Return of Organization Exempt from Income Tax 11 Form

What is the Return Of Organization Exempt From Income Tax 11

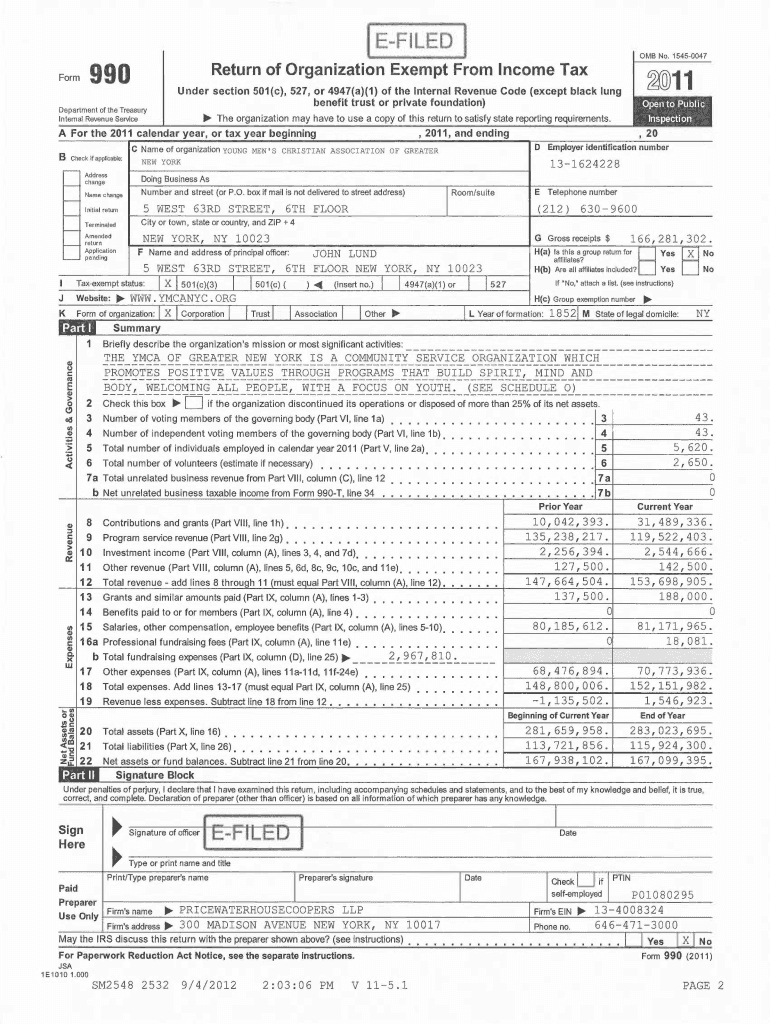

The Return Of Organization Exempt From Income Tax 11, commonly referred to as Form 990, is a tax form used by organizations that are exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code. This form is essential for maintaining tax-exempt status, as it provides the IRS with information about the organization's activities, governance, and financials. Organizations must file this form annually to report their income, expenses, and compliance with tax regulations.

How to use the Return Of Organization Exempt From Income Tax 11

Using Form 990 requires careful attention to detail. Organizations should gather financial records, including income statements and balance sheets, as well as information on governance and programs. The form includes sections that require disclosures about compensation for officers and directors, fundraising activities, and program service accomplishments. Accurate completion of this form is crucial for transparency and compliance with IRS regulations.

Steps to complete the Return Of Organization Exempt From Income Tax 11

Completing Form 990 involves several key steps:

- Gather necessary financial documents, including bank statements and accounting records.

- Review the form's sections to understand what information is required.

- Fill out the form accurately, ensuring all figures are correct and supported by documentation.

- Include required schedules that provide additional information about specific activities or financial details.

- Review the completed form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Organizations must file Form 990 by the 15th day of the fifth month after the end of their fiscal year. For example, if an organization operates on a calendar year basis, the deadline would be May 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Organizations can request a six-month extension if necessary, but they must file Form 8868 to obtain this extension.

Key elements of the Return Of Organization Exempt From Income Tax 11

Form 990 consists of several key elements that organizations must address:

- Basic Information: This includes the organization's name, address, and Employer Identification Number (EIN).

- Revenue and Expenses: Organizations must report total revenue, expenses, and changes in net assets.

- Program Service Accomplishments: A description of the organization's mission and a summary of its major programs.

- Governance: Information about the board of directors and policies regarding conflict of interest.

Legal use of the Return Of Organization Exempt From Income Tax 11

Form 990 serves a legal purpose by ensuring that tax-exempt organizations comply with federal regulations. Filing this form is not only a requirement for maintaining tax-exempt status but also promotes transparency in the nonprofit sector. Organizations that fail to file may face penalties, including the loss of their tax-exempt status. Therefore, understanding the legal implications of this form is essential for all exempt organizations.

Quick guide on how to complete return of organization exempt from income tax 11

Complete [SKS] effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and eSign your documents swiftly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential parts of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Return Of Organization Exempt From Income Tax 11

Create this form in 5 minutes!

How to create an eSignature for the return of organization exempt from income tax 11

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Return Of Organization Exempt From Income Tax 11?

The Return Of Organization Exempt From Income Tax 11 is a tax form used by certain organizations to report their income, expenses, and activities to the IRS. This form is essential for maintaining tax-exempt status and ensuring compliance with federal regulations. Understanding this form is crucial for organizations to avoid penalties and maintain their tax-exempt status.

-

How can airSlate SignNow help with the Return Of Organization Exempt From Income Tax 11?

airSlate SignNow streamlines the process of preparing and submitting the Return Of Organization Exempt From Income Tax 11 by allowing users to eSign and send documents securely. Our platform simplifies document management, ensuring that all necessary forms are completed accurately and submitted on time. This efficiency helps organizations focus on their mission rather than paperwork.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Return Of Organization Exempt From Income Tax 11. These features ensure that your documents are not only compliant but also easily accessible. Additionally, our platform allows for collaboration among team members, enhancing productivity.

-

Is airSlate SignNow cost-effective for organizations filing the Return Of Organization Exempt From Income Tax 11?

Yes, airSlate SignNow is a cost-effective solution for organizations needing to file the Return Of Organization Exempt From Income Tax 11. Our pricing plans are designed to accommodate various budgets, ensuring that even small organizations can access essential document management tools. By reducing the time spent on paperwork, our solution ultimately saves organizations money.

-

Can airSlate SignNow integrate with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software, making it easier to manage the Return Of Organization Exempt From Income Tax 11. These integrations allow for automatic data transfer, reducing the risk of errors and ensuring that your tax documents are always up-to-date. This connectivity enhances overall efficiency in your tax processes.

-

What are the benefits of using airSlate SignNow for tax-exempt organizations?

Using airSlate SignNow provides numerous benefits for tax-exempt organizations, including enhanced security, ease of use, and compliance with IRS regulations. Our platform simplifies the process of preparing the Return Of Organization Exempt From Income Tax 11, allowing organizations to focus on their core missions. Additionally, the ability to track document status ensures that nothing falls through the cracks.

-

How does airSlate SignNow ensure the security of sensitive tax documents?

airSlate SignNow prioritizes the security of sensitive tax documents, including the Return Of Organization Exempt From Income Tax 11, by employing advanced encryption and secure cloud storage. Our platform complies with industry standards to protect your data from unauthorized access. This commitment to security gives organizations peace of mind when managing their important tax documents.

Get more for Return Of Organization Exempt From Income Tax 11

Find out other Return Of Organization Exempt From Income Tax 11

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile

- eSignature Nevada Mechanic's Lien Myself