31 113a Iowa Form

What is the 31 113a Iowa

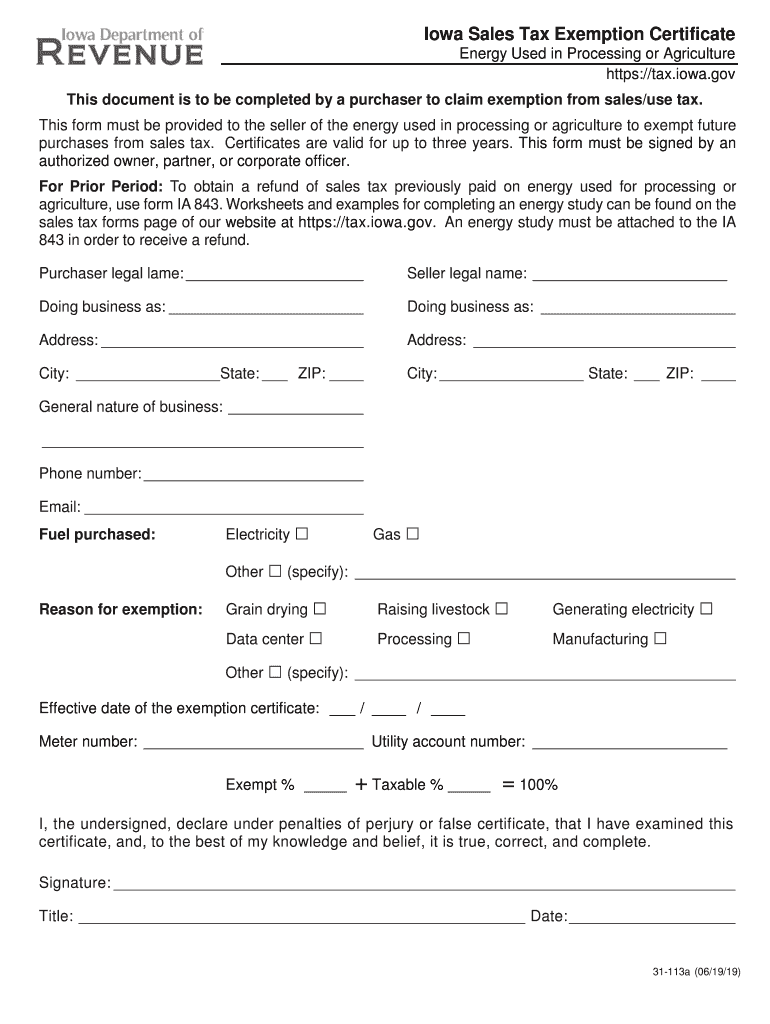

The 31 113a Iowa form, also known as the Iowa Sales Tax Exemption Certificate, is a crucial document for businesses and individuals seeking to claim exemptions from sales tax on specific purchases. This form is particularly relevant for agricultural producers and certain organizations that qualify under Iowa law. By completing this form, eligible parties can avoid paying sales tax on items directly used in their operations, such as equipment and materials necessary for agricultural production.

How to use the 31 113a Iowa

Using the 31 113a Iowa form involves several key steps. First, ensure that you meet the eligibility criteria for a sales tax exemption. Next, accurately fill out the form, providing necessary details such as the purchaser's name, address, and the nature of the exempt purchase. After completing the form, present it to the seller at the time of purchase. This allows the seller to recognize the transaction as tax-exempt, ensuring compliance with state regulations.

Steps to complete the 31 113a Iowa

Completing the 31 113a Iowa form requires careful attention to detail. Follow these steps for accurate submission:

- Gather necessary information, including your business details and the specific items for which you seek exemption.

- Fill in the purchaser's name and address at the top of the form.

- Specify the type of exemption being claimed, such as agricultural use.

- List the items being purchased and their intended use.

- Sign and date the form to validate the information provided.

Legal use of the 31 113a Iowa

The legal use of the 31 113a Iowa form is governed by Iowa state tax laws. To ensure compliance, it is essential to use the form only for qualifying purchases. Misuse of the exemption certificate can lead to penalties, including back taxes and fines. Therefore, it is vital to maintain accurate records of exempt purchases and ensure that the items purchased qualify under the specified exemptions.

Eligibility Criteria

To qualify for the 31 113a Iowa exemption, certain criteria must be met. Generally, the purchaser must be engaged in agricultural production or operate a qualifying organization. The items purchased must be directly related to the exempt activity, such as equipment used in farming or materials for agricultural production. It is advisable to consult Iowa Department of Revenue guidelines to confirm eligibility before submitting the form.

Required Documents

When completing the 31 113a Iowa form, certain documents may be required to support your exemption claim. These may include:

- Proof of business registration, such as an Iowa sales tax permit.

- Documentation demonstrating the nature of the agricultural activity.

- Invoices or receipts for the items being purchased under the exemption.

Form Submission Methods

The 31 113a Iowa form can be submitted in various ways, depending on the seller’s preferences. Typically, the form is presented in person at the time of purchase. However, some sellers may accept electronic versions of the form, provided they comply with state regulations. It is essential to check with the seller regarding their preferred submission method to ensure the transaction is processed correctly.

Quick guide on how to complete purchases from sales tax

Effortlessly Prepare 31 113a Iowa on Any Device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it stored online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hold-ups. Manage 31 113a Iowa on any device using airSlate SignNow’s apps for Android or iOS and enhance any paperwork-driven process today.

The simplest method to modify and electronically sign 31 113a Iowa with ease

- Locate 31 113a Iowa and click on Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the data and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing fresh document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Update and electronically sign 31 113a Iowa and guarantee effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the purchases from sales tax

How to make an eSignature for the Purchases From Sales Tax in the online mode

How to generate an eSignature for the Purchases From Sales Tax in Google Chrome

How to create an eSignature for putting it on the Purchases From Sales Tax in Gmail

How to make an eSignature for the Purchases From Sales Tax right from your smart phone

How to make an electronic signature for the Purchases From Sales Tax on iOS devices

How to generate an eSignature for the Purchases From Sales Tax on Android devices

People also ask

-

What is form 31 113 and how can airSlate SignNow help with it?

Form 31 113 is a document that can be used in various business processes. airSlate SignNow simplifies the management of form 31 113 by allowing users to easily send, eSign, and store the document securely. With our user-friendly interface, businesses can expedite their operations involving form 31 113 without the hassle of paperwork.

-

Is there a cost associated with using airSlate SignNow for processing form 31 113?

Yes, airSlate SignNow offers several pricing plans tailored to meet different business needs. You can choose a plan that fits your budget and ensures efficient handling of form 31 113 and other documents. Our pricing is competitive, making it a cost-effective solution for businesses looking to streamline their documentation.

-

What features does airSlate SignNow provide for handling form 31 113?

airSlate SignNow provides a rich feature set for handling form 31 113, including eSignatures, document templates, and cloud storage. Users can create reusable templates for form 31 113, ensuring faster turnaround times and reducing the risk of errors. Additionally, the platform allows real-time collaboration, which enhances productivity.

-

How does airSlate SignNow ensure the security of form 31 113 documents?

Security is a priority at airSlate SignNow. We use advanced encryption protocols to protect form 31 113 and all uploaded documents. Moreover, we comply with industry standards and regulations, ensuring that your information remains confidential and secure throughout the signing process.

-

Can I integrate airSlate SignNow with other tools for form 31 113 management?

Absolutely! airSlate SignNow offers seamless integrations with a variety of business tools to enhance your workflow for form 31 113. Whether you’re using CRM software or project management tools, you can easily connect airSlate SignNow to synchronize data and simplify your document processes.

-

What are the benefits of using airSlate SignNow for form 31 113?

Using airSlate SignNow for form 31 113 provides numerous benefits, including time savings, reduced paperwork, and enhanced compliance. The platform allows you to manage documents efficiently, enabling quicker approvals and increasing overall productivity. Additionally, the ease of use fosters a better user experience for both senders and signers.

-

Is it easy to create a form 31 113 using airSlate SignNow?

Yes, creating form 31 113 with airSlate SignNow is straightforward. Our platform offers intuitive tools to generate and customize the document as needed. With drag-and-drop functionality and customizable fields, you can tailor form 31 113 to suit your business requirements quickly.

Get more for 31 113a Iowa

Find out other 31 113a Iowa

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online