NJ 1040 Schedule NJ COJ Credit for Income or Wage Taxes Paid 2022

What is the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

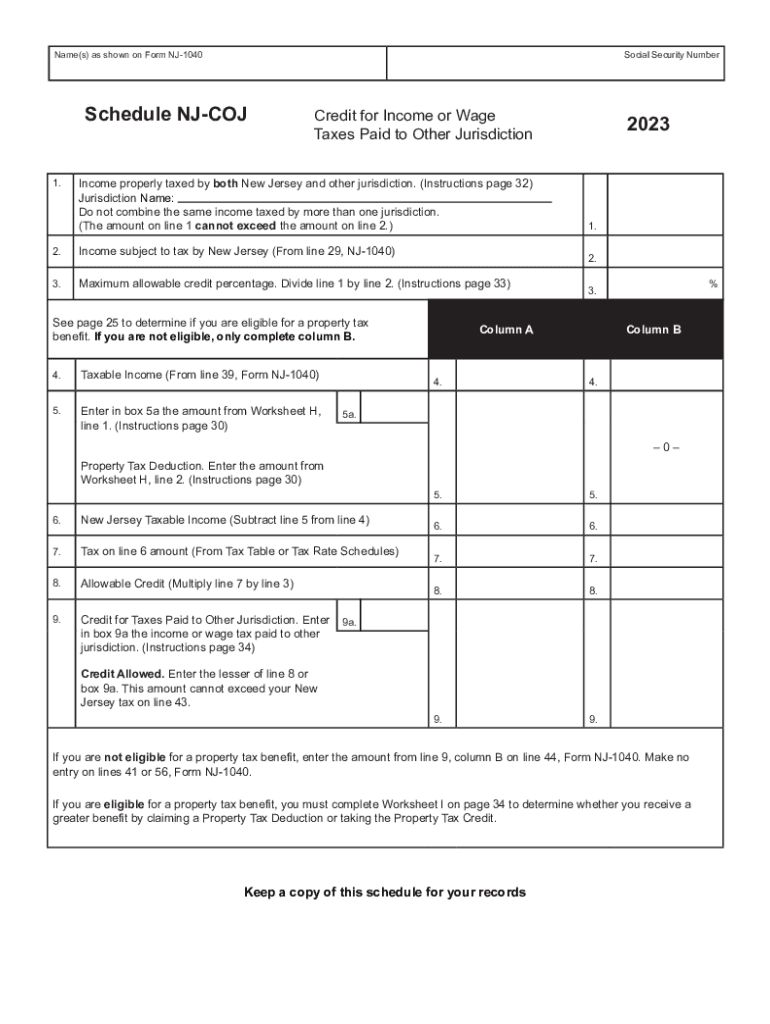

The NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid is a form used by New Jersey residents to claim a credit for taxes paid to other jurisdictions. This credit helps to alleviate the double taxation burden on individuals who work in one municipality but reside in another. By utilizing this schedule, taxpayers can reduce their New Jersey income tax liability by the amount of income or wage taxes they have already paid to other local governments.

Key Elements of the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

Several key elements define the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid. These include:

- Eligibility Criteria: Taxpayers must have paid income or wage taxes to a municipality outside of New Jersey.

- Documentation Requirements: Proof of taxes paid to other jurisdictions is necessary, such as W-2 forms or tax receipts.

- Calculation Method: The credit amount is determined based on the taxes paid and is subject to specific limitations outlined by the state.

- Filing Instructions: Taxpayers must include this schedule with their NJ 1040 tax return when filing.

Steps to Complete the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

Completing the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid involves several steps:

- Gather necessary documentation, including W-2 forms and proof of taxes paid to other jurisdictions.

- Fill out the schedule, ensuring that all relevant income and tax amounts are accurately reported.

- Calculate the credit amount based on the guidelines provided in the form instructions.

- Attach the completed schedule to your NJ 1040 tax return.

- Review your entire tax return for accuracy before submission.

State-Specific Rules for the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

New Jersey has specific rules governing the use of the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid. These rules include:

- Only taxes paid to municipalities that impose an income or wage tax qualify for the credit.

- The credit cannot exceed the amount of New Jersey tax liability.

- Taxpayers must file the schedule in the same tax year that the taxes were paid to other jurisdictions.

Examples of Using the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

Understanding practical examples can clarify how to utilize the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid:

- A New Jersey resident who works in New York City and pays local income taxes can claim a credit for those taxes on their NJ 1040.

- If a taxpayer lives in a municipality that does not impose an income tax but works in one that does, they may also qualify for the credit.

Legal Use of the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

The NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid is legally sanctioned by New Jersey tax law. Taxpayers are entitled to claim this credit as part of their legal right to reduce their tax burden. Proper completion and submission of the schedule ensure compliance with state regulations, helping to avoid potential penalties for incorrect filings.

Quick guide on how to complete nj 1040 schedule nj coj credit for income or wage taxes paid

Prepare NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents quickly and without interruptions. Handle NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and electronically sign NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid without any hassle

- Obtain NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your modifications.

- Select your preferred method of sharing your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nj 1040 schedule nj coj credit for income or wage taxes paid

Create this form in 5 minutes!

How to create an eSignature for the nj 1040 schedule nj coj credit for income or wage taxes paid

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

The NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid is a form used by residents of New Jersey to claim a credit for taxes paid on income or wages. It helps reduce your overall tax liability based on the income tax you've already paid. Filing this schedule accurately can signNowly impact your tax refund or amount owed.

-

How can airSlate SignNow help me file the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

With airSlate SignNow, you can easily prepare and eSign your NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid documents online. Our platform streamlines the signature process and allows you to send documents for eSignature securely. This saves time and ensures you meet all necessary deadlines.

-

Is airSlate SignNow cost-effective for filing the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

Yes, airSlate SignNow offers a cost-effective solution for professionals and individuals preparing their NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid. Our pricing plans are designed to suit various needs, ensuring affordability without sacrificing quality or features. You can choose a plan that fits your budget.

-

What features does airSlate SignNow offer for handling the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

airSlate SignNow offers a range of features including document templates, customizable workflows, and secure eSigning for your NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid. These features help simplify the filing process and enhance your overall efficiency. You can track document statuses and manage multiple signatures effortlessly.

-

Can I integrate airSlate SignNow with other platforms for filing the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

Absolutely! airSlate SignNow integrates with a variety of popular platforms like Google Drive, Dropbox, and Microsoft Office. This allows you to easily import and export necessary documents for your NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid. Seamless integration enhances your workflow efficiency.

-

What benefits does using airSlate SignNow provide when filing the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

Using airSlate SignNow to file your NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid offers numerous benefits, including time savings, secure document handling, and an easy-to-navigate interface. Additionally, our tracking features ensure you never miss an important deadline, making the filing process smoother.

-

Is there customer support available for airSlate SignNow users filing the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid?

Yes, airSlate SignNow provides dedicated customer support to assist users with any questions or issues related to filing the NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid. Our team is available via chat, email, or phone to ensure you have the resources needed for a successful filing.

Get more for NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

- Cg 2045 586609391 form

- Form i 9 supplement section 1 preparer andor translator

- Department of homeland security omb no 1625 0010 us coast form

- Cvc wi 027 uscg office of commercial vessel form

- Cbp form 349

- The health care provider or officer will complete form

- 914378 form

- Fa 4150v wi state courts form

Find out other NJ 1040 Schedule NJ COJ Credit For Income Or Wage Taxes Paid

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online