Form 149

What is the Form 149

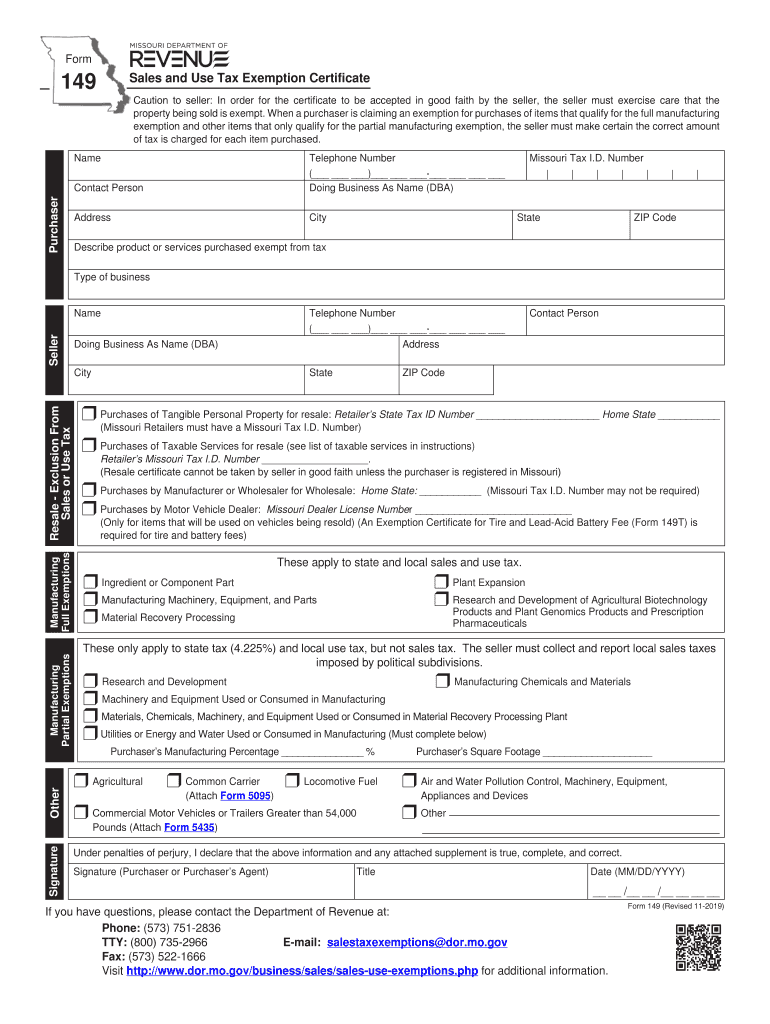

The Form 149, also known as the Missouri sales tax exemption certificate, is a crucial document used by businesses and individuals in Missouri to claim exemption from sales tax on qualifying purchases. This form is typically utilized by organizations that are exempt from paying sales tax, such as non-profit entities, government agencies, and certain educational institutions. By submitting this form, purchasers can avoid paying sales tax on eligible items, facilitating cost savings for exempt organizations.

How to use the Form 149

Using the Form 149 involves several steps to ensure compliance with Missouri tax regulations. First, the purchaser must complete the form accurately, providing necessary details such as the name of the purchaser, the address, and the reason for the exemption. Once filled out, the form should be presented to the seller at the time of purchase. It is essential for sellers to maintain a copy of the completed form for their records, as it serves as proof of the tax-exempt status of the transaction.

Steps to complete the Form 149

Completing the Form 149 requires careful attention to detail. Follow these steps to ensure accuracy:

- Obtain a copy of the Form 149 from the Missouri Department of Revenue website or a trusted source.

- Fill in the purchaser's name and address in the designated fields.

- Indicate the type of exemption being claimed, such as non-profit status or government entity.

- Provide a description of the items being purchased that qualify for the exemption.

- Sign and date the form to certify that the information is accurate and complete.

Legal use of the Form 149

The legal use of the Form 149 is governed by Missouri tax laws. To ensure compliance, it is important to understand that misuse of the form can lead to penalties. The form must only be used for legitimate tax-exempt purchases. Sellers are required to verify the validity of the exemption claimed and should retain the completed form as part of their sales records. This protects both the seller and the purchaser in case of an audit by the Missouri Department of Revenue.

Key elements of the Form 149

Several key elements are essential for the proper completion of the Form 149. These include:

- Purchaser Information: Name and address of the entity claiming the exemption.

- Exemption Reason: Clearly state the basis for the exemption, such as non-profit status.

- Item Description: Provide a detailed description of the items being purchased tax-free.

- Signature: The form must be signed by an authorized representative of the purchaser.

State-specific rules for the Form 149

Missouri has specific rules regarding the use of the Form 149. It is important to be aware of these regulations to ensure proper compliance. For example, the form must be used only for purchases that are directly related to the exempt purpose of the organization. Additionally, the Missouri Department of Revenue may require periodic updates or renewals of exemption status, so keeping documentation current is vital for maintaining tax-exempt status.

Quick guide on how to complete resale certificate cannot be taken by seller in good faith unless the purchaser is registered in missouri

Complete Form 149 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow provides all the functionalities required to create, modify, and eSign your documents swiftly without delays. Handle Form 149 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Form 149 seamlessly

- Find Form 149 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from your selected device. Edit and eSign Form 149 to guarantee outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the resale certificate cannot be taken by seller in good faith unless the purchaser is registered in missouri

How to create an eSignature for the Resale Certificate Cannot Be Taken By Seller In Good Faith Unless The Purchaser Is Registered In Missouri in the online mode

How to create an eSignature for your Resale Certificate Cannot Be Taken By Seller In Good Faith Unless The Purchaser Is Registered In Missouri in Chrome

How to create an eSignature for putting it on the Resale Certificate Cannot Be Taken By Seller In Good Faith Unless The Purchaser Is Registered In Missouri in Gmail

How to make an eSignature for the Resale Certificate Cannot Be Taken By Seller In Good Faith Unless The Purchaser Is Registered In Missouri right from your mobile device

How to make an eSignature for the Resale Certificate Cannot Be Taken By Seller In Good Faith Unless The Purchaser Is Registered In Missouri on iOS

How to create an electronic signature for the Resale Certificate Cannot Be Taken By Seller In Good Faith Unless The Purchaser Is Registered In Missouri on Android

People also ask

-

What is the form 149 sales tax exemption?

The form 149 sales tax exemption is a document used to claim an exemption from sales tax for certain purchases within specific jurisdictions. By utilizing the form 149, businesses can streamline their tax management processes and ensure compliance with local regulations. Understanding how to properly fill out and submit this form can lead to signNow savings.

-

How can airSlate SignNow help with the form 149 sales tax exemption?

airSlate SignNow provides a user-friendly platform to digitally fill out and eSign the form 149 sales tax exemption. By using our solution, businesses can reduce paperwork and expedite the exemption process. This not only saves time but also minimizes errors commonly associated with manual submissions.

-

Is there a cost associated with using airSlate SignNow for the form 149 sales tax exemption?

AirSlate SignNow offers flexible pricing plans to accommodate various business needs, including those related to the form 149 sales tax exemption. Depending on your requirements, you can choose a subscription that fits your budget. Our platform remains a cost-effective solution for efficiently managing documents and transactions.

-

What features does airSlate SignNow provide for managing form 149 sales tax exemption?

With airSlate SignNow, you get features tailored for document management, such as templates for the form 149 sales tax exemption, automated workflows, and secure eSignature options. These tools enhance efficiency and make it easier to track the status of your exemption requests. Additionally, our platform is designed to keep documents organized and accessible.

-

Can I integrate airSlate SignNow with other applications for the form 149 sales tax exemption?

Yes, airSlate SignNow offers integrations with various applications, enhancing your ability to manage the form 149 sales tax exemption seamlessly. This allows you to connect with tools you already use for accounting, customer relationship management, and more. Streamlining your workflows can further improve your document handling processes.

-

What are the benefits of using airSlate SignNow for the form 149 sales tax exemption?

The primary benefits of using airSlate SignNow for the form 149 sales tax exemption include efficiency, accuracy, and reliability. Businesses can quickly fill out the form, gather necessary signatures, and submit it without delay. Additionally, our secure platform ensures that sensitive information remains protected throughout the process.

-

What support resources are available for the form 149 sales tax exemption users?

AirSlate SignNow offers robust support resources for users handling the form 149 sales tax exemption. Our help center includes FAQs, video tutorials, and detailed documentation to guide you through every step. For personalized assistance, our customer support team is readily available to address any queries or concerns.

Get more for Form 149

- New construction contract checklist form

- Apartments rules and regulations bell top apartments form

- Exclusive right to rent agreement 239970831 form

- Holding deposit 250138049 form

- Affidavit for domestic partnership form

- Purchase business contract template form

- Purchase addendum contract template form

- Purchase and sale contract template form

Find out other Form 149

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation