Utah State Tax Return Form

What is the Utah State Tax Return Form

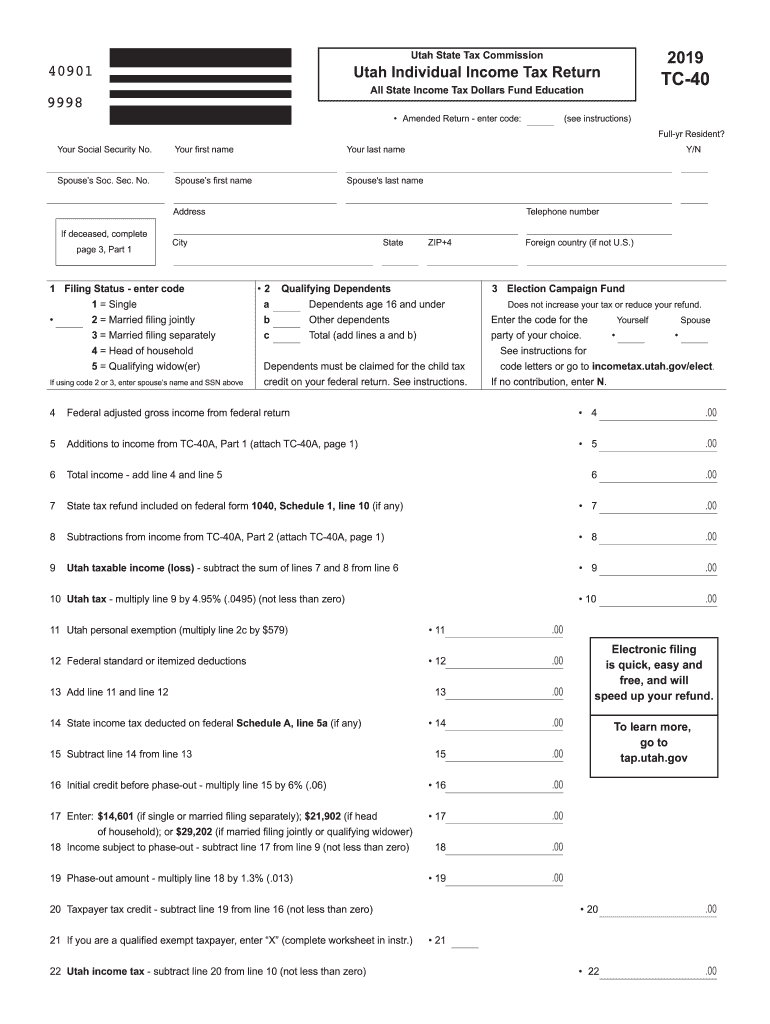

The Utah State Tax Return Form, commonly referred to as the TC-40, is an essential document for individuals filing their state income taxes in Utah. This form is used to report income, calculate tax liability, and determine any potential refunds. It is crucial for residents and those earning income in Utah to complete this form accurately to comply with state tax laws. The TC-40 encompasses various sections where taxpayers must input personal information, income details, and deductions applicable to their situation.

How to use the Utah State Tax Return Form

Using the Utah State Tax Return Form involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. Next, carefully fill out the TC-40, ensuring that all information is correct and complete. This includes reporting total income, claiming deductions, and calculating tax owed or refund due. After completing the form, review it for accuracy before submitting it either electronically or by mail.

Steps to complete the Utah State Tax Return Form

Completing the Utah State Tax Return Form involves a systematic approach:

- Gather necessary documents such as W-2s, 1099s, and any other relevant income records.

- Begin filling out the TC-40 by entering personal information, including your name, address, and Social Security number.

- Report all sources of income, ensuring to include wages, interest, dividends, and any other income types.

- Claim applicable deductions, such as those for dependents, education, and other eligible expenses.

- Calculate your total tax liability and determine if you owe taxes or are due a refund.

- Review the completed form for accuracy before submission.

Legal use of the Utah State Tax Return Form

The legal use of the Utah State Tax Return Form is governed by state tax laws, which require accurate reporting of income and payment of taxes owed. The TC-40 must be completed truthfully, as any discrepancies or false information can lead to penalties, including fines or audits. Additionally, e-filing the form using a compliant platform ensures that the submission meets legal standards and is processed efficiently by the state tax authority.

Filing Deadlines / Important Dates

Filing deadlines for the Utah State Tax Return Form are critical for taxpayers to observe. Typically, the deadline for filing the TC-40 is April 15 of the following year for income earned during the previous calendar year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions that may be available and the implications of late filing or payment.

Required Documents

To complete the Utah State Tax Return Form, several documents are necessary:

- W-2 forms from employers detailing annual earnings and withheld taxes.

- 1099 forms for any freelance or contract work, reporting other income sources.

- Documentation of deductions, such as receipts for medical expenses, education costs, and charitable contributions.

- Previous year’s tax return for reference and consistency in reporting.

Form Submission Methods (Online / Mail / In-Person)

The Utah State Tax Return Form can be submitted through various methods, allowing flexibility for taxpayers. The most common methods include:

- Online submission via approved e-filing platforms, which is often the fastest and most efficient method.

- Mailing a paper copy of the completed TC-40 to the appropriate state tax office address.

- In-person submission at designated tax offices, which may provide additional assistance if needed.

Quick guide on how to complete 2019 tc 40 utah individual income tax return forms ampamp publications

Complete Utah State Tax Return Form seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage Utah State Tax Return Form across any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest method to modify and electronically sign Utah State Tax Return Form effortlessly

- Find Utah State Tax Return Form and click on Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Edit and electronically sign Utah State Tax Return Form and guarantee effective communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 tc 40 utah individual income tax return forms ampamp publications

How to generate an eSignature for your 2019 Tc 40 Utah Individual Income Tax Return Forms Ampamp Publications online

How to create an eSignature for the 2019 Tc 40 Utah Individual Income Tax Return Forms Ampamp Publications in Chrome

How to create an electronic signature for putting it on the 2019 Tc 40 Utah Individual Income Tax Return Forms Ampamp Publications in Gmail

How to make an eSignature for the 2019 Tc 40 Utah Individual Income Tax Return Forms Ampamp Publications right from your smart phone

How to generate an eSignature for the 2019 Tc 40 Utah Individual Income Tax Return Forms Ampamp Publications on iOS

How to generate an electronic signature for the 2019 Tc 40 Utah Individual Income Tax Return Forms Ampamp Publications on Android OS

People also ask

-

What are the benefits of using airSlate SignNow for managing state taxes in Utah?

Using airSlate SignNow simplifies the management of state taxes in Utah by offering secure electronic signatures, which can expedite the filing process. Our platform helps ensure compliance with state tax regulations while providing an easy-to-use interface for all users. Additionally, airSlate SignNow’s document tracking feature allows you to keep a close eye on all submissions and approvals related to state taxes.

-

How does airSlate SignNow integrate with accounting software for state taxes in Utah?

airSlate SignNow offers seamless integrations with various accounting software, making it easier for businesses to manage state taxes in Utah. Integrating your existing tools with our platform allows for automated document generation and storage, reducing errors and saving time. This integration ensures you never miss an important deadline related to state tax filings.

-

Is airSlate SignNow suitable for small businesses dealing with state taxes in Utah?

Absolutely! airSlate SignNow is specifically designed to cater to small businesses managing state taxes in Utah. Our user-friendly platform is cost-effective and provides all the essential features needed to eSign documents efficiently, making tax compliance straightforward and manageable for businesses of any size.

-

What features does airSlate SignNow offer to help with state taxes in Utah?

airSlate SignNow provides several key features to assist with state taxes in Utah, including customizable templates, secure eSigning, and document storage. These tools help streamline your filing process, ensuring that your documents are not only signed timely but also organized for easy access. Additionally, the platform includes reminders and notifications to help you stay on track with important tax deadlines.

-

What pricing plans does airSlate SignNow offer for businesses managing state taxes in Utah?

airSlate SignNow offers flexible pricing plans, which are ideal for businesses managing state taxes in Utah. Our plans cater to various needs, from individuals to larger organizations, ensuring that you only pay for what you use. We also provide a free trial, which allows you to explore our features and determine the best fit for your specific requirements.

-

Can I use airSlate SignNow on mobile devices for state taxes in Utah?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to manage state taxes in Utah on the go. Our mobile application provides all the necessary functionalities, including eSigning and document management, so you can handle tax documents anytime, anywhere. This accessibility ensures that you stay productive, even outside the office.

-

How secure is airSlate SignNow when dealing with state taxes in Utah?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information related to state taxes in Utah. Our platform utilizes advanced encryption protocols to protect your documents and data. Additionally, we comply with industry standards to ensure that all electronic signatures and file transmissions are secure and trustworthy.

Get more for Utah State Tax Return Form

- About the solid state lighting programdepartment of energy form

- 30 ready to use real estate sms templates to save you time form

- Leasing data form 2 23

- Clubhouse reservation form morris management

- Microsoft word lor docx form

- Procurement award contract template form

- Procurement contract template 787753931 form

- Producer contract template form

Find out other Utah State Tax Return Form

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template

- Electronic signature Indiana Legal Contract Fast

- Electronic signature Indiana Legal Rental Application Online

- Electronic signature Delaware Non-Profit Stock Certificate Free

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free