Homestead Exemption Texas Online Application Form

What is the Homestead Exemption Texas Online Application

The Homestead Exemption Texas Online Application is a form used by homeowners in Texas to apply for a homestead exemption. This exemption reduces the amount of property taxes owed by allowing a portion of the home's value to be exempt from taxation. It is designed to provide financial relief to homeowners, particularly those who occupy their homes as their primary residence. By completing the application, eligible homeowners can benefit from lower property tax bills, making homeownership more affordable.

Eligibility Criteria for the Homestead Exemption Texas Online Application

To qualify for the Homestead Exemption in Texas, applicants must meet specific eligibility criteria. Homeowners must own the property and use it as their principal residence. Additionally, the property must not be used for business purposes. The applicant must also be a U.S. citizen or a legal resident. There are various exemptions available, including those for seniors, disabled individuals, and veterans, which may have additional requirements. Understanding these criteria is crucial for a successful application.

Steps to Complete the Homestead Exemption Texas Online Application

Completing the Homestead Exemption Texas Online Application involves several straightforward steps. First, gather all necessary documentation, including proof of ownership and identification. Next, visit the official Texas Comptroller website to access the online application form. Fill out the required fields accurately, ensuring all information is complete. After reviewing the application for accuracy, submit it electronically. It is advisable to keep a copy of the submission for personal records. Following these steps helps ensure a smooth application process.

Required Documents for the Homestead Exemption Texas Online Application

When applying for the Homestead Exemption in Texas, specific documents are required to support the application. Homeowners typically need to provide proof of ownership, such as a deed or tax statement. Identification, such as a driver's license or state ID, is also necessary to verify the applicant's identity. If claiming additional exemptions, such as for disability or age, relevant documentation must be included. Having all required documents ready can expedite the application process and reduce the chances of delays.

Form Submission Methods for the Homestead Exemption Texas Online Application

The Homestead Exemption Texas Online Application can be submitted through various methods. The most common and efficient way is to complete the application online via the Texas Comptroller's website. This method allows for immediate processing and confirmation of receipt. Alternatively, homeowners can print the application and submit it by mail or in person at their local appraisal district office. Each submission method has its timeline, so it's essential to choose the one that best fits the applicant's needs.

Legal Use of the Homestead Exemption Texas Online Application

The legal use of the Homestead Exemption Texas Online Application is governed by Texas property tax laws. By applying for the exemption, homeowners are asserting their right to receive tax benefits based on their primary residence status. It is crucial for applicants to provide accurate information, as any misrepresentation can lead to penalties or denial of the exemption. Understanding the legal implications of the application ensures that homeowners comply with state regulations while benefiting from the exemption.

Key Elements of the Homestead Exemption Texas Online Application

The key elements of the Homestead Exemption Texas Online Application include personal information, property details, and exemption claims. Homeowners must provide their name, address, and contact information. Additionally, details about the property, such as its legal description and current use, are required. If applicable, homeowners can indicate any additional exemptions they are claiming, such as those for seniors or disabled individuals. Ensuring all key elements are accurately completed is essential for a successful application.

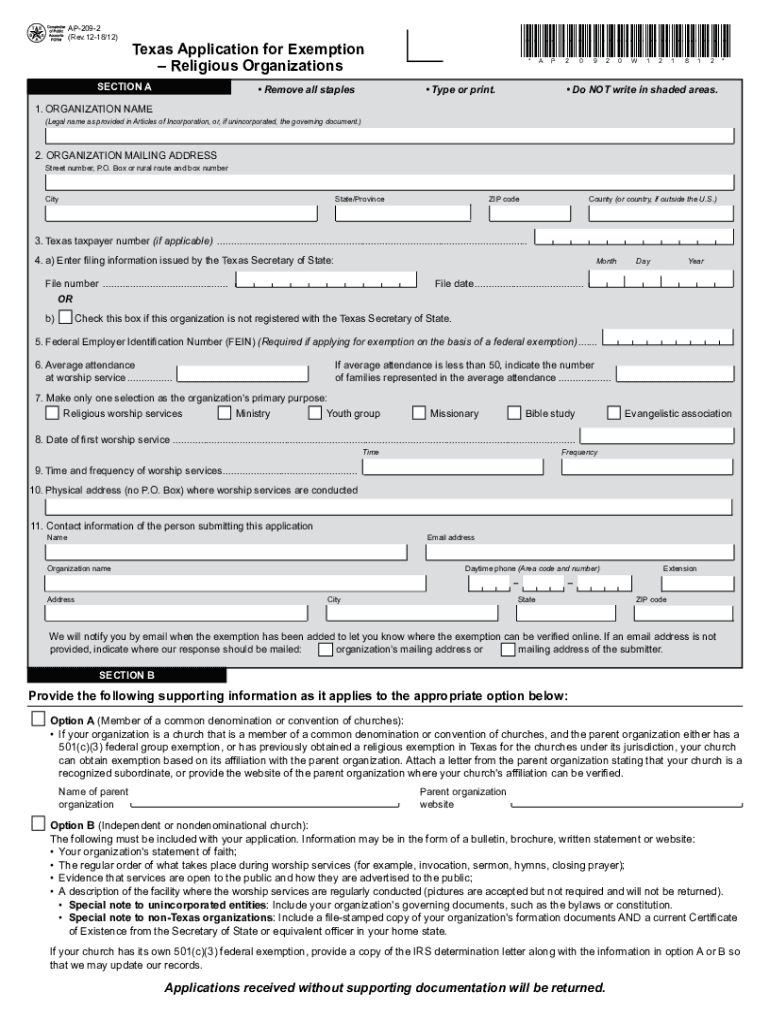

Quick guide on how to complete nonprofit religious organizations should use this application to request exemption from texas sales tax hotel occupancy tax

Prepare Homestead Exemption Texas Online Application effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily locate the correct template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hindrances. Manage Homestead Exemption Texas Online Application on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-oriented process today.

How to modify and eSign Homestead Exemption Texas Online Application with ease

- Find Homestead Exemption Texas Online Application and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Homestead Exemption Texas Online Application and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nonprofit religious organizations should use this application to request exemption from texas sales tax hotel occupancy tax

How to create an electronic signature for your Nonprofit Religious Organizations Should Use This Application To Request Exemption From Texas Sales Tax Hotel Occupancy Tax online

How to make an eSignature for your Nonprofit Religious Organizations Should Use This Application To Request Exemption From Texas Sales Tax Hotel Occupancy Tax in Google Chrome

How to create an electronic signature for putting it on the Nonprofit Religious Organizations Should Use This Application To Request Exemption From Texas Sales Tax Hotel Occupancy Tax in Gmail

How to make an eSignature for the Nonprofit Religious Organizations Should Use This Application To Request Exemption From Texas Sales Tax Hotel Occupancy Tax right from your smartphone

How to make an electronic signature for the Nonprofit Religious Organizations Should Use This Application To Request Exemption From Texas Sales Tax Hotel Occupancy Tax on iOS devices

How to create an eSignature for the Nonprofit Religious Organizations Should Use This Application To Request Exemption From Texas Sales Tax Hotel Occupancy Tax on Android devices

People also ask

-

What is the ap 209 form and why is it important?

The ap 209 form is a crucial document for businesses that helps streamline payment processes. It facilitates the efficient management of contracts and ensures that all parties are aligned regarding payment terms. Understanding this form is essential for maintaining smooth financial operations.

-

How can airSlate SignNow help me with the ap 209 form?

airSlate SignNow provides a user-friendly platform that allows you to easily create, send, and eSign the ap 209 form. With our solution, you can automate the workflow, ensuring that all required signatures are obtained efficiently. This eliminates paperwork hassles and speeds up the approval process.

-

What are the pricing options for using airSlate SignNow to manage the ap 209 form?

We offer flexible pricing plans that cater to different business needs when managing the ap 209 form. Our cost-effective solutions ensure that you only pay for what you use, making it accessible for businesses of all sizes. Contact us for a customized quote based on your specific requirements.

-

Can I integrate airSlate SignNow with other software while handling the ap 209 form?

Yes, airSlate SignNow seamlessly integrates with a variety of applications to enhance your experience with the ap 209 form. Whether you’re using CRM systems, cloud storage services, or project management tools, our integrations help you streamline processes and keep everything in one place.

-

What features does airSlate SignNow offer for the ap 209 form?

airSlate SignNow offers a range of features specifically designed to enhance your management of the ap 209 form. Our platform includes eSignature capabilities, customizable templates, and document status tracking. These features collectively minimize errors and improve overall efficiency in your workflow.

-

Is airSlate SignNow secure for handling the ap 209 form?

Absolutely! Security is a top priority at airSlate SignNow, especially when dealing with sensitive documents like the ap 209 form. We use industry-leading encryption and compliance measures to safeguard your information, ensuring that your data remains secure during and after the signing process.

-

Can I customize the ap 209 form using airSlate SignNow?

Yes, airSlate SignNow allows you to fully customize the ap 209 form to meet your specific business needs. You can add your logo, modify fields, and set up workflows that align with your operational requirements. This flexibility helps you maintain brand consistency and ensures the form is tailored to your processes.

Get more for Homestead Exemption Texas Online Application

- The form you are looking for begins on the next page of this file before

- Browning service repair form

- Cuny cap program form

- Mb2 form download

- Fenway health authorization for disclosure of protected form

- Premier league contract template form

- Prenuptial contract template form

- Prenuptial marriage contract template form

Find out other Homestead Exemption Texas Online Application

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free