R 1201 Form

What is the R 1201

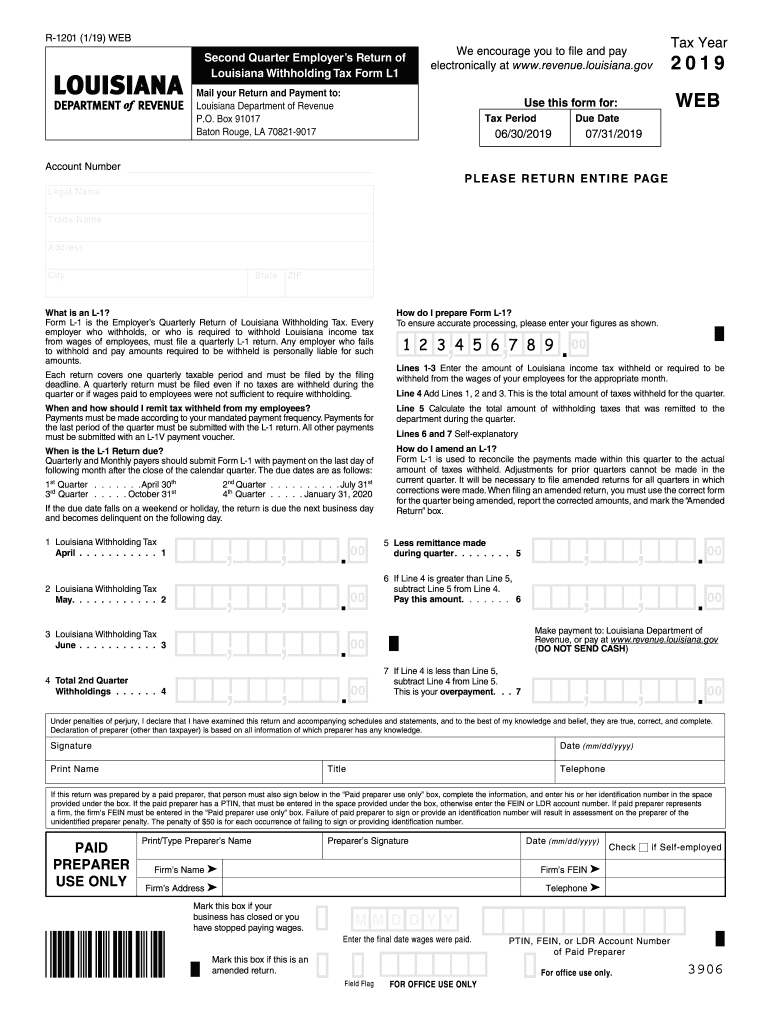

The R 1201 is a Louisiana withholding tax form used by employers to report and remit state income tax withheld from employees' wages. This form is crucial for ensuring compliance with Louisiana state tax regulations. Employers must accurately complete the R 1201 to reflect the total amount withheld during a specific quarter, which is then submitted to the Louisiana Department of Revenue. Understanding the purpose and requirements of the R 1201 is essential for businesses operating in Louisiana to avoid penalties and maintain good standing with state tax authorities.

Steps to complete the R 1201

Completing the R 1201 involves several key steps to ensure accuracy and compliance. Follow these steps:

- Gather necessary information, including employee wages and the total amount withheld for the reporting period.

- Access the R 1201 form, which can be obtained from the Louisiana Department of Revenue website or through authorized sources.

- Fill out the form by entering the required details, including employer information, total wages paid, and the amount of state income tax withheld.

- Review the completed form for accuracy to prevent errors that could lead to penalties.

- Submit the form either electronically or by mail, adhering to the submission guidelines provided by the Louisiana Department of Revenue.

Legal use of the R 1201

The R 1201 must be used in accordance with Louisiana state tax laws. Employers are legally required to withhold state income tax from employee wages and report this information using the R 1201. Failure to use the form correctly can result in penalties, including fines or interest on unpaid taxes. It is important for employers to stay informed about any changes to tax laws or form requirements to ensure compliance and avoid legal issues.

Filing Deadlines / Important Dates

Timely filing of the R 1201 is critical for compliance. The form must be submitted quarterly, with specific deadlines set by the Louisiana Department of Revenue. Generally, the due dates for filing the R 1201 are as follows:

- First Quarter: April 30

- Second Quarter: July 31

- Third Quarter: October 31

- Fourth Quarter: January 31 of the following year

Employers should mark these dates on their calendars to ensure they meet all filing requirements and avoid penalties for late submissions.

Form Submission Methods

Employers have several options for submitting the R 1201, which include:

- Online Submission: Employers can file the R 1201 electronically through the Louisiana Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the Louisiana Department of Revenue.

- In-Person Submission: Employers may also submit the form in person at designated Louisiana Department of Revenue offices.

Choosing the right submission method can help streamline the filing process and ensure that the form is received on time.

Who Issues the Form

The R 1201 is issued by the Louisiana Department of Revenue, which is responsible for managing state tax collection and compliance. This department provides employers with the necessary forms and guidelines to ensure proper reporting and remittance of state income tax withheld from employee wages. Employers can find additional resources and support through the Louisiana Department of Revenue's official website.

Quick guide on how to complete from wages of employees must file a quarterly l 1 return

Effortlessly Prepare R 1201 on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed forms, allowing you to locate the necessary template and securely save it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without hindrances. Handle R 1201 across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign R 1201 seamlessly

- Obtain R 1201 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight essential sections of the documents or redact sensitive details with the tools airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you'd like to share your form—via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Modify and electronically sign R 1201 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the from wages of employees must file a quarterly l 1 return

How to generate an eSignature for the From Wages Of Employees Must File A Quarterly L 1 Return in the online mode

How to generate an electronic signature for the From Wages Of Employees Must File A Quarterly L 1 Return in Chrome

How to create an eSignature for putting it on the From Wages Of Employees Must File A Quarterly L 1 Return in Gmail

How to generate an eSignature for the From Wages Of Employees Must File A Quarterly L 1 Return straight from your smartphone

How to create an electronic signature for the From Wages Of Employees Must File A Quarterly L 1 Return on iOS

How to create an electronic signature for the From Wages Of Employees Must File A Quarterly L 1 Return on Android devices

People also ask

-

What is the l1 form 2024 and how can airSlate SignNow help?

The l1 form 2024 is a crucial document for professionals seeking to streamline their workflow. airSlate SignNow offers features that allow you to easily send, sign, and manage the l1 form 2024 digitally, ensuring a smooth and efficient process.

-

What features does airSlate SignNow provide for managing the l1 form 2024?

airSlate SignNow offers a range of features for the l1 form 2024, including secure eSignature capabilities, template creation, and customizable workflows. These tools help to simplify the signing process and enhance document management efficiency.

-

Is airSlate SignNow cost-effective for businesses needing the l1 form 2024?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses needing the l1 form 2024. With various pricing plans, companies of all sizes can find an option that fits their budget while enjoying all the essential features for document management.

-

How does airSlate SignNow ensure the security of the l1 form 2024?

airSlate SignNow prioritizes the security of the l1 form 2024 by employing end-to-end encryption and compliant storage solutions. This guarantees that your sensitive information remains protected throughout the signing process.

-

What benefits can businesses expect from using airSlate SignNow for the l1 form 2024?

Businesses can expect numerous benefits from using airSlate SignNow for the l1 form 2024, including reduced turnaround times, improved workflow efficiency, and enhanced collaboration. These advantages lead to better overall document management and customer satisfaction.

-

Which integrations does airSlate SignNow offer that can assist with the l1 form 2024?

airSlate SignNow seamlessly integrates with a variety of platforms such as Google Workspace, Salesforce, and Microsoft Office. These integrations simplify the process of handling the l1 form 2024 by allowing users to manage documents within their preferred applications.

-

Can I customize the l1 form 2024 using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize the l1 form 2024 by adding fields, branding, and personalized messages. This level of customization enhances the user experience and ensures the document meets specific business needs.

Get more for R 1201

Find out other R 1201

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer