MONTHLY FLEET MILEAGE and FUEL SUMMARY Wisconsin D 2015-2026

Understanding the Monthly Fleet Mileage and Fuel Summary in Wisconsin

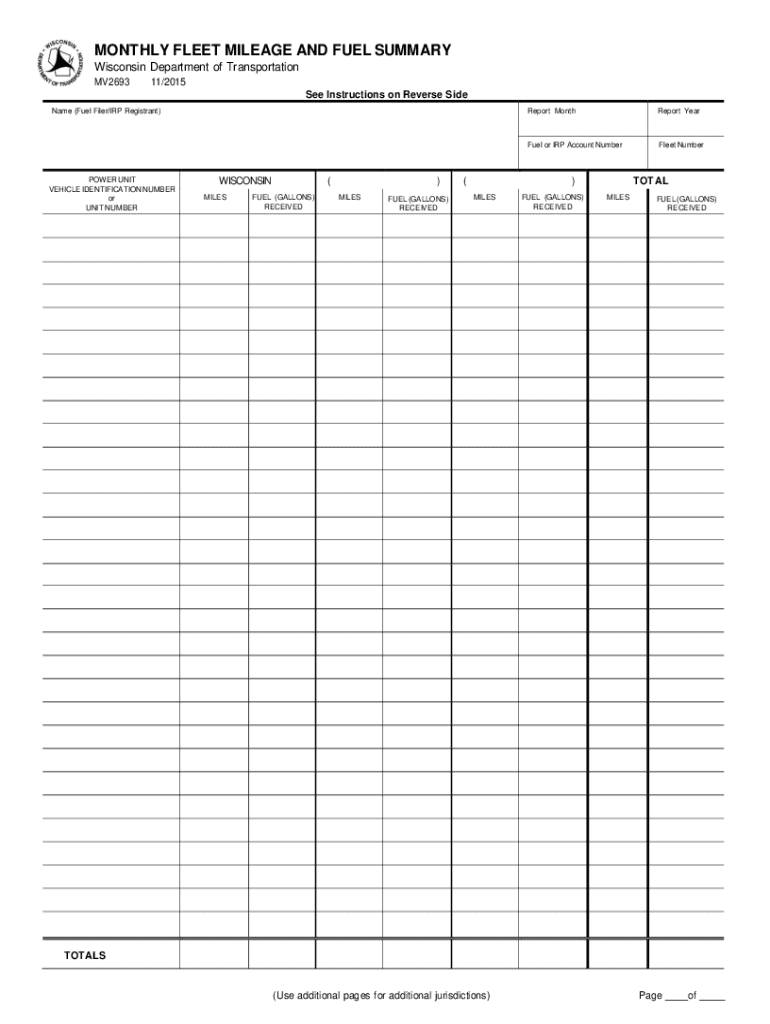

The Monthly Fleet Mileage and Fuel Summary is a crucial document for businesses operating vehicles in Wisconsin. This form collects essential data regarding the mileage and fuel consumption of a fleet over a month. Accurate reporting helps businesses manage costs, comply with state regulations, and optimize fleet performance. It is particularly important for companies that rely on transportation for their operations, ensuring they maintain detailed records for financial and regulatory purposes.

Steps to Complete the Monthly Fleet Mileage and Fuel Summary

Completing the Monthly Fleet Mileage and Fuel Summary involves a systematic approach to ensure accuracy and compliance. Here are the steps to follow:

- Gather all relevant data, including total miles driven and fuel purchased for each vehicle in the fleet.

- Document the odometer readings at the beginning and end of the reporting period.

- Calculate the total mileage for each vehicle by subtracting the starting odometer reading from the ending reading.

- Record the total gallons of fuel used for each vehicle during the month.

- Compile this information into the form, ensuring all entries are accurate and complete.

- Review the completed form for any errors before submission.

Key Elements of the Monthly Fleet Mileage and Fuel Summary

The Monthly Fleet Mileage and Fuel Summary includes several key elements that are vital for accurate reporting. These elements typically consist of:

- Vehicle Identification: Each vehicle should be clearly identified, often by license plate number or vehicle ID.

- Mileage Data: Total miles driven during the reporting period must be recorded.

- Fuel Consumption: Total gallons of fuel purchased and used should be documented.

- Dates of Reporting: The specific month for which the data is being reported must be indicated.

- Signature: A responsible party must sign the form to certify the accuracy of the information provided.

Legal Use of the Monthly Fleet Mileage and Fuel Summary

The Monthly Fleet Mileage and Fuel Summary is not just a formality; it serves legal purposes. Businesses must maintain accurate records for tax compliance and regulatory requirements. Failure to submit accurate data can lead to penalties or audits. In Wisconsin, this form may also be used to demonstrate compliance with state fuel tax regulations, ensuring that businesses are paying the correct amount of taxes based on their fuel usage.

Obtaining the Monthly Fleet Mileage and Fuel Summary

Businesses can obtain the Monthly Fleet Mileage and Fuel Summary from the appropriate state department or agency. Typically, this form is available online or can be requested directly from state offices. It is important to ensure that the most current version of the form is being used to comply with any recent changes in regulations or requirements.

Examples of Using the Monthly Fleet Mileage and Fuel Summary

Practical examples of using the Monthly Fleet Mileage and Fuel Summary can help illustrate its importance. For instance, a delivery company may use the form to track its fleet's fuel efficiency, helping identify vehicles that consume more fuel than expected. Additionally, a construction firm may utilize the summary to analyze transportation costs associated with different projects, allowing for better budgeting and resource allocation. These examples highlight how the form can aid in operational decision-making and financial planning.

Quick guide on how to complete monthly fleet mileage and fuel summarywisconsin d

Easily prepare MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents quickly without any delays. Manage MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D on any platform using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to modify and eSign MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D effortlessly

- Find MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your amendments.

- Select your preferred method of submitting the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form navigation, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Modify and eSign MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct monthly fleet mileage and fuel summarywisconsin d

Create this form in 5 minutes!

How to create an eSignature for the monthly fleet mileage and fuel summarywisconsin d

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D.?

The MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. is a comprehensive report that provides businesses with detailed insights into their fleet's mileage and fuel consumption. This summary helps fleet managers track performance, optimize routes, and reduce fuel costs effectively.

-

How can I access the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D.?

You can easily access the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. through the airSlate SignNow platform. Once you log in, navigate to the reporting section where you can generate and download your summary report in just a few clicks.

-

What features are included in the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D.?

The MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. includes features such as detailed mileage tracking, fuel usage analysis, and cost breakdowns. These features enable businesses to make informed decisions regarding their fleet management and operational efficiency.

-

Is there a cost associated with the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D.?

The MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. is included in the airSlate SignNow subscription plans. Pricing varies based on the plan you choose, but it offers a cost-effective solution for businesses looking to streamline their fleet management.

-

How does the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. benefit my business?

Utilizing the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. can signNowly benefit your business by providing insights that lead to reduced fuel expenses and improved route efficiency. This data-driven approach helps in making strategic decisions that enhance overall fleet performance.

-

Can I integrate the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. with other software?

Yes, the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. can be integrated with various fleet management and accounting software. This integration allows for seamless data transfer and enhances your ability to analyze fleet performance across different platforms.

-

How often is the MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. updated?

The MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D. is updated on a monthly basis, providing you with the most current data regarding your fleet's mileage and fuel usage. This regular update ensures that you have timely insights to manage your fleet effectively.

Get more for MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D

- Form stabilized

- Admissions and financial aid state university of new york form

- Plumbing permit city form

- Career pathway renewal application form

- Societ per azioni capitale sociale 659 form

- Broward county human services family success details form

- Schedule e form char410

- Njcu unemployment tuition waiver contract summer i 2020 form

Find out other MONTHLY FLEET MILEAGE AND FUEL SUMMARY Wisconsin D

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple