Grace Period for Purchases Form

Understanding the Grace Period For Purchases

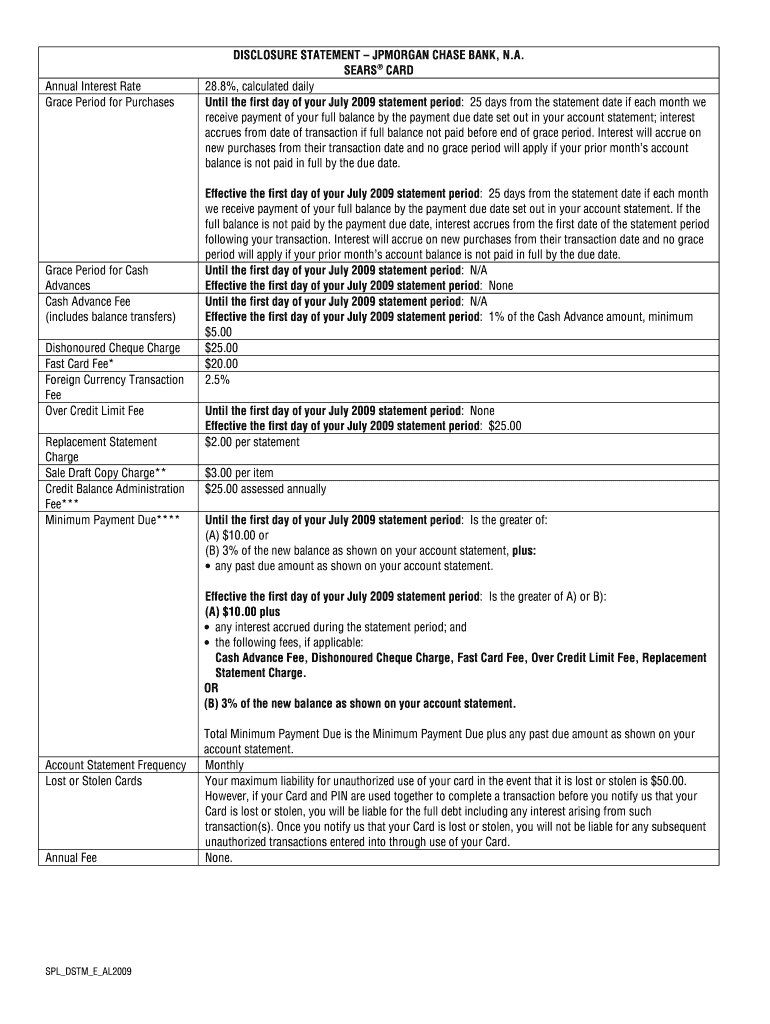

The grace period for purchases refers to a specific timeframe during which a borrower can pay off their credit card balance without incurring interest charges. This period typically begins on the last day of the billing cycle and ends on the due date of the payment. Understanding this concept is crucial for managing credit effectively and avoiding unnecessary fees.

During the grace period, if the cardholder pays the full balance by the due date, they will not be charged interest on new purchases made during that billing cycle. However, if the balance is not paid in full, interest will accrue on the remaining balance and any new purchases may also incur interest charges immediately.

How to Utilize the Grace Period For Purchases

To effectively use the grace period for purchases, it is essential to keep track of billing cycles and payment due dates. Here are some steps to consider:

- Review your credit card statement to identify the billing cycle dates.

- Note the due date for your payment, which marks the end of the grace period.

- Ensure that you pay the full balance by the due date to avoid interest charges.

By consistently paying off your balance during the grace period, you can maximize your credit card benefits and maintain a healthy credit score.

Eligibility Criteria for the Grace Period For Purchases

Eligibility for the grace period for purchases typically depends on the credit card issuer’s policies. Most credit cards offer a grace period if the account is in good standing. Key criteria include:

- The account must not have any past due balances.

- Payments must be made on time for previous billing cycles.

- The cardholder must not have taken a cash advance, as this may void the grace period.

It is advisable to read the terms and conditions of your credit card agreement to understand the specific requirements for maintaining a grace period.

Examples of Using the Grace Period For Purchases

Consider the following scenarios to illustrate how the grace period for purchases works:

- A cardholder makes a purchase of $1,000 on the last day of the billing cycle. If they pay the entire amount by the due date, they incur no interest.

- If the same cardholder only pays $500 by the due date, they will be charged interest on the remaining $500 and any new purchases made after the due date.

These examples highlight the importance of managing payments to take full advantage of the grace period.

Legal Use of the Grace Period For Purchases

The legal framework surrounding the grace period for purchases is primarily governed by the Truth in Lending Act (TILA). This federal law requires credit card issuers to disclose the terms of the grace period clearly. Key legal considerations include:

- Credit card issuers must provide a written statement of the terms, including the grace period duration.

- Consumers have the right to receive timely notifications about changes to their account status that may affect the grace period.

Understanding these legal aspects can empower consumers to make informed financial decisions regarding their credit usage.

Steps to Complete the Grace Period For Purchases

To successfully navigate the grace period for purchases, follow these steps:

- Check your billing statement for the grace period details.

- Plan your purchases to ensure you can pay the balance in full.

- Set reminders for payment due dates to avoid late fees.

- Monitor your spending to stay within your budget.

By adhering to these steps, you can effectively manage your credit card usage and take advantage of the grace period.

Quick guide on how to complete grace period for purchases

Complete [SKS] effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal green alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools required to produce, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent parts of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click the Done button to save your updates.

- Select how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misfiled documents, tedious form retrieval, or errors that require printing additional document copies. airSlate SignNow fulfills your requirements in document management with just a few clicks from your chosen device. Edit and eSign [SKS] and ensure seamless communication at any point of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Grace Period For Purchases

Create this form in 5 minutes!

How to create an eSignature for the grace period for purchases

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Grace Period For Purchases offered by airSlate SignNow?

The Grace Period For Purchases is a special offer that allows new users to experience airSlate SignNow's features without immediate payment. This period gives you ample time to evaluate our easy-to-use eSigning solution, ensuring it meets your business needs before committing financially.

-

How long is the Grace Period For Purchases at airSlate SignNow?

The duration of the Grace Period For Purchases typically lasts for 14 days. During this time, you can fully explore the platform, send documents, and utilize all major features without any cost, allowing you to see the benefits firsthand.

-

Can I access all features during the Grace Period For Purchases?

Yes, during the Grace Period For Purchases, you have full access to all features of airSlate SignNow. This includes eSigning, document templates, integrations, and more, ensuring you can test the platform comprehensively.

-

What happens after the Grace Period For Purchases ends?

Once the Grace Period For Purchases ends, you will need to select a pricing plan to continue using airSlate SignNow. If you choose not to subscribe, your access will be terminated, but you will not be charged during the Grace Period.

-

Is there a cancellation policy for the Grace Period For Purchases?

Yes, there is a flexible cancellation policy during the Grace Period For Purchases. If at any point you decide that airSlate SignNow isn't the right solution for your business, you can cancel without any charges or obligations.

-

Are there any limitations on the number of documents during the Grace Period For Purchases?

No, there are no limitations on the number of documents you can send during the Grace Period For Purchases. This allows you to fully assess the effectiveness of our eSigning capabilities in real business scenarios.

-

How can I get started with the Grace Period For Purchases?

Getting started with the Grace Period For Purchases is simple. Just visit our airSlate SignNow website, sign up for an account, and select the option for the Grace Period during the registration process to begin exploring our features immediately.

Get more for Grace Period For Purchases

Find out other Grace Period For Purchases

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy