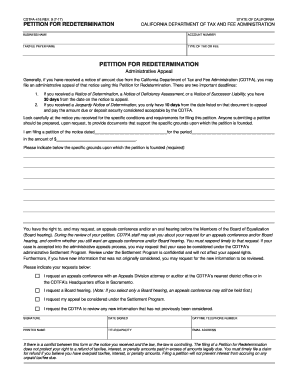

CDTFA 416 REV 2021

What is the CDTFA 416 REV

The CDTFA 416 REV is a form used by businesses in California to report and pay sales and use taxes. This document is essential for ensuring compliance with state tax regulations. It is specifically designed for entities that need to report their taxable sales, purchases, and any applicable tax liabilities. The form helps streamline the process of tax reporting, making it easier for businesses to fulfill their obligations to the California Department of Tax and Fee Administration (CDTFA).

How to use the CDTFA 416 REV

To effectively use the CDTFA 416 REV, businesses must first gather all necessary financial records, including sales receipts and purchase invoices. This information will be crucial in accurately completing the form. After filling out the required fields, businesses can submit the form electronically through the CDTFA's online portal or by mailing a paper copy to the appropriate address. It is important to ensure that all information is accurate to avoid any potential penalties.

Steps to complete the CDTFA 416 REV

Completing the CDTFA 416 REV involves several key steps:

- Gather all relevant sales and purchase records for the reporting period.

- Fill out the form, ensuring all required fields are completed accurately.

- Calculate the total sales tax due based on the reported sales and purchases.

- Review the completed form for any errors or omissions.

- Submit the form electronically or by mail, ensuring it is sent to the correct address.

Legal use of the CDTFA 416 REV

The CDTFA 416 REV is legally required for businesses operating in California that are subject to sales and use tax. Proper use of this form ensures compliance with state tax laws, helping to avoid penalties and interest for late or inaccurate filings. Businesses must adhere to the guidelines set forth by the CDTFA to maintain good standing and avoid legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for the CDTFA 416 REV can vary depending on the reporting period. Generally, businesses must file the form quarterly or annually, depending on their sales volume. It is crucial to be aware of these deadlines to ensure timely submissions. Missing a deadline can result in penalties and interest, making it essential for businesses to keep track of important dates throughout the year.

Required Documents

To complete the CDTFA 416 REV, businesses should have the following documents on hand:

- Sales receipts and invoices

- Purchase invoices for taxable items

- Previous tax returns for reference

- Any correspondence from the CDTFA regarding tax obligations

Form Submission Methods (Online / Mail / In-Person)

The CDTFA 416 REV can be submitted through various methods to accommodate different business needs. Businesses can file the form online via the CDTFA's official website, which is often the quickest and most efficient method. Alternatively, they can mail a paper copy of the form to the designated address. In-person submissions may also be possible at CDTFA offices, although this method is less common.

Quick guide on how to complete cdtfa 416 rev

Complete CDTFA 416 REV seamlessly on any device

Managing documents online has gained immense popularity among businesses and individuals. It serves as a superb eco-friendly substitute for traditional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle CDTFA 416 REV on any platform with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and eSign CDTFA 416 REV effortlessly

- Obtain CDTFA 416 REV and click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether via email, text message (SMS), invite link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign CDTFA 416 REV to ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct cdtfa 416 rev

Create this form in 5 minutes!

How to create an eSignature for the cdtfa 416 rev

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the CDTFA 416 REV form?

The CDTFA 416 REV form is a crucial document used for reporting sales and use tax in California. It helps businesses comply with state tax regulations by providing accurate information on taxable sales. Understanding how to fill out the CDTFA 416 REV form correctly is essential for avoiding penalties.

-

How can airSlate SignNow assist with the CDTFA 416 REV form?

airSlate SignNow simplifies the process of completing and submitting the CDTFA 416 REV form by allowing users to eSign documents securely. Our platform ensures that all necessary fields are filled out correctly, reducing the risk of errors. With airSlate SignNow, you can streamline your tax reporting process efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include features tailored for efficient document management, including the ability to handle the CDTFA 416 REV form. You can choose a plan that best fits your needs and budget.

-

What features does airSlate SignNow provide for managing the CDTFA 416 REV form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for forms like the CDTFA 416 REV. These tools enhance your workflow and ensure that your documents are processed quickly and securely. Additionally, you can collaborate with team members in real-time.

-

Are there any integrations available with airSlate SignNow for the CDTFA 416 REV form?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your document management experience. You can connect with accounting software and other tools to streamline the completion of the CDTFA 416 REV form. This integration helps ensure that all your data is synchronized and up-to-date.

-

What are the benefits of using airSlate SignNow for the CDTFA 416 REV form?

Using airSlate SignNow for the CDTFA 416 REV form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows you to complete and submit your forms quickly, ensuring compliance with state regulations. Additionally, the eSigning feature saves time and resources.

-

Is airSlate SignNow secure for handling sensitive documents like the CDTFA 416 REV form?

Absolutely! airSlate SignNow employs advanced security measures to protect your sensitive documents, including the CDTFA 416 REV form. We use encryption and secure cloud storage to ensure that your data remains confidential and safe from unauthorized access. You can trust us with your important documents.

Get more for CDTFA 416 REV

Find out other CDTFA 416 REV

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple

- How To Sign New Jersey Non-Disturbance Agreement