T1213 Request to Reduce Tax Deductions at Source 2022

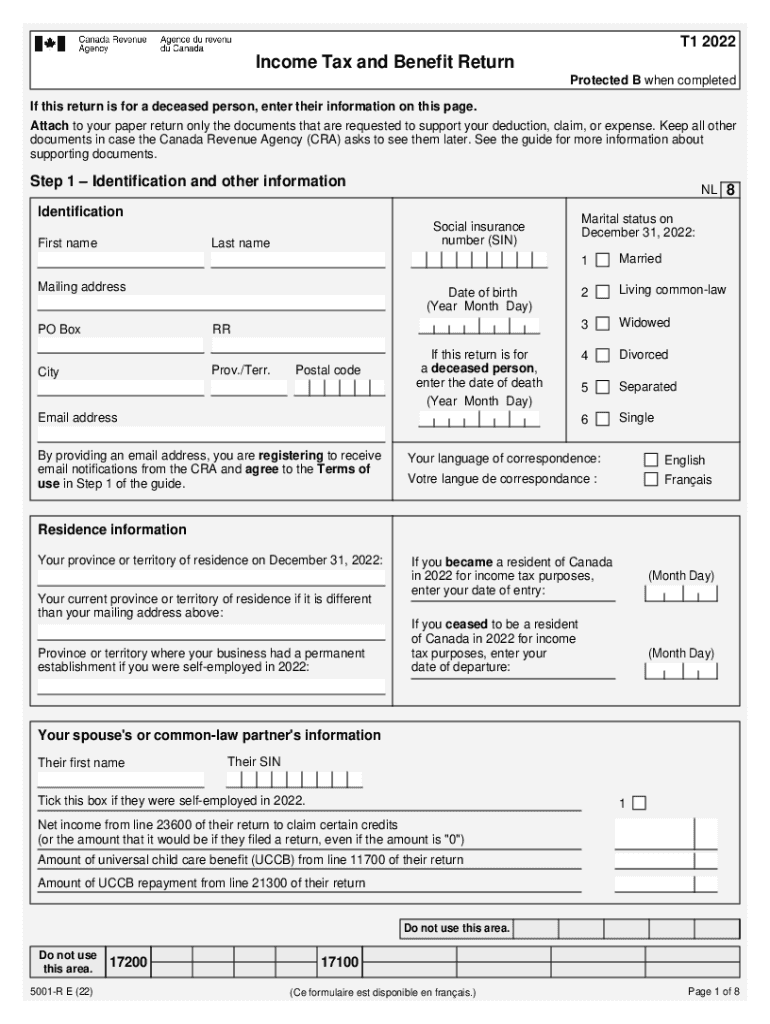

What is the income tax benefit return form?

The income tax benefit return form is a critical document used by individuals and businesses to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). This form allows taxpayers to claim various tax benefits, including credits and deductions that can reduce their overall tax burden. Understanding this form is essential for ensuring compliance with tax regulations and maximizing potential refunds.

Steps to complete the income tax benefit return form

Completing the income tax benefit return form involves several key steps:

- Gather necessary documents, such as W-2s, 1099s, and receipts for deductible expenses.

- Determine your filing status, which can affect your tax rate and eligibility for certain deductions.

- Fill out the form accurately, ensuring that all income sources and deductions are reported.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically or by mail, depending on your preference and the requirements of the IRS.

Filing deadlines and important dates

It is crucial to be aware of the filing deadlines for the income tax benefit return form to avoid penalties. Typically, the deadline for filing individual tax returns is April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers may request an extension, but any taxes owed must still be paid by the original deadline to avoid interest and penalties.

Required documents for filing

To successfully file the income tax benefit return form, you will need several documents, including:

- W-2 forms from employers, which report annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, detailing income earned outside of traditional employment.

- Receipts for deductible expenses, such as medical bills, charitable contributions, and business-related costs.

- Records of any other income sources, such as rental income or investment earnings.

Eligibility criteria for claiming tax benefits

Eligibility for claiming various tax benefits on the income tax benefit return form can vary based on several factors:

- Income level: Some credits and deductions are phased out at higher income levels.

- Filing status: Certain benefits may only be available to specific filing statuses, such as single, married filing jointly, or head of household.

- Dependents: Taxpayers with dependents may qualify for additional credits, such as the Child Tax Credit.

IRS guidelines for accurate filing

Following IRS guidelines is essential for accurately completing the income tax benefit return form. The IRS provides detailed instructions for each form, outlining how to report income, claim deductions, and calculate tax liabilities. Taxpayers should refer to the official IRS website or consult a tax professional for the most current information and guidance on compliance with tax laws.

Quick guide on how to complete t1213 request to reduce tax deductions at source

Prepare T1213 Request To Reduce Tax Deductions At Source effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage T1213 Request To Reduce Tax Deductions At Source on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign T1213 Request To Reduce Tax Deductions At Source with ease

- Find T1213 Request To Reduce Tax Deductions At Source and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow has designed specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign T1213 Request To Reduce Tax Deductions At Source while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct t1213 request to reduce tax deductions at source

Create this form in 5 minutes!

How to create an eSignature for the t1213 request to reduce tax deductions at source

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an income tax benefit return form?

An income tax benefit return form is a document that individuals use to report their income and claim deductions or benefits related to their taxes. This form helps taxpayers ensure they receive the maximum tax benefits available to them. By accurately completing the income tax benefit return form, you can potentially reduce your tax liability.

-

How can airSlate SignNow help with the income tax benefit return form?

airSlate SignNow provides a seamless platform for electronically signing and sending your income tax benefit return form. With its user-friendly interface, you can easily manage your documents and ensure they are securely signed and submitted. This simplifies the process, making it faster and more efficient.

-

Is there a cost associated with using airSlate SignNow for the income tax benefit return form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and reflects the value of the features provided, such as unlimited eSigning and document management. Investing in airSlate SignNow can save you time and resources when handling your income tax benefit return form.

-

What features does airSlate SignNow offer for managing the income tax benefit return form?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for your income tax benefit return form. These tools enhance your document management experience, ensuring that you can easily access and edit your forms as needed. Additionally, the platform supports multiple file formats for added convenience.

-

Can I integrate airSlate SignNow with other software for my income tax benefit return form?

Absolutely! airSlate SignNow offers integrations with various software applications, allowing you to streamline your workflow when handling the income tax benefit return form. Whether you use accounting software or CRM systems, these integrations help you manage your documents more efficiently and keep everything organized.

-

What are the benefits of using airSlate SignNow for my income tax benefit return form?

Using airSlate SignNow for your income tax benefit return form provides numerous benefits, including enhanced security, faster processing times, and reduced paperwork. The platform ensures that your documents are signed and stored securely, minimizing the risk of errors. Additionally, the ease of use allows you to focus on other important tasks.

-

Is airSlate SignNow suitable for individuals or just businesses when dealing with the income tax benefit return form?

airSlate SignNow is suitable for both individuals and businesses when managing the income tax benefit return form. Whether you are a freelancer or a large corporation, the platform can cater to your specific needs. Its flexibility and scalability make it an ideal solution for anyone looking to simplify their document signing process.

Get more for T1213 Request To Reduce Tax Deductions At Source

- Texas temporary paper id template texas temporary paper id template form

- Everyday math grade 3 unit 2 study guide cc edition pdf form

- Request for ta recoupment waiver withdrawal for military wm reasons form

- Application licensing motor vehicle 2011 2019 form

- Texas temporary drivers license template form

- Employment application georgetown chamber of commerce form

- And printable pa 1500 2016 2019 form

- Tr 320 cr 320 cant afford to pay fine traffic san mateo court form

Find out other T1213 Request To Reduce Tax Deductions At Source

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS