Mississippi State Tax Withholding Form

What is the Mississippi State Tax Withholding Form

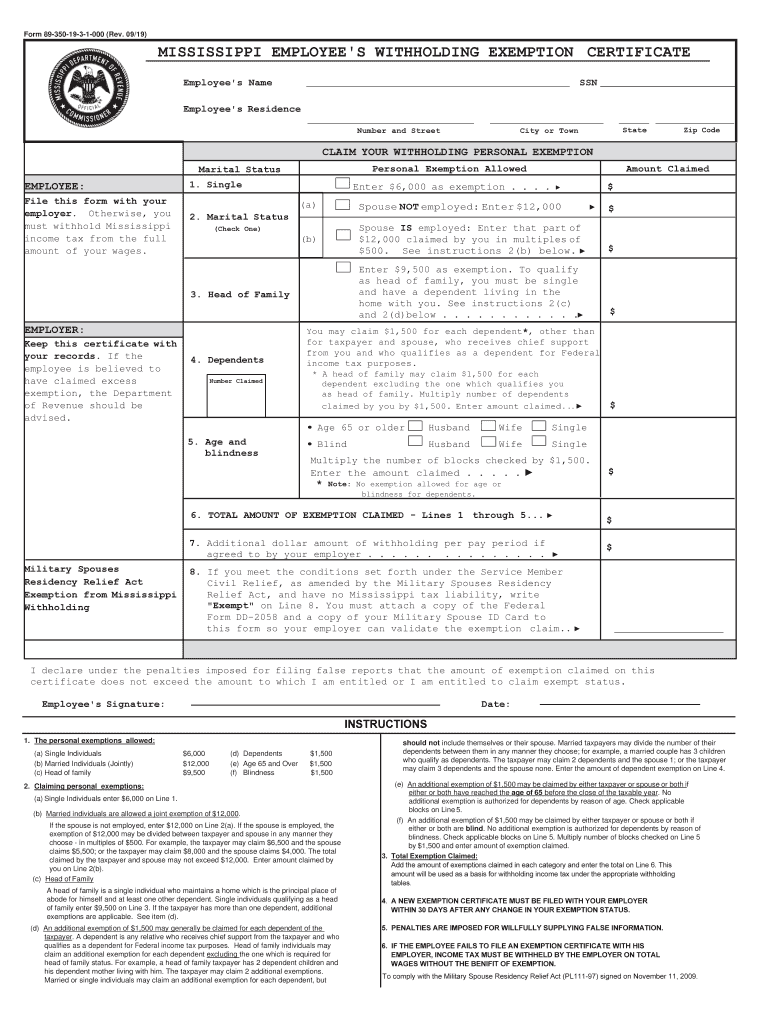

The Mississippi State Tax Withholding Form is a crucial document for employees and employers in Mississippi. This form is used to determine the amount of state income tax to withhold from an employee's paycheck. It ensures that the correct amount is deducted based on the employee's earnings and tax situation. Employers are responsible for submitting this form to the Mississippi Department of Revenue to comply with state tax laws.

Steps to complete the Mississippi State Tax Withholding Form

Completing the Mississippi State Tax Withholding Form involves several key steps:

- Gather personal information, including your name, address, and Social Security number.

- Identify your filing status, such as single, married, or head of household.

- Determine the number of allowances you wish to claim, which can affect your withholding amount.

- Review any additional withholding requests, if applicable, to ensure accurate deductions.

- Sign and date the form to validate your information.

How to obtain the Mississippi State Tax Withholding Form

The Mississippi State Tax Withholding Form can be obtained through various means. It is available for download from the Mississippi Department of Revenue's official website. Additionally, employers may provide copies of the form to their employees. It is important to ensure you are using the most current version of the form to comply with state regulations.

Legal use of the Mississippi State Tax Withholding Form

The legal use of the Mississippi State Tax Withholding Form is essential for compliance with state tax laws. This form must be filled out accurately and submitted in a timely manner to avoid penalties. Employers are required to keep this form on file for their records and to ensure that they are withholding the correct amount of state tax from employee wages.

Key elements of the Mississippi State Tax Withholding Form

Several key elements are essential to the Mississippi State Tax Withholding Form:

- Personal Information: Includes the employee's name, address, and Social Security number.

- Filing Status: Indicates whether the employee is single, married, or head of household.

- Allowances: The number of allowances claimed affects the withholding amount.

- Additional Withholding: Any extra amount the employee wishes to withhold can be specified.

Form Submission Methods (Online / Mail / In-Person)

The Mississippi State Tax Withholding Form can be submitted in several ways. Employers may choose to file the form electronically through the Mississippi Department of Revenue's online portal. Alternatively, the form can be mailed to the appropriate tax office or submitted in person at designated locations. Each method has its own advantages, such as speed and convenience, so it is important to choose the one that best suits your needs.

Quick guide on how to complete form 89 350 19 3 1 000 rev

Prepare Mississippi State Tax Withholding Form effortlessly on any device

Online document administration has become widely accepted by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, adjust, and eSign your paperwork quickly and without holdups. Manage Mississippi State Tax Withholding Form on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to adjust and eSign Mississippi State Tax Withholding Form with ease

- Find Mississippi State Tax Withholding Form and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misdirected files, tiresome form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Adjust and eSign Mississippi State Tax Withholding Form and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 89 350 19 3 1 000 rev

How to generate an electronic signature for your Form 89 350 19 3 1 000 Rev online

How to create an electronic signature for the Form 89 350 19 3 1 000 Rev in Google Chrome

How to generate an eSignature for putting it on the Form 89 350 19 3 1 000 Rev in Gmail

How to generate an eSignature for the Form 89 350 19 3 1 000 Rev straight from your smartphone

How to generate an electronic signature for the Form 89 350 19 3 1 000 Rev on iOS devices

How to generate an eSignature for the Form 89 350 19 3 1 000 Rev on Android devices

People also ask

-

What is Mississippi withholding, and how does it affect my business?

Mississippi withholding refers to the state-mandated income tax that employers must deduct from their employees' wages. Understanding Mississippi withholding is crucial for businesses to ensure compliance with state tax laws and to avoid penalties. Properly managing withholding can affect cash flow and employee satisfaction.

-

How can airSlate SignNow help with Mississippi withholding documentation?

airSlate SignNow simplifies the process of creating and managing documents related to Mississippi withholding. With our eSigning features, businesses can swiftly send and receive tax forms, ensuring they are compliant with state regulations. This reduces the risk of errors and accelerates the onboarding process for new employees.

-

What features of airSlate SignNow support Mississippi withholding tax processing?

airSlate SignNow includes features like automated workflows and secure electronic signatures that are crucial for managing Mississippi withholding. Our platform ensures that all necessary documents are electronically signed and stored securely, making it easy to retrieve records during audits. This efficiency directly supports compliance with Mississippi withholding requirements.

-

Are there any costs associated with using airSlate SignNow for Mississippi withholding?

Yes, airSlate SignNow offers various pricing plans designed to cater to businesses of all sizes. These plans provide comprehensive features to manage Mississippi withholding efficiently while remaining cost-effective. A free trial is available, allowing organizations to assess the platform’s value before committing to a paid plan.

-

Can I integrate airSlate SignNow with other payroll systems for managing Mississippi withholding?

Absolutely! airSlate SignNow integrates seamlessly with various payroll systems, making it easier to manage Mississippi withholding alongside your existing processes. This integration allows for automatic updates and accurate calculations of withholding tax, ensuring that your business remains compliant and efficient.

-

What benefits do businesses gain from using airSlate SignNow for Mississippi withholding?

Using airSlate SignNow for Mississippi withholding provides businesses with enhanced efficiency, less paperwork, and quicker turnaround times for document approvals. These benefits lead to improved compliance with state regulations and a better experience for both employers and employees. Businesses can focus on growth while we handle the complexities of withholding management.

-

Is airSlate SignNow secure for handling sensitive Mississippi withholding documents?

Yes, airSlate SignNow prioritizes the security of your documents, including those related to Mississippi withholding. Our platform employs industry-standard security measures such as encryption and secure storage to protect sensitive information. You can confidently manage employee documents, knowing they are safe and compliant.

Get more for Mississippi State Tax Withholding Form

- Social networking strategies for business chase form

- How to fill out the adult disability report form ssa 3368 bk

- X rayfluoroscopy request form

- Electronic receipts florida department of financial services form

- Renovation construction contract template form

- Renovation bc contract template form

- Renovation contract template form

- Renovation remodel contract template form

Find out other Mississippi State Tax Withholding Form

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online