K 120 Form

What is the K-120?

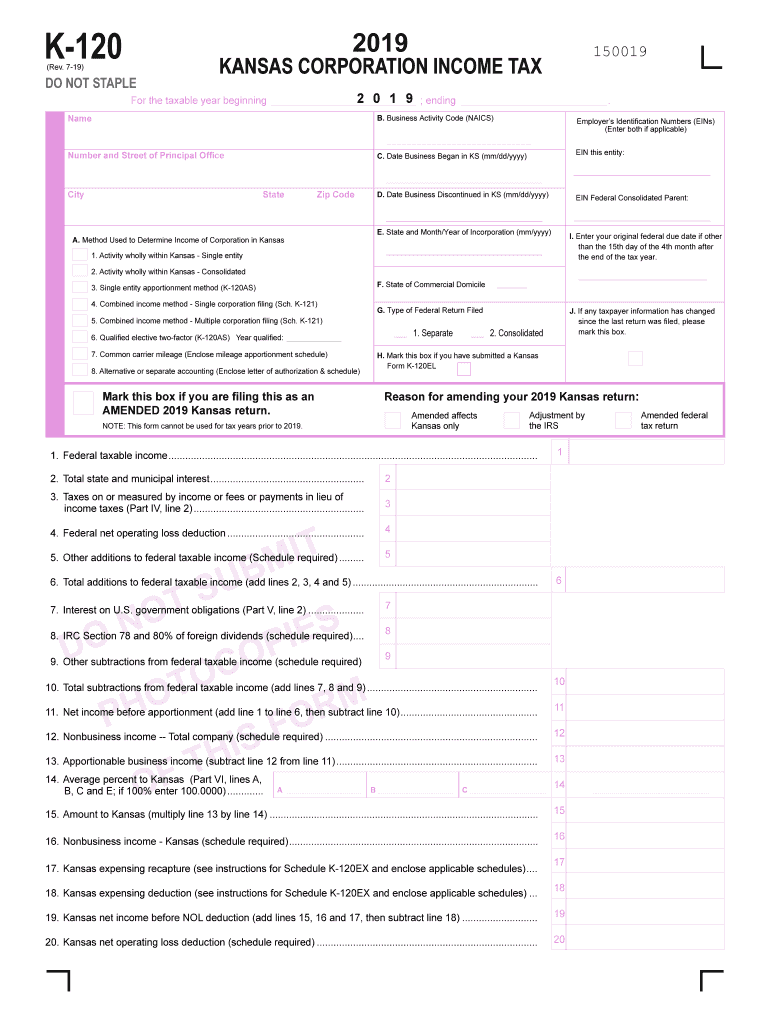

The K-120 is a tax form used by businesses in Kansas to report income and calculate tax liability. It is specifically designed for corporations and partnerships operating within the state. This form captures essential financial information, including revenue, expenses, and deductions, allowing the state to assess the correct amount of taxes owed. Understanding the K-120 is crucial for compliance with Kansas tax laws and ensuring accurate reporting.

How to use the K-120

Using the K-120 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and expense reports. Next, complete the form by entering your business's financial data in the designated sections. Be sure to follow the instructions carefully to avoid errors. After filling out the form, review it for accuracy before submission. This process helps ensure that your tax return is filed correctly and on time.

Steps to complete the K-120

Completing the K-120 involves a systematic approach:

- Gather financial documents: Collect all relevant financial records, including profit and loss statements.

- Fill out the form: Enter your business's income, deductions, and any credits in the appropriate sections.

- Review for accuracy: Double-check all entries to ensure they are correct and complete.

- Submit the form: File the K-120 either electronically or via mail, following the submission guidelines provided by the state.

Legal use of the K-120

The K-120 must be completed and submitted in accordance with Kansas state tax laws. It serves as a legal document that outlines a business's tax obligations. To ensure compliance, it is important to adhere to all filing requirements and deadlines. Failure to properly use the K-120 can result in penalties, including fines or interest on unpaid taxes. Therefore, understanding the legal implications of this form is essential for all businesses operating in Kansas.

Filing Deadlines / Important Dates

Filing deadlines for the K-120 are critical for compliance. Generally, the form must be submitted by the 15th day of the fourth month following the end of the tax year. For businesses operating on a calendar year, this means the deadline is April 15. It is important to keep track of these dates to avoid late fees and penalties. Additionally, extensions may be available, but they must be requested in advance.

Required Documents

To complete the K-120, certain documents are necessary. These typically include:

- Income statements detailing revenue earned.

- Expense reports outlining business costs.

- Records of any deductions or credits claimed.

- Prior year tax returns for reference.

Having these documents on hand will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete k 120 2019 kansas corporate income tax return rev 7 19 corporate tax

Complete K 120 effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It offers a flawless eco-friendly substitute to conventional printed and signed documentation, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to generate, modify, and eSign your documents promptly without delays. Manage K 120 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to adjust and eSign K 120 with ease

- Obtain K 120 and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Select important portions of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Wave goodbye to lost or mislaid documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Edit and eSign K 120 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the k 120 2019 kansas corporate income tax return rev 7 19 corporate tax

How to make an electronic signature for the K 120 2019 Kansas Corporate Income Tax Return Rev 7 19 Corporate Tax online

How to create an electronic signature for your K 120 2019 Kansas Corporate Income Tax Return Rev 7 19 Corporate Tax in Google Chrome

How to create an eSignature for putting it on the K 120 2019 Kansas Corporate Income Tax Return Rev 7 19 Corporate Tax in Gmail

How to make an electronic signature for the K 120 2019 Kansas Corporate Income Tax Return Rev 7 19 Corporate Tax right from your smart phone

How to create an electronic signature for the K 120 2019 Kansas Corporate Income Tax Return Rev 7 19 Corporate Tax on iOS

How to create an eSignature for the K 120 2019 Kansas Corporate Income Tax Return Rev 7 19 Corporate Tax on Android OS

People also ask

-

What is the 2020 k 120 document and how can airSlate SignNow help manage it?

The 2020 k 120 document is a crucial tax form for businesses that need to report their income and expenses. airSlate SignNow simplifies the process by allowing you to send, eSign, and manage your 2020 k 120 documents seamlessly within a user-friendly interface.

-

What features does airSlate SignNow offer for handling the 2020 k 120?

airSlate SignNow offers features like customizable templates, real-time document tracking, and a robust eSigning solution to help you manage your 2020 k 120 efficiently. These features ensure that you remain compliant and streamline the document preparation process.

-

Is there a cost associated with using airSlate SignNow for the 2020 k 120?

Yes, airSlate SignNow provides various pricing plans tailored to suit different business needs. The cost-effective solution enables businesses to handle important documents like the 2020 k 120 without breaking the bank.

-

How does airSlate SignNow ensure the security of my 2020 k 120 documents?

Security is a top priority for airSlate SignNow. When you use our platform for the 2020 k 120, your documents are protected with industry-standard encryption and secure storage, ensuring that sensitive information remains confidential.

-

Can I integrate airSlate SignNow with other tools for processing the 2020 k 120?

Absolutely! airSlate SignNow integrates smoothly with a variety of popular applications, allowing you to streamline your workflow. This makes it easy to manage your 2020 k 120 alongside your other business tools for enhanced productivity.

-

What benefits does airSlate SignNow provide for businesses working with the 2020 k 120?

Using airSlate SignNow for the 2020 k 120 offers many benefits, including time savings, error reduction, and a more efficient document signing process. It empowers businesses to quickly prepare, send, and receive signed documents, which can enhance operational efficiency.

-

Can I track the status of my 2020 k 120 documents with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all your documents, including the 2020 k 120. This means you can easily see when your document is sent, viewed, and signed, keeping you informed every step of the way.

Get more for K 120

- Accentra credit union direct deposit form

- Declaration and order for release of exhibits doc sb court form

- Deed contract template form

- Payment term contract template form

- Payroll outsourc contract template form

- Penetration test contract template form

- Payroll service contract template form

- Peer supervision contract template form

Find out other K 120

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online