to users dealing with sensitive information.

-

What is the user experience like when working with CT 300 instructions on airSlate SignNow?

The user experience with CT 300 instructions on airSlate SignNow is designed to be intuitive and straightforward. Users can easily navigate the interface, helping them quickly find resources and manage their documents. This streamlined experience allows for faster turnaround times and increased productivity.

Get more for Ct300

- Pii access response form department of transportation wv

- Tc 96 167 docx form

- City of san jose rental rights and referrals program form

- Dmv ohio near me form

- Small estate declaration and indemnity equiniti shareview form

- Sell business contract template form

- Sell car privately contract template form

- Sell contract template form

Find out other Ct300

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements

- eSign Pennsylvania Property management lease agreement Secure

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms