Death of Taxpayer Prior to Filing Return 2023-2026

Understanding the Death of Taxpayer Prior to Filing Return

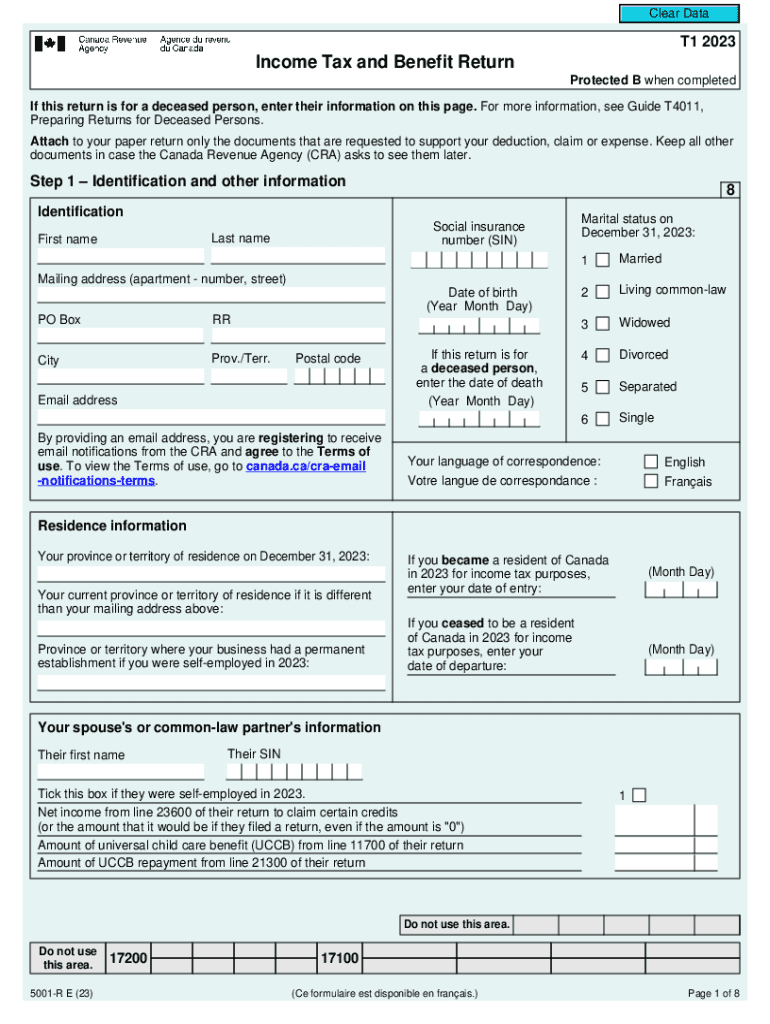

The Death of Taxpayer Prior to Filing Return refers to the specific circumstances under which a taxpayer passes away before they have the opportunity to file their tax return for the year. This situation can complicate tax obligations and the filing process. In the United States, the estate of the deceased taxpayer may be responsible for settling any outstanding tax liabilities. It is essential to understand the implications of this scenario, as the IRS has established guidelines for handling the tax affairs of deceased individuals.

Steps to Complete the Death of Taxpayer Prior to Filing Return

Completing the tax return for a deceased taxpayer involves several key steps:

- Gather necessary documents, including the deceased's Social Security number and any relevant financial records.

- Determine the filing status, which may include options such as married filing jointly or qualifying widow(er).

- Complete the tax return using the appropriate forms, typically the IRS Form 1040 or 1040-SR.

- Include any income earned by the taxpayer up to the date of death and account for any deductions or credits applicable.

- Submit the completed return to the IRS, ensuring it is filed by the appropriate deadline for the year of death.

Legal Use of the Death of Taxpayer Prior to Filing Return

Legally, the death of a taxpayer prior to filing a return requires the executor or administrator of the estate to manage the tax obligations. This role involves filing the deceased's final tax return and addressing any tax liabilities. The estate may also need to file Form 706, the estate tax return, if the estate exceeds the federal estate tax exemption limit. Understanding these legal responsibilities is crucial for ensuring compliance with IRS regulations and avoiding potential penalties.

Required Documents for Filing

When filing a tax return for a deceased taxpayer, certain documents are necessary to ensure accuracy and compliance. These documents include:

- The deceased taxpayer's Social Security number.

- Income statements such as W-2s and 1099s for the year of death.

- Records of any deductions or credits the taxpayer may be eligible for.

- Documentation related to the estate, including any previous tax returns filed.

IRS Guidelines for Filing

The IRS provides specific guidelines for filing a tax return for a deceased taxpayer. It is important to follow these guidelines to avoid complications. Key points include:

- The final return must reflect income earned up to the date of death.

- Filing deadlines may differ; generally, the return is due on the regular tax deadline of April 15, unless an extension is requested.

- Any refund owed to the estate must be claimed within three years of the due date of the return.

Examples of Filing Scenarios

Understanding various scenarios can help clarify the process. For instance:

- If a married couple files jointly and one spouse passes away, the surviving spouse can still file jointly for that year.

- In cases where the taxpayer was self-employed, the final return must include all business income and expenses incurred up to the date of death.

Quick guide on how to complete death of taxpayer prior to filing return

Complete Death Of Taxpayer Prior To Filing Return effortlessly on any gadget

Managing documents online has become increasingly popular among organizations and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly, without delays. Handle Death Of Taxpayer Prior To Filing Return on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign Death Of Taxpayer Prior To Filing Return with ease

- Locate Death Of Taxpayer Prior To Filing Return and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign Death Of Taxpayer Prior To Filing Return and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct death of taxpayer prior to filing return

Create this form in 5 minutes!

How to create an eSignature for the death of taxpayer prior to filing return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What happens to tax obligations in the event of the Death Of Taxpayer Prior To Filing Return?

In the case of the Death Of Taxpayer Prior To Filing Return, the tax obligations typically transfer to the estate of the deceased. The executor or administrator of the estate is responsible for filing any outstanding tax returns and settling any tax liabilities. It's crucial to consult with a tax professional to ensure compliance with tax laws.

-

How can airSlate SignNow assist in managing documents related to the Death Of Taxpayer Prior To Filing Return?

airSlate SignNow provides a streamlined platform for managing and eSigning documents related to the Death Of Taxpayer Prior To Filing Return. Users can easily create, send, and track important documents, ensuring that all necessary paperwork is handled efficiently. This can help alleviate some of the stress during a difficult time.

-

What features does airSlate SignNow offer for handling sensitive documents after the Death Of Taxpayer Prior To Filing Return?

airSlate SignNow offers robust security features, including encryption and secure cloud storage, to protect sensitive documents related to the Death Of Taxpayer Prior To Filing Return. Additionally, the platform allows for customizable workflows and audit trails, ensuring that all actions are documented and compliant with legal standards.

-

Is there a cost associated with using airSlate SignNow for documents related to the Death Of Taxpayer Prior To Filing Return?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those dealing with the Death Of Taxpayer Prior To Filing Return. The pricing is competitive and designed to provide a cost-effective solution for businesses of all sizes. You can choose a plan that best fits your requirements.

-

Can airSlate SignNow integrate with other tools for managing the Death Of Taxpayer Prior To Filing Return?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms, making it easier to manage documents related to the Death Of Taxpayer Prior To Filing Return. This integration capability allows users to streamline their workflows and enhance productivity by connecting with accounting software and other essential applications.

-

What are the benefits of using airSlate SignNow for handling documents after the Death Of Taxpayer Prior To Filing Return?

Using airSlate SignNow for handling documents after the Death Of Taxpayer Prior To Filing Return offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the eSigning process, allowing for quicker turnaround times on important documents. This can be particularly beneficial during the sensitive time following a taxpayer's death.

-

How does airSlate SignNow ensure compliance with legal requirements related to the Death Of Taxpayer Prior To Filing Return?

airSlate SignNow is designed to comply with legal requirements for electronic signatures and document management, which is crucial when dealing with the Death Of Taxpayer Prior To Filing Return. The platform adheres to industry standards and regulations, ensuring that all signed documents are legally binding and secure. Users can trust that their documents meet necessary compliance standards.

Get more for Death Of Taxpayer Prior To Filing Return

- Hlurb case form no 01 complaint

- Int 110 2018 2019 form

- The commonwealth of massachusetts city town of application for approval of tank truck fp044 rev sterlingfd form

- Jurgensen companies business credit application form

- Current saf 1 automobile insurance application form

- California state forms ea 100 2018 2019

- Time value of money formula sheet

- Criminal history brecordb request bformb nebraska state patrol statepatrol nebraska

Find out other Death Of Taxpayer Prior To Filing Return

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple