State of South Carolina Wh 1605 Form

Understanding the PT401 Form Revenue

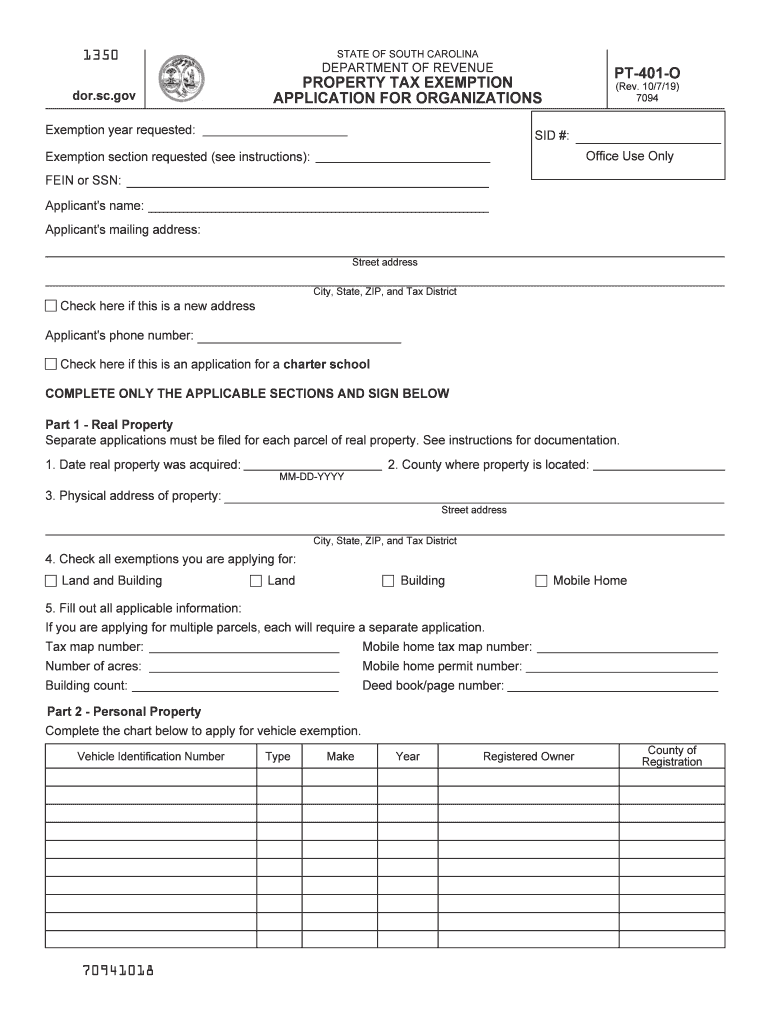

The PT401 form revenue is a critical document used in South Carolina for property tax exemptions. This form is specifically designed for organizations seeking to claim exemptions from property taxes. By completing the PT401 form, eligible entities can demonstrate their qualification for tax relief under state law, which can significantly reduce their financial burden.

Steps to Complete the PT401 Form

Completing the PT401 form involves several key steps to ensure accuracy and compliance with South Carolina regulations. First, gather all necessary information regarding your organization, including its legal name, address, and tax identification number. Next, provide detailed information about the property for which the exemption is being requested, including its location and intended use. After filling out the required sections, review the form carefully to ensure all information is accurate. Finally, submit the completed form to the appropriate county assessor’s office by the deadline specified by local regulations.

Eligibility Criteria for the PT401 Form

To qualify for the PT401 form revenue exemption, organizations must meet specific eligibility criteria outlined by the South Carolina Department of Revenue. Generally, this includes being a nonprofit organization, educational institution, or religious entity. The property must be used exclusively for the purposes that qualify for exemption, such as charitable, educational, or religious activities. It is essential to review the detailed requirements to confirm that your organization meets all necessary conditions before applying.

Required Documents for Submission

When submitting the PT401 form, certain documents must accompany the application to support the exemption claim. These typically include proof of the organization’s tax-exempt status, such as a letter from the IRS confirming 501(c)(3) status, and any additional documentation that demonstrates the property’s use. It is advisable to check with the local county assessor’s office for any specific documentation requirements that may apply to your situation.

Form Submission Methods

The PT401 form can be submitted through various methods, depending on the preferences of the submitting organization and the requirements of the local assessor’s office. Common submission methods include mailing a physical copy of the completed form and supporting documents or submitting them in person at the county office. Some jurisdictions may also offer online submission options, allowing for a more streamlined process. Always verify the preferred submission method with your local authority to ensure compliance.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the PT401 form can lead to significant penalties. If an organization submits an incomplete or inaccurate form, it may result in the denial of the exemption claim, leading to the full payment of property taxes owed. Additionally, late submissions may incur fines or interest on the owed amount. It is crucial for organizations to adhere to all guidelines and deadlines to avoid these potential consequences.

Quick guide on how to complete exemption year requested

Prepare State Of South Carolina Wh 1605 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools you require to create, modify, and eSign your documents promptly without delays. Manage State Of South Carolina Wh 1605 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign State Of South Carolina Wh 1605 with ease

- Obtain State Of South Carolina Wh 1605 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to finalize your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Leave behind the hassle of lost or misplaced documents, extensive form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of South Carolina Wh 1605 and guarantee excellent communication at any stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the exemption year requested

How to generate an electronic signature for the Exemption Year Requested online

How to generate an electronic signature for the Exemption Year Requested in Google Chrome

How to make an eSignature for putting it on the Exemption Year Requested in Gmail

How to make an electronic signature for the Exemption Year Requested from your smartphone

How to make an electronic signature for the Exemption Year Requested on iOS devices

How to create an electronic signature for the Exemption Year Requested on Android OS

People also ask

-

What is the State Of South Carolina Wh 1605 form and how is it used?

The State Of South Carolina Wh 1605 form is a state-specific document used for withholding tax purposes. Businesses in South Carolina must familiarize themselves with this form to ensure compliance with state tax regulations. airSlate SignNow simplifies the process of filling out and eSigning the State Of South Carolina Wh 1605, making it easier for businesses to manage their tax obligations.

-

How can airSlate SignNow help with the State Of South Carolina Wh 1605?

airSlate SignNow streamlines the process of completing the State Of South Carolina Wh 1605 by providing an intuitive platform for document management. Users can easily fill out the form, eSign it, and share it securely with relevant parties. This efficiency reduces errors and saves time, helping businesses stay compliant with South Carolina tax laws.

-

Is there a cost associated with using airSlate SignNow for the State Of South Carolina Wh 1605?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for those who frequently handle the State Of South Carolina Wh 1605 form. These plans are designed to be cost-effective while providing robust features for document management and eSigning. You can choose a plan that aligns with your business requirements and budget.

-

What features does airSlate SignNow offer for handling the State Of South Carolina Wh 1605?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows to facilitate the handling of the State Of South Carolina Wh 1605. These tools enable users to create, send, and track documents efficiently, ensuring that all necessary details are captured and compliance is maintained.

-

Can I integrate airSlate SignNow with other software for managing the State Of South Carolina Wh 1605?

Absolutely! airSlate SignNow offers seamless integrations with various business applications, allowing users to manage the State Of South Carolina Wh 1605 alongside other essential tools. This integration capability enhances workflow efficiency, enabling you to sync data and automate processes related to document management and eSigning.

-

What benefits does airSlate SignNow provide for businesses dealing with the State Of South Carolina Wh 1605?

Using airSlate SignNow for the State Of South Carolina Wh 1605 provides numerous benefits, including improved accuracy, reduced paperwork, and faster processing times. The platform's user-friendly interface ensures that even those unfamiliar with the form can complete it without hassle. Additionally, the security features protect sensitive tax information.

-

How secure is airSlate SignNow for submitting the State Of South Carolina Wh 1605?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the State Of South Carolina Wh 1605. The platform utilizes advanced encryption and secure cloud storage to protect all data. Users can confidently eSign and share their documents, knowing that their information is safeguarded.

Get more for State Of South Carolina Wh 1605

- Employees claim for credit for excess uiwfswf disability insurance andor family leave insurance contributions form nj 2450

- Schedule nj dop schedule nj wwc schedule nj dop schedule nj wwc form

- Florida payroll tax registration the ultimate guide faqs form

- New jersey election to participate in a composite return form

- Florida small business taxes what employers should know form

- Effective 0123 form

- Nj 1040 schedule nj coj credit for income or wage taxes paid form

- Instructions for dr 15ez form

Find out other State Of South Carolina Wh 1605

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy