New Jersey Election to Participate in a Composite Return 2022

What is the New Jersey Election To Participate In A Composite Return

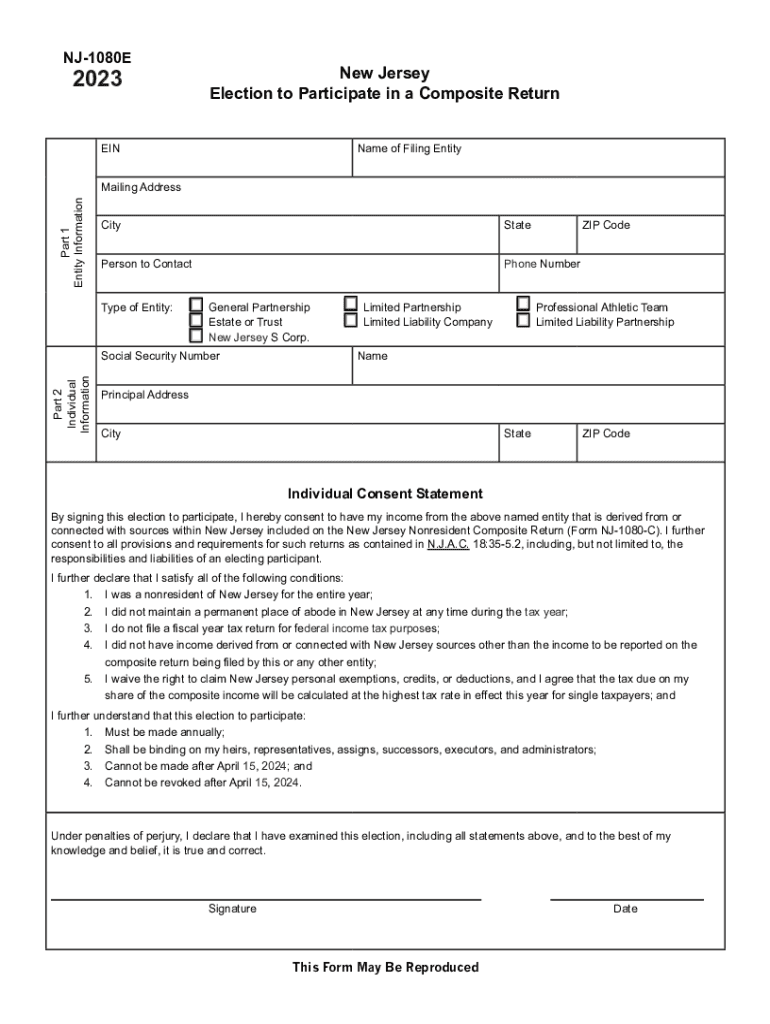

The New Jersey Election To Participate In A Composite Return is a tax election that allows certain entities, such as partnerships and S corporations, to file a single tax return on behalf of all their non-resident partners or shareholders. This election simplifies the tax filing process by enabling these entities to report income, gains, losses, and deductions collectively rather than requiring each non-resident partner or shareholder to file individual returns in New Jersey. By participating in this composite return, businesses can streamline their tax obligations and minimize administrative burdens.

How to use the New Jersey Election To Participate In A Composite Return

To utilize the New Jersey Election To Participate In A Composite Return, eligible entities must first notify the New Jersey Division of Taxation of their intention to elect this option. This involves completing the appropriate forms and providing necessary information about the entity and its partners or shareholders. Once the election is made, the entity must report all relevant income and deductions on the composite return, ensuring that all non-resident partners or shareholders are included. It is crucial to maintain accurate records and documentation to support the information reported on the composite return.

Steps to complete the New Jersey Election To Participate In A Composite Return

Completing the New Jersey Election To Participate In A Composite Return involves several key steps:

- Determine eligibility: Ensure that your entity qualifies for the composite return election based on the New Jersey tax regulations.

- Notify the Division of Taxation: Submit the required forms to inform the state of your intention to elect the composite return option.

- Gather necessary information: Collect details about all non-resident partners or shareholders, including their income and deductions.

- Complete the composite return: Fill out the composite return form accurately, ensuring all required information is included.

- Submit the return: File the completed composite return by the designated deadline, either electronically or via mail.

Key elements of the New Jersey Election To Participate In A Composite Return

Several key elements are essential for understanding the New Jersey Election To Participate In A Composite Return:

- Eligibility criteria: Only certain entities, such as partnerships and S corporations, can elect to file a composite return.

- Filing requirements: The composite return must include all non-resident partners or shareholders, along with their respective shares of income and deductions.

- Deadline: There are specific deadlines for filing the composite return, which must be adhered to avoid penalties.

- Record-keeping: Entities must maintain detailed records to support the information reported on the composite return.

Required Documents

When preparing to file the New Jersey Election To Participate In A Composite Return, several documents are necessary:

- Form to notify the Division of Taxation of the election.

- Income statements for all non-resident partners or shareholders.

- Documentation of deductions and credits applicable to the entity.

- Any previous tax returns that may impact the current filing.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the New Jersey Election To Participate In A Composite Return can result in significant penalties. Entities that do not file the composite return on time may face late fees, interest on unpaid taxes, and potential audits. Additionally, non-compliance can lead to individual partners or shareholders being required to file separate returns, increasing their tax liability and administrative burden. It is essential to adhere to all filing requirements and deadlines to avoid these consequences.

Quick guide on how to complete new jersey election to participate in a composite return

Complete New Jersey Election To Participate In A Composite Return seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the features necessary to create, edit, and electronically sign your documents swiftly and without hold-ups. Manage New Jersey Election To Participate In A Composite Return on any platform using airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The simplest method to edit and eSign New Jersey Election To Participate In A Composite Return effortlessly

- Locate New Jersey Election To Participate In A Composite Return and click on Get Form to begin.

- Utilize the features we provide to fill out your form.

- Emphasize important sections of your documents or conceal sensitive details using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign New Jersey Election To Participate In A Composite Return and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new jersey election to participate in a composite return

Create this form in 5 minutes!

How to create an eSignature for the new jersey election to participate in a composite return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Jersey Election To Participate In A Composite Return?

The New Jersey Election To Participate In A Composite Return is a tax option that allows certain businesses to file taxes collectively rather than individually. This election can simplify the filing process for companies with multiple partners or shareholders. Understanding this election is crucial for businesses looking to optimize their tax obligations.

-

How does airSlate SignNow facilitate the New Jersey Election To Participate In A Composite Return?

airSlate SignNow streamlines the process of preparing and signing documents related to the New Jersey Election To Participate In A Composite Return. Our easy-to-use platform ensures that all necessary forms are completed accurately and electronically signed by all stakeholders. This can save time and reduce errors compared to traditional paper methods.

-

What are the pricing options for using airSlate SignNow for the New Jersey Election To Participate In A Composite Return?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those related to the New Jersey Election To Participate In A Composite Return. You can choose from monthly or annual subscriptions, with costs scaling based on user count and features. Our solutions are designed to be cost-effective, making eSigning accessible for all businesses.

-

What key features does airSlate SignNow offer for the New Jersey Election To Participate In A Composite Return?

Key features of airSlate SignNow include customizable templates, real-time tracking, and secure eSigning capabilities specifically beneficial for the New Jersey Election To Participate In A Composite Return. Additionally, our platform allows you to collaborate seamlessly with team members and clients to ensure that all forms are completed accurately. The user-friendly interface helps you manage the signing process effortlessly.

-

What benefits can businesses expect when using airSlate SignNow for their New Jersey Election To Participate In A Composite Return?

Businesses can expect enhanced efficiency, reduced paperwork, and a streamlined signing process when using airSlate SignNow for the New Jersey Election To Participate In A Composite Return. Our platform helps mitigate the risks of delays and errors associated with traditional signatures. By adopting our solutions, businesses can focus more on their core operations while ensuring compliance.

-

Is airSlate SignNow compliant with New Jersey regulations for the Election To Participate In A Composite Return?

Yes, airSlate SignNow is designed to comply with all relevant New Jersey regulations concerning the Election To Participate In A Composite Return. We prioritize security and legal compliance, ensuring your documents meet state requirements. Our dedicated support team is also available to help navigate any regulatory concerns you may have.

-

What integrations does airSlate SignNow support for those filing the New Jersey Election To Participate In A Composite Return?

airSlate SignNow offers various integrations with popular software solutions tailored for those handling the New Jersey Election To Participate In A Composite Return. This includes compatibility with CRM systems, document management tools, and accounting software. Such integrations can enhance productivity by allowing seamless data flow and reducing repetitive tasks.

Get more for New Jersey Election To Participate In A Composite Return

- Black bear sightings florida fish and wildlife form

- Www fs usda gov internet fsedocumentsunited states department of agriculture forest service custer form

- Fsa 10755108 form

- Rd 1944 59 rev 04 07 united states department of agriculture rural housing service certificate of eligibility this is to form

- Landlords verification forms sc egov usda

- U s department of agriculture forest service form

- Ccc191 form

- United states department of agriculture forest form

Find out other New Jersey Election To Participate In A Composite Return

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form