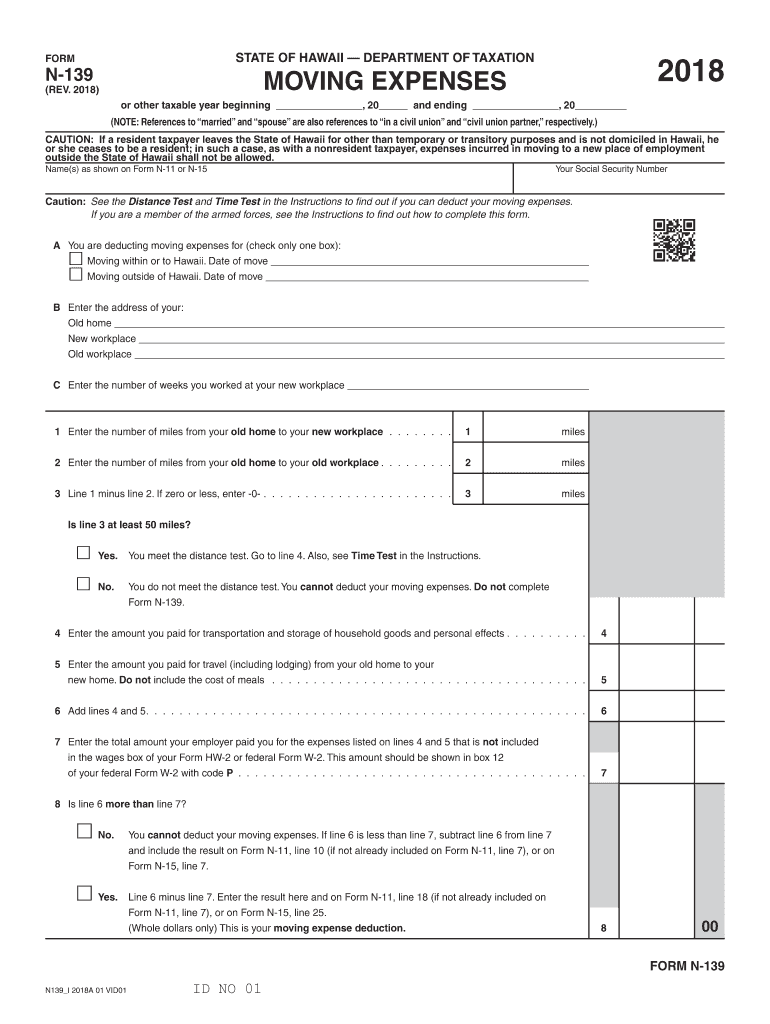

Hawaii 139 Form

What is the Hawaii 139?

The Hawaii 139 form, also known as the Hawaii state tax form N-139, is a document used for reporting certain tax information to the state of Hawaii. This form is primarily utilized by individuals and businesses to ensure compliance with state tax regulations. It serves as a means to report income, deductions, and other relevant financial information to the Hawaii Department of Taxation. Understanding the purpose of the Hawaii 139 is essential for taxpayers to fulfill their obligations accurately and timely.

How to use the Hawaii 139

Using the Hawaii 139 form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements, receipts, and prior tax returns. Next, carefully fill out the form, making sure to provide accurate information regarding your income and applicable deductions. After completing the form, review it for errors and ensure that all required sections are filled out. Finally, submit the form according to the guidelines provided by the Hawaii Department of Taxation, either online or by mail.

Steps to complete the Hawaii 139

Completing the Hawaii 139 form requires attention to detail and adherence to specific guidelines. Follow these steps for successful completion:

- Gather all relevant financial documents, including W-2s, 1099s, and any other income statements.

- Review the instructions provided with the form to understand the requirements and sections.

- Fill out the form accurately, ensuring that all information is correct and complete.

- Double-check your entries for accuracy, especially numerical values and personal identification information.

- Sign and date the form before submission.

Legal use of the Hawaii 139

The Hawaii 139 form must be completed and submitted in accordance with state tax laws to be considered legally valid. This includes adhering to deadlines for submission and ensuring that all information reported is truthful and accurate. Failure to comply with these legal requirements can result in penalties, including fines or other legal repercussions. It is essential for taxpayers to understand their responsibilities when using this form to avoid any legal issues.

Filing Deadlines / Important Dates

Filing deadlines for the Hawaii 139 form are crucial for compliance with state tax regulations. Typically, the form must be submitted by the due date for individual income tax returns, which is usually April 20 for most taxpayers. However, those who file for an extension may have additional time. It is important to stay informed about any changes to deadlines or requirements set by the Hawaii Department of Taxation to ensure timely submission.

Required Documents

To complete the Hawaii 139 form accurately, certain documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Receipts for deductible expenses

- Prior year tax returns for reference

Having these documents on hand will facilitate a smoother completion process and help ensure accuracy in reporting.

Quick guide on how to complete form n 139 rev 2018 moving expenses forms 2018

Effortlessly prepare Hawaii 139 on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an optimal eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly and without issues. Manage Hawaii 139 on any device with the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to modify and eSign Hawaii 139 with ease

- Find Hawaii 139 and click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Select important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you would like to share your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate concerns of lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign Hawaii 139 and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form n 139 rev 2018 moving expenses forms 2018

How to make an electronic signature for the Form N 139 Rev 2018 Moving Expenses Forms 2018 online

How to make an eSignature for your Form N 139 Rev 2018 Moving Expenses Forms 2018 in Google Chrome

How to generate an eSignature for putting it on the Form N 139 Rev 2018 Moving Expenses Forms 2018 in Gmail

How to make an electronic signature for the Form N 139 Rev 2018 Moving Expenses Forms 2018 straight from your mobile device

How to create an electronic signature for the Form N 139 Rev 2018 Moving Expenses Forms 2018 on iOS devices

How to make an electronic signature for the Form N 139 Rev 2018 Moving Expenses Forms 2018 on Android OS

People also ask

-

What is Hawaii 139 and how can it benefit my business?

Hawaii 139 offers a streamlined solution for managing electronic signatures and document workflows. By leveraging airSlate SignNow's features, your business can enhance efficiency, reduce turnaround times, and ensure compliance, all while simplifying your document handling processes.

-

How much does Hawaii 139 cost?

The pricing for Hawaii 139 is competitive and designed to fit various business needs. Depending on the plan you select, you can access a range of features at an affordable price, making it a cost-effective option for companies looking to digitize their documentation.

-

What features does Hawaii 139 offer?

Hawaii 139 is packed with features such as customizable templates, real-time tracking, and advanced authentication options. These capabilities ensure that your documents are secure and easily accessible, streamlining your business operations.

-

Can Hawaii 139 integrate with other software?

Yes, Hawaii 139 integrates seamlessly with various software solutions, including CRMs and project management tools. This allows for a smoother workflow, as you can manage all your documents within the tools you already use.

-

Is Hawaii 139 suitable for small businesses?

Absolutely! Hawaii 139 is designed to cater to businesses of all sizes, including small enterprises. Its affordability and user-friendly interface make it an ideal choice for small businesses looking to optimize their document management.

-

How does Hawaii 139 ensure document security?

Hawaii 139 prioritizes document security by implementing advanced encryption and authentication methods. This ensures that your sensitive documents remain protected during the entire eSigning process.

-

What are the benefits of using Hawaii 139 for eSigning?

Using Hawaii 139 for eSigning offers numerous benefits, including increased efficiency, reduced paper usage, and faster turnaround times. Additionally, it enhances the customer experience by providing a convenient way to sign documents from any device.

Get more for Hawaii 139

- Product amp liability primary form wells fargo insurance services

- Form 07 04

- Ultrasound request form sample fill online printable

- North carolina division of motor vehicles 3148 form

- Remodel construction contract template form

- Remodel contract template form

- Remote employee contract template form

- Remote job contract template form

Find out other Hawaii 139

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form