Florida Small Business Taxes What Employers Should Know 2022

Understanding Florida Small Business Taxes

Florida small business taxes encompass various tax obligations that employers must be aware of to ensure compliance and avoid penalties. These taxes typically include corporate income tax, sales tax, and employment taxes. Each type of tax has specific regulations and requirements that business owners should understand to manage their financial responsibilities effectively.

For instance, corporate income tax applies to most businesses operating in Florida, while sales tax is collected on goods and certain services sold within the state. Employers also need to withhold federal income tax, Social Security, and Medicare taxes from employee wages, contributing to their overall tax obligations.

Steps to Complete Florida Small Business Taxes

Completing Florida small business taxes involves several key steps that ensure accurate filing and compliance with state regulations. First, business owners should gather all necessary financial documents, including income statements, expense reports, and payroll records. This information is crucial for calculating taxable income and determining tax liabilities.

Next, businesses must identify the specific taxes applicable to their operations. This may involve registering for a sales tax permit if selling taxable goods or services and ensuring proper withholding for employee taxes. After determining the tax obligations, businesses can proceed to fill out the required forms, such as the Florida Corporate Income Tax Return (Form F-1120) or the Florida Sales and Use Tax Return (Form DR-15).

Finally, businesses should submit their completed forms by the appropriate deadlines, ensuring they keep copies for their records. Using digital solutions, such as e-filing options, can streamline this process and enhance accuracy.

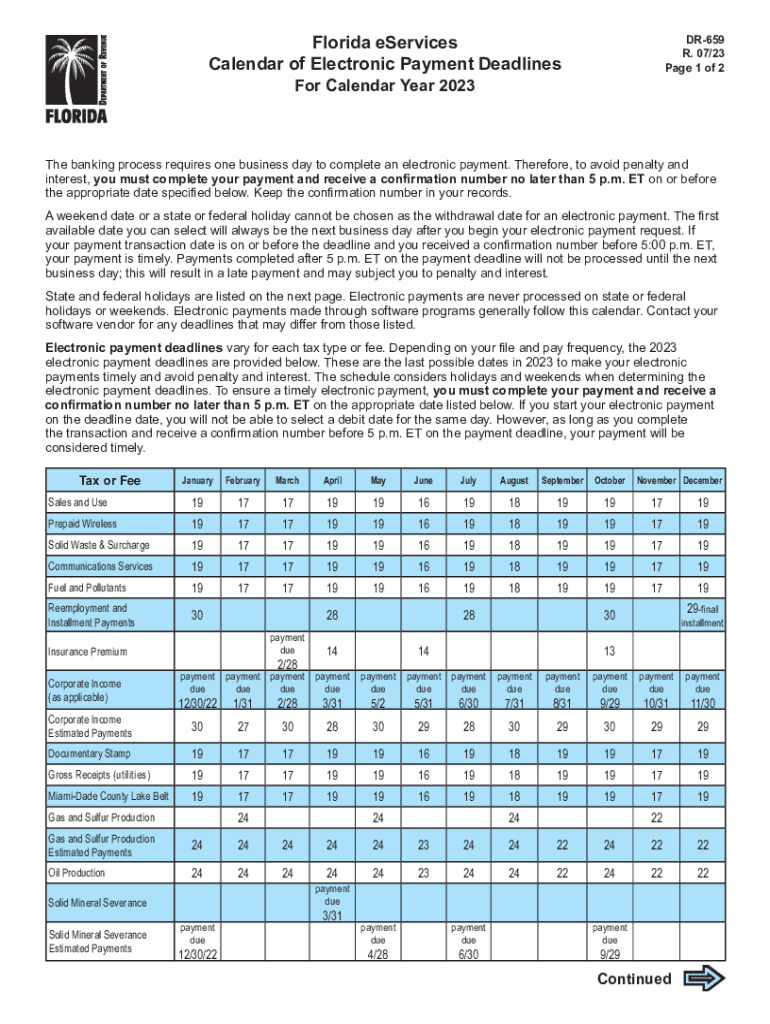

Filing Deadlines and Important Dates

Filing deadlines for Florida small business taxes vary based on the type of tax and the business structure. For instance, the corporate income tax return is typically due on the first day of the fourth month following the end of the business's fiscal year. For many businesses operating on a calendar year, this means the return is due on April 1.

Sales tax returns are generally due on the 20th of the month following the reporting period. Businesses should also be aware of quarterly deadlines for employment tax filings, which require timely submission to avoid penalties. Keeping a calendar of these important dates can help ensure compliance and facilitate smooth financial operations.

Required Documents for Tax Filing

To successfully complete Florida small business tax filings, several documents are essential. These include:

- Income statements detailing revenue generated during the tax period.

- Expense reports that outline all business-related expenditures.

- Payroll records showing wages paid to employees, including tax withholdings.

- Sales records indicating taxable sales and any applicable exemptions.

- Previous tax returns for reference and comparison.

Having these documents organized and readily accessible can simplify the tax preparation process and help ensure accuracy in filings.

Penalties for Non-Compliance

Failure to comply with Florida small business tax regulations can lead to significant penalties. Common consequences include fines, interest on unpaid taxes, and potential legal action. For example, late filing of tax returns may incur a penalty of five percent of the unpaid tax for each month the return is late, up to a maximum of 25 percent.

Additionally, businesses that fail to remit collected sales tax may face severe penalties, including criminal charges in extreme cases. To mitigate these risks, it is crucial for business owners to stay informed about their tax obligations and deadlines, ensuring timely and accurate submissions.

State-Specific Rules for Florida Small Business Taxes

Florida has unique tax regulations that differ from other states, making it essential for small business owners to understand these state-specific rules. One notable aspect is that Florida does not impose a personal income tax, which can benefit business owners and employees alike.

However, businesses must navigate the corporate income tax, which is levied at a rate of five and a half percent on net income. Additionally, Florida has specific sales tax rates that may vary by county, requiring businesses to be aware of local tax regulations. Understanding these nuances can help businesses optimize their tax strategies and ensure compliance with state laws.

Quick guide on how to complete florida small business taxes what employers should know

Effortlessly Prepare Florida Small Business Taxes What Employers Should Know on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without any delays. Handle Florida Small Business Taxes What Employers Should Know on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign Florida Small Business Taxes What Employers Should Know with Ease

- Obtain Florida Small Business Taxes What Employers Should Know and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, either by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Florida Small Business Taxes What Employers Should Know and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct florida small business taxes what employers should know

Create this form in 5 minutes!

How to create an eSignature for the florida small business taxes what employers should know

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key considerations for Florida small business taxes?

When navigating Florida small business taxes, employers should be aware of their obligation to pay state sales tax, employee wage taxes, and the possibility of corporate taxes depending on their business structure. Additionally, understanding deductions and credits available at the state level can help maximize tax savings.

-

How can airSlate SignNow help streamline tax-related document management?

airSlate SignNow empowers businesses with an easy-to-use platform that simplifies the process of managing tax-related documents. Employers can effortlessly send and eSign essential documents, ensuring compliance while saving time and reducing errors associated with paperwork.

-

What features does airSlate SignNow offer for small business employers?

Key features of airSlate SignNow include the ability to create reusable templates, collect signatures seamlessly, and integrate with various accounting software. These tools are essential for managing Florida small business taxes efficiently and keeping tax documents organized.

-

Is airSlate SignNow cost-effective for Florida small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses. With competitive pricing plans, employers can manage their tax documentation needs without breaking the bank, making it an ideal choice for managing Florida small business taxes.

-

How does airSlate SignNow ensure compliance with Florida tax laws?

AirSlate SignNow helps ensure compliance with Florida tax laws by providing an audit trail and secure storage of signed documents. Employers can easily access necessary tax documents and stay organized, which is crucial for meeting regulatory requirements.

-

What integrations does airSlate SignNow offer for tax-related processes?

AirSlate SignNow integrates with various accounting and financial software, allowing seamless data management. These integrations are vital for Florida small business taxes, as they streamline the flow of information and reduce manual data entry.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, utilizing advanced encryption methods to protect sensitive information. Employers can rest assured that their tax documents are safeguarded while complying with Florida small business taxes regulations.

Get more for Florida Small Business Taxes What Employers Should Know

- Fsa 612834809 form

- Form rd 440 21 rev 4 97 appraisal of chattel forms forms sc egov usda

- Guaranteed loan report of loss forms sc egov usda

- Compliance review rcac form

- Fha case number cancellation form

- Housing urban development management form

- You must make a choice on getting a home inspection form

- District vi juvenile detention center bannock county idaho form

Find out other Florida Small Business Taxes What Employers Should Know

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online