Pa 1000 Form PDF

What is the PA-1000 Form?

The PA-1000 form, also known as the Pennsylvania Property Tax Rebate Application, is a crucial document for eligible Pennsylvania residents seeking a rebate on property taxes paid. This form is designed for individuals who meet specific income criteria and have paid property taxes on their primary residence. The PA-1000 form is particularly important for senior citizens, individuals with disabilities, and low-income homeowners, providing them with financial relief through property tax rebates.

Steps to Complete the PA-1000 Form

Completing the PA-1000 form involves several key steps to ensure accuracy and compliance with state requirements. Here’s a simplified process:

- Gather Required Information: Collect all necessary documentation, including proof of income, property tax statements, and identification.

- Fill Out the Form: Carefully complete each section of the PA-1000 form, ensuring that all information is accurate and up-to-date.

- Review for Errors: Double-check the form for any mistakes or missing information to avoid delays in processing.

- Submit the Form: Choose your preferred submission method—online, by mail, or in person—and send the completed form to the appropriate state office.

Eligibility Criteria for the PA-1000 Form

To qualify for the PA-1000 form, applicants must meet specific eligibility requirements set by the state. These include:

- Age: Applicants must be at least sixty-five years old, or be a widow/widower aged fifty-one or older, or be permanently disabled.

- Income Limits: Total income must not exceed the threshold established by the state, which is adjusted annually.

- Property Ownership: The property must be the applicant's primary residence, and they must have paid property taxes on it.

Filing Deadlines for the PA-1000 Form

Timely submission of the PA-1000 form is essential to ensure eligibility for the property tax rebate. The filing deadline typically falls on June 30 of the year following the tax year for which the rebate is being claimed. For example, for property taxes paid in 2022, the application must be submitted by June 30, 2023. It is advisable to check for any updates or changes to deadlines each year.

Form Submission Methods

Applicants have several options for submitting the PA-1000 form, making the process accessible and convenient:

- Online Submission: Eligible applicants can complete and submit the PA-1000 form electronically through the Pennsylvania Department of Revenue's online portal.

- Mail Submission: The completed form can be printed and mailed to the appropriate address provided by the state.

- In-Person Submission: Applicants may also choose to submit the form in person at designated state offices or local tax assistance centers.

Legal Use of the PA-1000 Form

The PA-1000 form is legally recognized as a valid application for property tax rebates in Pennsylvania. To ensure compliance, it is important that all information provided is truthful and accurate. Misrepresentation or fraudulent claims can lead to penalties, including the denial of the rebate and potential legal action. Therefore, applicants should maintain thorough records of their property tax payments and income documentation.

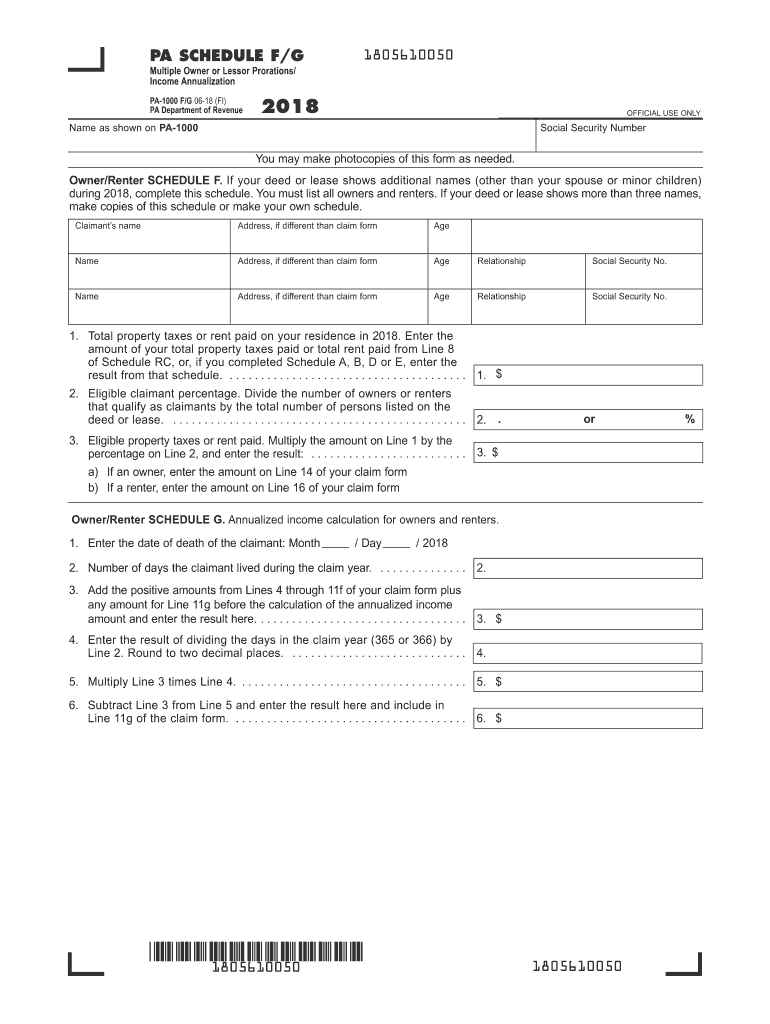

Quick guide on how to complete 2018 pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

Prepare Pa 1000 Form Pdf seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute for conventional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Handle Pa 1000 Form Pdf on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to edit and eSign Pa 1000 Form Pdf with ease

- Find Pa 1000 Form Pdf and then click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or conceal confidential information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or share a link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Pa 1000 Form Pdf and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2018 pa schedule fg multiple owner or lessor prorationsincome annualization pa 1000 fg formspublications

How to create an eSignature for your 2018 Pa Schedule Fg Multiple Owner Or Lessor Prorationsincome Annualization Pa 1000 Fg Formspublications in the online mode

How to generate an eSignature for the 2018 Pa Schedule Fg Multiple Owner Or Lessor Prorationsincome Annualization Pa 1000 Fg Formspublications in Chrome

How to generate an eSignature for signing the 2018 Pa Schedule Fg Multiple Owner Or Lessor Prorationsincome Annualization Pa 1000 Fg Formspublications in Gmail

How to make an electronic signature for the 2018 Pa Schedule Fg Multiple Owner Or Lessor Prorationsincome Annualization Pa 1000 Fg Formspublications straight from your smartphone

How to make an electronic signature for the 2018 Pa Schedule Fg Multiple Owner Or Lessor Prorationsincome Annualization Pa 1000 Fg Formspublications on iOS devices

How to generate an eSignature for the 2018 Pa Schedule Fg Multiple Owner Or Lessor Prorationsincome Annualization Pa 1000 Fg Formspublications on Android OS

People also ask

-

What is tax shopping in Pennsylvania?

Tax shopping in Pennsylvania refers to the strategic evaluation of tax policies and incentives within the state to minimize tax liability. It involves understanding the various local tax laws and identifying opportunities for tax savings. This can be crucial for both individuals and businesses looking to maximize their financial efficiency.

-

How can airSlate SignNow help with tax shopping in Pennsylvania?

airSlate SignNow simplifies document management by allowing users to easily send and eSign important tax-related documents. This streamlined process can save time and reduce the administrative burden associated with tax shopping in Pennsylvania, enabling you to focus on optimizing your tax situation.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to different business needs and sizes. By investing in our solutions, you can enhance your tax shopping in Pennsylvania while ensuring your document workflows remain efficient and cost-effective. Check our website for the most current pricing details.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow boasts various features including customizable templates, secure cloud storage, and advanced eSignature capabilities. These tools can greatly facilitate your tax shopping in Pennsylvania by enabling hassle-free documentation and ensuring compliance with state regulations.

-

Is airSlate SignNow compliant with Pennsylvania's tax laws?

Yes, airSlate SignNow is designed to meet the compliance requirements of Pennsylvania's tax laws. Our solution helps you maintain accurate records and provides a secure environment for managing documents related to tax shopping in Pennsylvania, safeguarding sensitive financial information.

-

Can I integrate airSlate SignNow with other software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various financial and tax software applications, enhancing your capabilities in tax shopping in Pennsylvania. This integration allows for smooth data transfer and improved efficiency in handling all your tax documentation.

-

What benefits does eSigning provide during tax shopping in Pennsylvania?

eSigning with airSlate SignNow provides faster turnaround on documents, enhanced security, and improved tracking capabilities. By adopting eSigning, you can signNowly streamline your processes during tax shopping in Pennsylvania, ensuring timely submissions and accurate records.

Get more for Pa 1000 Form Pdf

Find out other Pa 1000 Form Pdf

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now